Airtran 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

59

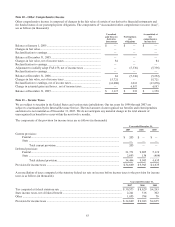

Note 9 – Stock Option Plans and Restricted Stock Awards

Our 1993 Incentive Stock Option Plan provided for the grant of options to officers, directors and key employees to purchase

up to 4.8 million shares of common stock at prices not less than the fair value of the shares on the dates of grant. Our 2002

Long-term Incentive Plan, 1996 Stock Option Plan and 1994 Stock Option Plan authorized up to 5 million, 5 million, and

4 million incentive stock options or nonqualified options, respectively, to be granted to our officers, directors, key employees

and consultants.

In connection with the acquisition of Airways Corporation in 1997, we assumed the Airways Corporation 1995 Stock Option

Plan (Airways Plan) and the Airways Corporation 1995 Director Stock Option Plan (Airways DSOP). Under the Airways

Plan, up to 1.2 million incentive stock options or nonqualified options could be granted to our officers, directors, key

employees or consultants. Under the Airways DSOP, up to 150,000 nonqualified options could be granted to directors.

Vesting and term of all options is determined by the Board of Directors and may vary by optionee; however, the term may be

no longer than ten years from the date of grant. As of December 31, 2007, an aggregate of 2.2 million shares of restricted

stock and options to acquire common stock remained available for future grant.

Effective January 1, 2006, we adopted the provisions of Statement of Financial Accounting Standards No. 123(R), Share-

Based Payment (SFAS 123(R)), which requires companies to recognize the cost of employee services received in exchange

for awards of equity instruments based on the grant date fair value of those awards in the financial statements.

Prior to January 1, 2006, we accounted for our stock-based compensation plans in accordance with Accounting Principles

Board Opinion No. 25 Accounting for Stock Issued to Employees (APB 25), and related interpretations. Accordingly, we

recognized compensation expense related to restricted stock grants based on the market value of the common stock at the date

of grant and recognized compensation expense for a stock option grant only if the exercise price was less than the market

value of our common stock on the grant date. Prior to the adoption of SFAS 123(R), as required under the disclosure

provisions of SFAS 123, we provided pro forma net income and earnings per share for each period presented as if we had

applied the fair value method to measure stock-based compensation expense.

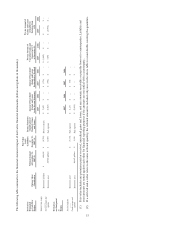

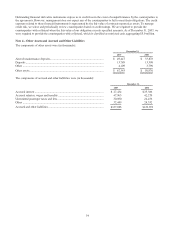

The following table illustrates the effect on 2005 net income and earnings per share for as if we had applied the fair value

method to measure stock-based compensation, as required under the disclosure provision in SFAS 123 (in thousands, except

for per share amounts):

Net income, as reported .....................................................................................................................

.

$ 7,545

Add: Stoc

k

-based employee compensation expense included in reported income, net of related tax

effects ...........................................................................................................................................

.

2,059

Deduct: Stock-based employee compensation expense determined under the fair value based method,

net of related tax effects ................................................................................................................

.

(3,891)

Pro forma net income.........................................................................................................................

.

$ 5,713

Earnings Per Share:

Basic, as reported ..............................................................................................................................

.

$ 0.09

Basic, pro forma................................................................................................................................

.

$ 0.07

Diluted, as reported ...........................................................................................................................

.

$ 0.08

Diluted, pro forma .............................................................................................................................

.

$ 0.06

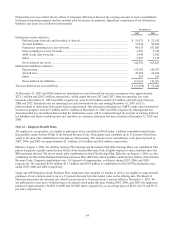

The fair value for the stock options was estimated at the date of grant using the Black-Scholes option pricing model. There

were no options granted during 2007, 2006 or 2005.

The adoption of SFAS 123(R) also affected our accounting for our employee stock purchase plan. See Note 12 to the

Consolidated Financial Statements. The change in the accounting for the stock purchase plan does not have a material impact

on our statement of operations. The adoption of SFAS 123(R) had no impact on our accounting for restricted stock awards.