Airtran 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Year 2008 Cash Requirements and Sources of Liquidity

During 2008, we will need cash for capital expenditures and debt maturities. It is anticipated that capital expenditures and 2008 debt

and capital lease maturities will be funded with cash flow from operations, financings, and the use of existing cash resources. We

anticipate that during 2008: expenditures for acquisition of other property and equipment and rotable parts will aggregate

approximately $37 million; expenditures, not funded by committed financing, for the acquisition of aircraft will aggregate

approximately $113 million; and the maturities of existing debt and capital lease obligations will aggregate $99.7 million. We

anticipate obtaining additional aircraft acquisition related financing which would reduce the expenditures, not funded by financing, for

the acquisition of aircraft to approximately $55 million.

We have various options available to meet our debt repayments, capital expenditures and operating commitments including internally

generated funds and various financing or leasing options. Additionally, we have an outstanding shelf registration which we may utilize

to raise funds for aircraft financings or other purposes in the future. However, except as discussed in the following paragraph, we have

no unused lines of credit available and our owned aircraft and our pre-delivery deposits are pledged as collateral for outstanding debt.

There can be no assurance that financing will be available for all B737 aircraft deliveries or for other capital expenditures not covered

by firm financing commitments. Should fuel prices remain high and if we are unable to generate revenues to cover our costs, we may

slow our growth, including through the rescheduling of aircraft deliveries or through the sale, lease or sublease of some of our aircraft.

In January 2008, one of the counter parties to our derivative financial arrangements agreed to provide us with an unsecured line of

credit of up to $15 million to fund any of our future collateral obligations arising from certain derivative financial arrangements. The

line of credit commitment expires July 2008.

Income Taxes

We have not been required to pay significant federal or state income taxes since 1999 because we have had a loss for federal income

tax purposes in each of those years, largely because tax basis depreciation has exceeded depreciation expense calculated for financial

accounting purposes.

Our December 31, 2007 consolidated balance sheet includes gross deferred tax assets of $145.4 million and gross deferred tax

liabilities of $167.0 million. The deferred tax assets include $88.6 million pertaining to the tax effect of $271.1 million of federal net

operating losses (NOLs) previously recognized as a tax benefit for financial reporting purposes. Such NOLs, which expire in the years

2017 to 2027, are available to be carried forward to offset future taxable income and thereby reduce future income tax payments. Our

deferred income tax liability is in large part due to the excess of the financial statement carrying value of owned flight equipment and

other assets over the tax bases of such assets. Consequently, future tax basis depreciation will tend to be lower than financial

accounting depreciation for these assets. Accordingly, management has determined that it is more likely than not that the deferred tax

assets will be realized through the reversal of existing deferred tax liabilities and future taxable income.

Section 382 of the Internal Revenue Code (Section 382) imposes limitations on a corporation’s ability to utilize NOLs if it experiences

an “ownership change.” In general terms, an ownership change may result from transactions increasing the ownership of certain

stockholders in the stock of a corporation by more than 50 percentage points over a three-year period. In the event of an ownership

change as defined in the Code, utilization of our NOLs would be subject to an annual limitation under Section 382 determined by

multiplying the value of our stock at the time of the ownership change by the applicable long-term tax exempt rate. Any unused NOLs

in excess of the annual limitation may be carried over to later years. As of December 31, 2007, we were not subject to the limitations

under Section 382.

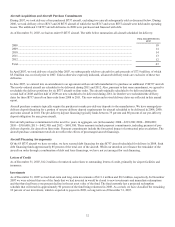

Contractual Obligations

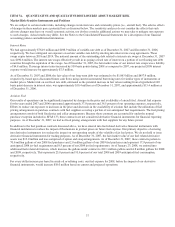

Our contractual obligations of December 31, 2007 are estimated to be due as follows (in millions):

Nature of commitment

Total 2008 2009-2010 2011-2012 Thereafte

r

Long-term debt (1) ...................................................................... $ 1,597.0 $ 171.0 $ 268.2 $ 226.0 $ 931.8

Operating lease obligations (2) .................................................... 3,334.8 292.6 537.2 510.6 1,994.4

Capital lease obligations .............................................................. 19.8 2.7 5.7 6.2 5.2

Aircraft purchase commitments (3).............................................. 2,281.5 391.3 1,026.6 863.6 —

Other (4) ..................................................................................... 3.0 1.5 1.5 — —

Total contractual obligations........................................................ $ 7,236.1 $ 859.1 $ 1,839.2 $ 1,606.4 $ 2,931.4