Anthem Blue Cross 2000 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2000 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

Anthem Insurance Companies, Inc.

Notes to Consolidated Financial Statements (continued)

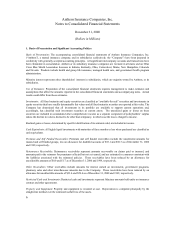

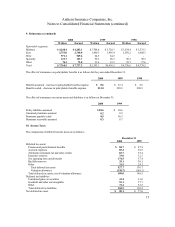

1. Basis of Presentation and Significant Accounting Policies (continued)

Other revenue principally includes amounts from the sales of prescription drugs and revenues are recognized as

prescription drug orders are delivered or shipped.

Federal Income Taxes: Anthem files a consolidated return with its subsidiaries that qualify as defined by the Internal

Revenue Code.

Reclassifications: Certain prior year balances have been reclassified to conform to the current year presentation.

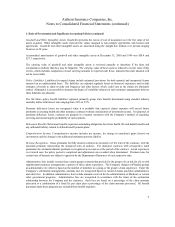

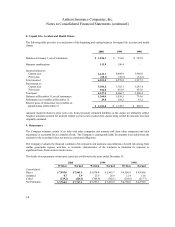

2. Acquisitions, Divestitures and Discontinued Operations

Acquisitions:

2000

On June 5, 2000, the Company completed its purchase of substantially all of the assets and liabilities of Associated

Hospital Service of Maine, formerly d/b/a Blue Cross and Blue Shield of Maine (“BCBS-ME”), in accordance with

the Asset Purchase Agreement dated July 13, 1999. The purchase price was $95.4 (including direct costs of

acquisition) and resulted in $92.6 of goodwill and other intangible assets which are being amortized over periods

which range from ten to 20 years. The application of purchase accounting for this acquisition is subject to further

refinement based on final valuation studies and post-closing adjustments in certain circumstances. This acquisition

was accounted for as a purchase and the net assets and results of operations have been included in the Company’ s

consolidated financial statements from the purchase date. The pro forma effects of the BCBS-ME acquisition would

not be material to the Company’ s consolidated results of operations for periods preceding the purchase date.

1999

On October 27, 1999, the Company completed its purchase of the assets and liabilities of New Hampshire-Vermont

Health Services, formerly d/b/a Blue Cross Blue Shield of New Hampshire (“BCBS-NH”), in accordance with the

Asset Purchase Agreement entered into on February 19, 1999. The purchase price was $125.4 (including direct

costs of acquisition), which resulted in $107.9 of goodwill and other intangible assets which are being amortized

over periods which range from two to 20 years.

On November 16, 1999, the Company completed its purchase of the stock of Rocky Mountain Hospital and Medical

Service, formerly d/b/a Blue Cross and Blue Shield of Colorado and Blue Cross and Blue Shield of Nevada

(“BCBS-CO/NV”). The purchase price was $160.7 (including direct costs of acquisition) and resulted in $152.1 of

goodwill and other intangible assets which are being amortized over periods which range from five to 20 years.

These acquisitions were accounted for as purchases and the net assets and results of operations have been included

in the Company’ s consolidated financial statements from the respective purchase dates. During 2000, purchase

price allocations for these acquisitions were refined based on final valuation studies resulting in increases to

goodwill and other intangible assets of $33.8.