Anthem Blue Cross 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

Anthem Insurance Companies, Inc.

Notes to Consolidated Financial Statements (continued)

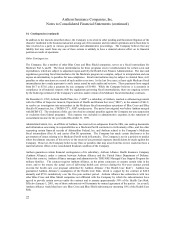

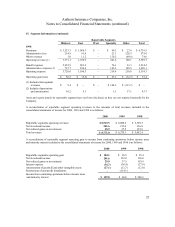

16. Statutory Information

Statutory policyholders’ surplus of Anthem amounted to $1,907.5 and $1,444.2 at December 31, 2000 and 1999,

respectively. Statutory net income of Anthem was $91.7, $201.7 and $80.6 for 2000, 1999 and 1998, respectively.

Surplus of insurance subsidiaries of Anthem is subject to regulatory restrictions with respect to amounts available for

dividends to Anthem.

In 1998, the National Association of Insurance Commissioners adopted codified statutory accounting principles

(“Codification”) which will be effective January 1, 2001. Codification will result in changes to certain accounting

practices that Anthem and it’ s insurance subsidiaries use to prepare statutory-basis financial statements. Management

believes the impact of these changes will not be significant.

17. Subsequent Events

On January 29, 2001 Anthem’ s board of directors appointed a special committee to work with management to

develop a plan for demutualization and conversion to a publicly traded stock company (the “Plan”) for the board’ s

further review. On June 18, 2001 the Plan was approved by Anthem’ s board of directors and management believes

that the demutualization process could be completed before the end of 2001. Anthem’ s members will see no

increase in premiums or changes to the terms of their health care benefits as a result of the demutualization.

On April 18, 2001, Anthem and its subsidiary, Anthem Alliance Health Insurance Company (“Alliance”), entered

into an Agreement and Plan of Merger to sell the TRICARE operations of Alliance to a subsidiary of Humana, Inc.

The transaction closed on May 31, 2001.

On May 30, 2001, Anthem and Blue Cross and Blue Shield of Kansas (“BCBS-KS”) signed a definitive agreement

pursuant to which BCBS-KS will become a wholly owned subsidiary of Anthem. Under the proposed transaction,

BCBS-KS will demutualize and convert to a stock insurance company. The agreement calls for Anthem to pay

$190.0 in exchange for all of the shares of BCBS-KS. Subject to the approval of BCBS-KS policyholders and the

approval of the Kansas Department of Insurance, the transaction is expected to close in late 2001.

On May 22, 2001, the Ohio Court of Appeals (Fifth District) affirmed the jury award of $1,350 (actual dollars) for

breach of contract against Community Insurance Company (“CIC”), a subsidiary of the Company, affirmed the

award of $2.5 compensatory damages for bad faith in claims handling and appeals processing against CIC, but

dismissed the claims and judgments against Anthem. The court also reversed the award of $49.0 in punitive

damages against both the Company and CIC, and remanded the question of punitive damages against CIC to the trial

court for a new trial. (See Note 14, fifth paragraph.)