Anthem Blue Cross 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Anthem Insurance Companies, Inc.

Notes to Consolidated Financial Statements (continued)

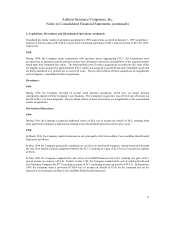

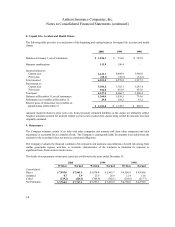

5. Long Term Debt and Commitments

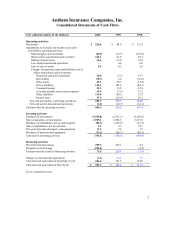

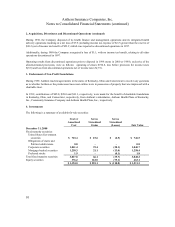

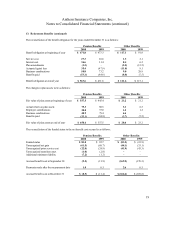

Debt consists of the following at December 31:

2000 1999

Surplus notes at 9.00% due 2027 $ 197.2 $ 197.0

Surplus notes at 9.125% due 2010 295.5 -

Senior guaranteed notes at 6.75% due 2003 99.5 99.3

Bank credit agreements -220.0

Other 5.5 5.9

Long term debt 597.7 522.2

Current portion of long-term debt (0.2) (0.2)

Long-term debt, less current portion $ 597.5 $ 522.0

On January 28, 2000, Anthem issued $300.0 principal amount of 9.125% surplus notes due April 1, 2010. On

February 3, 2000, a portion of the proceeds was used for repayment of the $220.0 outstanding under the revolving

bank credit agreement discussed below. The remainder of the proceeds was used for general corporate purposes

including the acquisition of BCBS-ME (see Note 2).

The Company has a $300.0 revolving credit agreement with a syndicate of banks which is available for general

corporate purposes and to support the Company’ s commercial paper program. The facility matures in 2002. In 1999,

the Company borrowed $220.0 to facilitate the acquisitions of BCBS-NH and BCBS-CO/NV as described in Note 2.

No additional borrowings were made under this credit agreement during 2000 and 1999 borrowings were paid in

February 2000. Availability under this facility is reduced by the amount of any commercial paper outstanding.

The Company has a $300.0 commercial paper program available for general corporate purposes. Commercial paper is

sold through a dealer, in denominations greater than $150 thousand dollars with a maturity not to exceed 270 days from

date of issuance, at then available market rates. Availability under the commercial paper program is reduced by the

amount of any borrowings outstanding under the Company’ s revolving credit agreement. There were no commercial

paper notes outstanding at December 31, 2000 or 1999.

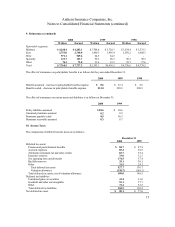

The Company must maintain certain financial covenants including limits on minimum net worth, maximum

consolidated debt, and maximum asset dispositions annually.

Any payment of interest or principal on the surplus notes may be made only with the prior approval of the Indiana

Department of Insurance (“DOI”), and only out of policyholders’ surplus funds that the DOI determines to be available

for the payment under Indiana insurance laws. For statutory accounting purposes, the surplus notes are considered a

part of policyholders’ surplus.

Interest paid during 2000, 1999 and 1998 was $54.7, $28.2 and $28.0, respectively.

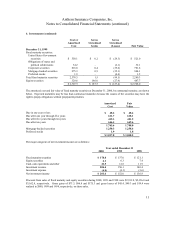

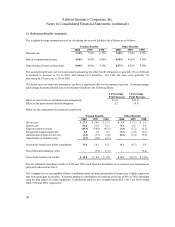

Future maturities of debt are as follows: 2001, $0.2; 2002, $0.3; 2003, $99.9; 2004, $1.4 ; 2005, $0.5 and thereafter

$495.4.