Anthem Blue Cross 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Anthem Insurance Companies, Inc.

Notes to Consolidated Financial Statements (continued)

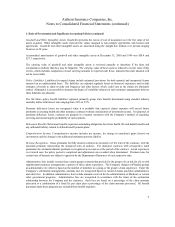

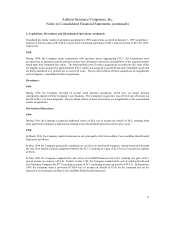

9. Reinsurance (continued)

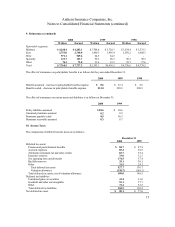

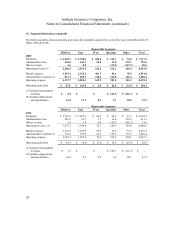

2000 1999 1998

Written Earned Written Earned Written Earned

Reportable segments:

Midwest $ 4,240.4 $ 4,203.1 $ 3,708.6 $ 3,729.3 $ 3,554.4 $ 3,533.3

East 2,753.0 2,768.9 1,490.3 1,495.4 1,076.2 1,088.3

West 571.1 569.6 64.5 64.2 - -

Specialty 123.7 123.7 96.3 96.3 90.3 90.3

Other 76.3 72.0 33.4 33.3 29.7 27.6

Total $ 7,764.5 $ 7,737.3 $ 5,393.1 $5,418.5 $ 4,750.6 $ 4,739.5

The effect of reinsurance on policyholder benefits is as follows for the years ended December 31:

2000 1999 1998

Benefits assumed – increase in policyholder benefits expense $ 8.6 $ 27.4 $ 2.5

Benefits ceded – decrease in policyholder benefits expense 233.0 299.8 208.3

The effect of reinsurance on certain assets and liabilities is as follows at December 31:

2000 1999

Policy liabilities assumed $ 28.6 $ 30.6

Unearned premiums assumed 0.2 0.2

Premiums payable ceded 8.5 36.3

Premiums receivable assumed 0.3 0.7

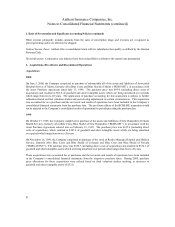

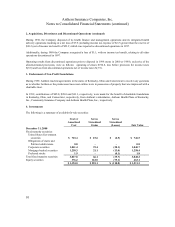

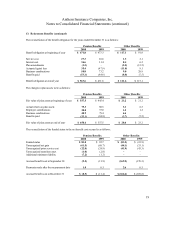

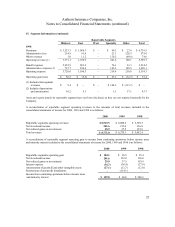

10. Income Taxes

The components of deferred income taxes are as follows:

December 31

2000 1999

Deferred tax assets:

Pension and postretirement benefits $ 84.7 $ 87.9

Accrued expenses 85.2 69.5

Alternative minimum tax and other credits 83.7 35.4

Insurance reserves 33.0 32.3

Net operating loss carryforwards 174.5 57.4

Bad debt reserves 35.1 30.1

Other 31.5 24.1

Total deferred tax assets 527.7 336.7

Valuation allowance (338.7) (148.2)

Total deferred tax assets, net of valuation allowance 189.0 188.5

Deferred tax liabilities:

Unrealized gains on securities 41.4 21.0

Goodwill and other tax intangibles 55.1 57.7

Other 72.4 52.2

Total deferred tax liabilities 168.9 130.9

Net deferred tax asset $ 20.1 $ 57.6