Anthem Blue Cross 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Anthem Insurance Companies, Inc.

Consolidated Financial Statements

as filed with Form S-1 on August 16, 2001

Years ended December 31, 2000, 1999 and 1998

with Report of Independent Auditors

Table of contents

-

Page 1

Anthem Insurance Companies, Inc. Consolidated Financial Statements as filed with Form S-1 on August 16, 2001 Years ended December 31, 2000, 1999 and 1998 with Report of Independent Auditors -

Page 2

Anthem Insurance Companies, Inc. Consolidated Financial Statements Years ended December 31, 2000, 1999 and 1998 Contents Report of Independent Auditors...1 Audited Consolidated Financial Statements: Consolidated Balance Sheets ...2 Consolidated Statements of Income ...3 Consolidated Statements of ... -

Page 3

... have audited the accompanying consolidated balance sheets of Anthem Insurance Companies, Inc. as of December 31, 2000 and 1999, and the related consolidated statements of income, policyholders' surplus and cash flows for each of the three years in the period ended December 31, 2000. These financial... -

Page 4

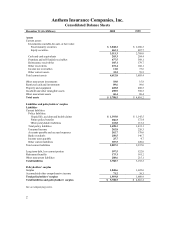

Anthem Insurance Companies, Inc. Consolidated Balance Sheets December 31 (In Millions) Assets Current assets: Investments available-for-sale, at fair value: Fixed maturity securities Equity securities Cash and cash equivalents Premium and self funded receivables Reinsurance receivables Other ... -

Page 5

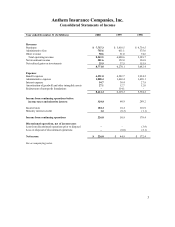

Anthem Insurance Companies, Inc. Consolidated Statements of Income Year ended December 31 (In Millions) 2000 1999 1998 Revenues Premiums Administrative fees Other revenue Total operating revenue Net investment income Net realized gains on investments $ 7,737.3 755.6 50.6 8,543.5 201.6 25.9 8,771.0... -

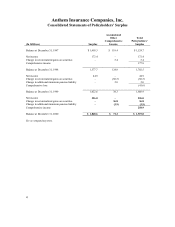

Page 6

... minimum pension liability Comprehensive loss Balance at December 31, 1999 Net income Change in net unrealized gains on securities Change in additional minimum pension liability Comprehensive income Balance at December 31, 2000 See accompanying notes. Surplus $ 1,405.3 172.4 - Total Policyholders... -

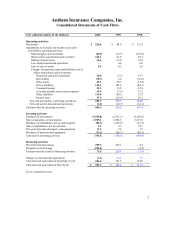

Page 7

... Loss on sale of assets Changes in operating assets and liabilities, net of effect of purchases and divestitures: Restricted cash and investments Receivables Other assets Policy liabilities Unearned income Accounts payable and accrued expenses Other liabilities Income taxes Net cash provided by... -

Page 8

... consolidation. Anthem or its subsidiary insurance companies are licensed in all states and are Blue Cross Blue Shield Association licensees in Indiana, Kentucky, Ohio, Connecticut, Maine, New Hampshire, Colorado and Nevada. Products include health and group life insurance, managed health care, and... -

Page 9

... is reviewed once the policy period is completed and adjustments are recorded when determined. Premium rates for certain lines of business are subject to approval by the Department of Insurance of each respective state. Administrative fees include revenue from certain groups contracts that provide... -

Page 10

... 16, 1999, the Company completed its purchase of the stock of Rocky Mountain Hospital and Medical Service, formerly d/b/a Blue Cross and Blue Shield of Colorado and Blue Cross and Blue Shield of Nevada ("BCBS-CO/NV"). The purchase price was $160.7 (including direct costs of acquisition) and resulted... -

Page 11

... Anthem Health and Life Insurance Company for $77.5 resulting in a gain of $1.1 (including income tax benefit of $14.1). In September 1998, the Company made a provision of $10.4 (net of income tax benefit of $3.4) for the estimated loss on the disposal of its remaining non-Blue Cross and Blue Shield... -

Page 12

... in Kentucky, Ohio, and Connecticut, respectively, from Anthem' s subsidiaries, Anthem Health Plans of Kentucky, Inc., Community Insurance Company and Anthem Health Plans, Inc., respectively. 4. Investments The following is a summary of available-for-sale securities: Cost or Amortized Cost December... -

Page 13

... Value 48.4 618.1 451.9 669.6 1,788.0 1,258.4 1.8 $ 3,048.2 The major categories of net investment income are as follows: Year ended December 31 1999 $ 137.0 6.3 12.8 156.1 (4.1) $ 152.0 2000 Fixed maturity securities Equity securities Cash, cash equivalents and other Investment revenue Investment... -

