Anthem Blue Cross 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

Anthem Insurance Companies, Inc.

Notes to Consolidated Financial Statements (continued)

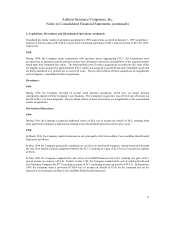

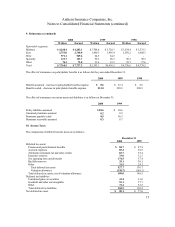

4. Investments (continued)

Cost or

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses) Fair Value

December 31, 1999

Fixed maturity securities:

United States Government

securities $ 550.1 $ 0.2 $ (29.3) $ 521.0

Obligations of states and

political subdivisions 34.2 –(2.1) 32.1

Corporate securities 816.8 0.4 (35.6) 781.6

Mortgage-backed securities 975.3 0.9 (32.1) 944.1

Preferred stocks 1.9 –(0.4) 1.5

Total fixed maturity securities 2,378.3 1.5 (99.5) 2,280.3

Equity securities 329.6 186.0 (27.9) 487.7

$ 2,707.9 $ 187.5 $ (127.4) $ 2,768.0

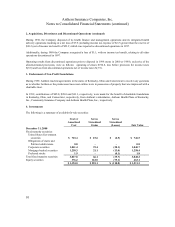

The amortized cost and fair value of fixed maturity securities at December 31, 2000, by contractual maturity, are shown

below. Expected maturities may be less than contractual maturities because the issuers of the securities may have the

right to prepay obligations without prepayment penalties.

Amortized

Cost

Fair

Value

Due in one year or less $ 48.2 $ 48.4

Due after one year through five years 611.7 618.1

Due after five years through ten years 439.3 451.9

Due after ten years 666.4 669.6

1,765.6 1,788.0

Mortgage-backed securities 1,250.3 1,258.4

Preferred stocks 1.9 1.8

$ 3,017.8 $ 3,048.2

The major categories of net investment income are as follows:

Year ended December 31

2000 1999 1998

Fixed maturity securities $ 178.8 $ 137.0 $ 121.1

Equity securities 6.1 6.3 7.4

Cash, cash equivalents and other 21.5 12.8 11.9

Investment revenue 206.4 156.1 140.4

Investment expense (4.8) (4.1) (3.6)

Net investment income $ 201.6 $ 152.0 $ 136.8

Proceeds from sales of fixed maturity and equity securities during 2000, 1999 and 1998 were $2,911.8, $2,336.8 and

$3,162.8, respectively. Gross gains of $71.3, $86.8 and $175.3 and gross losses of $45.4, $49.3 and $19.4 were

realized in 2000, 1999 and 1998, respectively, on those sales.