Airtran 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

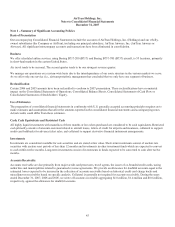

Taxes

We remit a variety of taxes and fees to various governmental authorities including: income taxes; transportation fees and taxes

collected from our customers; property taxes; sales and use taxes; payroll taxes; and fuel taxes. The taxes and fees remitted by us are

subject to review and audit by the applicable governmental authorities which could result in liability for additional assessments.

Contingencies for taxes which are not based on income are accounted for in accordance with Statement of Financial Accounting

Standards No. 5, Accounting for Contingencies. Uncertain income tax positions taken on income tax returns are accounted for in

accordance with FIN 48, effective January 1, 2007. Although management believes that the positions taken on previously filed tax

returns are reasonable, we nevertheless have recorded accrued liabilities in recognition that various taxing authorities may challenge

certain of the positions we have taken, which may also potentially result in additional liabilities for taxes and interest in excess of

accrued liabilities. These accrued liabilities are reviewed periodically and are adjusted as events occur that affect the estimates, such

as: the availability of new information; the lapsing of applicable statutes of limitations; the conclusion of tax audits; the measurement

of additional estimated liability based on current calculations; the identification of new tax contingencies; or the rendering of relevant

court decisions.

Employees

As of December 31, 2007, approximately 47.3 percent of our employees were represented by unions. Our agreement with our flight

attendants becomes amendable in December 2008. The pilots’ collective bargaining agreement became amendable in 2005 and is

currently in mediation. While there can be no assurance that our generally good labor relations with our employees will continue, we

have established as a significant component of our business strategy the preservation of good relations with our employees.

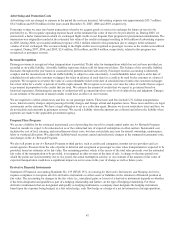

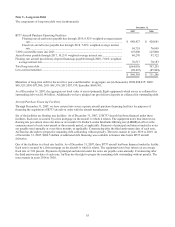

Note 3 – Financial Instruments

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of cash and cash

equivalents, restricted cash, short-term investments, long term investments and accounts receivable. We maintain cash and cash

equivalents and short-term investments with various high credit-quality financial institutions or in short-duration, high-quality debt

securities. Investments are stated at fair value, which approximates cost. We periodically evaluate the relative credit standing of those

financial institutions that are considered in our investment strategy. We use specific identification of securities for determining gains

and losses. As of December 31, 2007, we had short-term and long-term investments, all of which are available for sale securities, of

$111.1 million and $8.2 million, respectively, consisting of $82.3 million in a strategic investment fund and $37.1 million in auction

rate securities. In December 2007, we were advised that the strategic investment fund we had invested in would be closed to new

investments and immediate redemptions and that there had been a one percent decline in the net asset value of the fund. As a result,

we recorded a $1.1 million charge to interest income related to the realized and unrealized losses on that fund. The fund currently has

a projected redemption schedule that will result in approximately 90 percent of the fund being redeemed in 2008. As a result, we have

classified the remaining 10 percent of our investment, which is expected to payout in 2009, as long-term as of December 31, 2007.

Contractual maturities for our other available-for-sale securities at December 31, 2007, which consisted of auction rate securities,

exceed ten years while the auction re-set periods are 28 to 35 days. In January 2008, we converted all of our investments in auction

rate securities to investments in U.S. Treasury securities. There were no material realized or unrealized gains or losses on our

available-for-sale securities for the years ended December 31, 2006 or 2005.

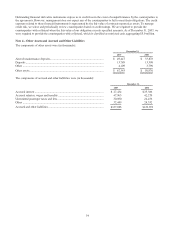

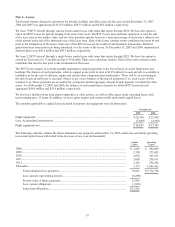

The estimated fair value of other financial instruments, excluding debt, approximates their carrying amount. The fair values of long-

term debt are based on quoted market prices, if available, or are estimated using discounted cash flow analyses, based on current

incremental borrowing rates for similar types of borrowing arrangements. The financial statement carrying amounts and estimated fair

values of long-term debt and capital leases were $1.058 billion and $1.063 billion, respectively, at December 31, 2007, and $811.1

million and $857.9 million, respectively, at December 31, 2006.

The majority of our receivables result from the sale of tickets to individuals, mostly through the use of major credit cards. These

receivables are short-term, generally being settled shortly after sale.

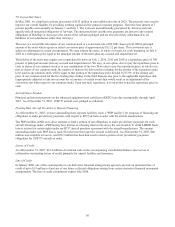

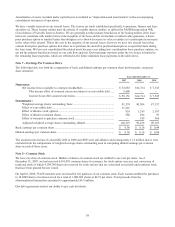

During the year ended December 31, 2007, we entered into various derivative financial instruments with financial institutions to

reduce the impact of fluctuations in jet fuel prices on future fuel expense. Our primary objective of entering into derivative

instruments is to reduce the impact on our operating results of the volatility of jet fuel prices. We do not hold or issue derivative

financial instruments for trading purposes. We enter into both fuel related swap and option derivative financial arrangements.