Page 14

... the Company' s revolving credit agreement. There were no commercial paper notes outstanding at December 31, 2000 or 1999. The Company must maintain certain financial covenants including limits on minimum net worth, maximum consolidated debt, and maximum asset dispositions annually. Any payment of... -

Page 15

...the relatively short period of time between the origination of the instruments and their expected realization. Fair values for securities and restricted investments are based on quoted market prices, where available. For securities not actively traded, fair values are estimated using values obtained... -

Page 16

Anthem Insurance Companies, Inc. Notes to Consolidated Financial Statements (continued) 8. Unpaid Life, Accident and Health Claims The following table provides a reconciliation of the beginning and ending balances for unpaid life, accident and health claims: 2000 Balances at January 1, net of ... -

Page 17

...benefits Accrued expenses Alternative minimum tax and other credits Insurance reserves Net operating loss carryforwards Bad debt reserves Other Total deferred tax assets Valuation allowance Total deferred tax assets, net of valuation allowance Deferred tax liabilities: Unrealized gains on securities... -

Page 18

... 35.0 2.4 1.1 (0.6) 2000 Amount % Amount at statutory rate State and local income taxes (benefit) net of federal tax benefit Amortization of goodwill Dividends received deduction Deferred tax valuation allowance change, net of net operating loss carryforwards and other tax credits Other, net $ 115... -

Page 19

... 31: 2000 Gross unrealized gains on securities Gross unrealized losses on securities Total pretax net unrealized gains on securities Deferred tax liability Net unrealized gains on securities Additional minimum pension liability Deferred tax asset Net additional minimum pension liability Accumulated... -

Page 20

... Companies, Inc. Notes to Consolidated Financial Statements (continued) 13. Retirement Benefits Anthem and its subsidiaries, Anthem Health Plans of New Hampshire, Inc. (which acquired the business of BCBSNH), Rocky Mountain Hospital and Medical Service, Inc. ("RMHMS") (formerly known as BCBS-CO/NV... -

Page 21

... Fair value of plan assets at end of year Pension Benefits 2000 1999 $ 445.4 $ 557.5 75.3 30.0 40.9 (53.1) $ 650.6 80.5 37.0 79.4 (84.8) $ 557.5 Other Benefits 2000 1999 $ 21.2 $ 23.2 3.1 1.2 4.6 (3.7) $ 28.4 8.3 1.2 - (7.5) $ 23.2 The reconciliation of the funded status to the net benefit cost... -

Page 22

... change in assumed health care cost trend rates would have the following effects: 1-Percentage Point Increase $ 0.4 5.2 1-Percentage Point Decrease $ (0.4) (4.3) Effect on total of service and interest cost components Effect on the postretirement benefit obligation Below are the components of net... -

Page 23

...A number of managed care organizations have recently been sued in class action lawsuits asserting various causes of action under federal and state law. These lawsuits typically allege that the defendant managed care organizations employ policies and procedures for providing health care benefits that... -

Page 24

... contingencies of its subsidiary, Anthem Alliance Health Insurance Company (Anthem Alliance), under a contract between Anthem Alliance and the United States Department of Defense. Under that contract, Anthem Alliance manages and administers the TRICARE Managed Care Support Program for military... -

Page 25

... Federal which administers Medicare programs in Indiana, Illinois, Kentucky and Ohio and Anthem Alliance which provides health care benefits and administration in nine states for the Department of Defense' s TRICARE Program for military families. The Other segment also includes intersegment revenue... -

Page 26

Anthem Insurance Companies, Inc. Notes to Consolidated Financial Statements (continued) 15. Segment Information (continued) The following tables present operating gain (loss) by reportable segment for each of the years ended December 31, 2000, 1999 and 1998: Reportable Segments West Specialty $ 569... -

Page 27

Anthem Insurance Companies, Inc. Notes to Consolidated Financial Statements (continued) 15. Segment Information (continued) Reportable Segments West Specialty 90.3 21.1 130.2 241.6 76.1 142.3 218.4 23.2 Midwest 1998 Premiums Administrative fees Other revenues Operating revenue (1) Benefit expense ... -

Page 28

..., Anthem Alliance Health Insurance Company ("Alliance"), entered into an Agreement and Plan of Merger to sell the TRICARE operations of Alliance to a subsidiary of Humana, Inc. The transaction closed on May 31, 2001. On May 30, 2001, Anthem and Blue Cross and Blue Shield of Kansas ("BCBS-KS...