Anthem Blue Cross 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

Anthem Insurance Companies, Inc.

Notes to Consolidated Financial Statements (continued)

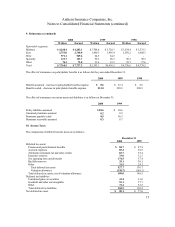

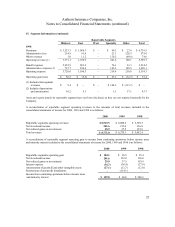

10. Income Taxes (continued)

The resolution of an Internal Revenue Service examination during 2000 resulted in certain subsidiaries having an

increase in alternative minimum tax credits and net operating loss carryforwards. Due to the uncertainty of the

realization of these deferred tax assets, the Company increased its valuation allowance accordingly. The net change

in the valuation allowance for 2000, 1999 and 1998 totaled $190.5, $(14.4) and $1.1, respectively.

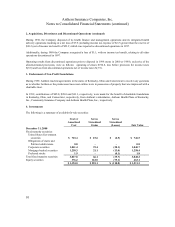

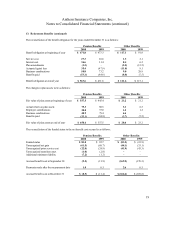

Deferred tax assets and liabilities reported with other current assets and other noncurrent assets on the accompanying

consolidated balance sheets are as follows:

December 31

2000 1999

Deferred tax assets – current $ 10.5 $ 29.4

Deferred tax assets – noncurrent 9.6 28.2

Net deferred tax assets $ 20.1 $ 57.6

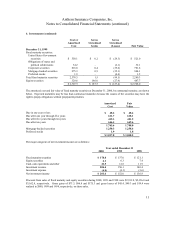

Significant components of the provision for income taxes consist of the following:

Year ended December 31

2000 1999 1998

Current tax expense (benefit):

Federal $ 53.9 $ (2.6) $ 63.0

State and local 3.9 (7.0) 9.8

Total current tax expense (benefit) 57.8 (9.6) 72.8

Deferred tax expense 44.4 19.8 38.1

Total income tax expense $ 102.2 $10.2 $ 110.9

Current federal income taxes consisted of amounts due for alternative minimum tax and tax obligations of subsidiaries

not included in the consolidated return of Anthem. During 2000, 1999 and 1998 federal income taxes paid totaled

$26.3, $0.0 and $23.7, respectively.

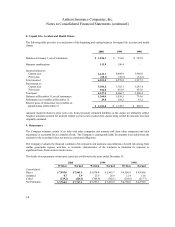

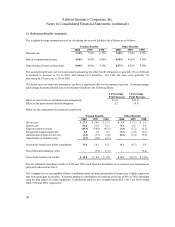

A reconciliation between actual income tax expense and the amount computed at the statutory rate is as follows:

Year ended December 31

2000 1999 1998

Amount %Amount %Amount %

Amount at statutory rate $ 115.4 35.0 $ 21.3 35.0 $ 100.9 35.0

State and local income taxes (benefit)

net of federal tax benefit 2.6 0.8 (4.8) (7.9) 7.0 2.4

Amortization of goodwill 5.6 1.7 3.1 5.1 3.0 1.1

Dividends received deduction (1.2) (0.4) (1.3) (2.1) (1.7) (0.6)

Deferred tax valuation allowance change,

net of net operating loss carryforwards

and other tax credits (20.0) (6.0) (14.4) (23.7) 1.1 0.4

Other, net (0.2) (0.1) 6.3 10.4 0.6 0.2

$ 102.2 31.0 $10.2 16.8 $ 110.9 38.5

At December 31, 2000, the Company had unused federal tax net operating loss carryforwards of approximately $498.7

to offset future taxable income. The loss carryforwards expire in the years 2001 through 2019.