Airtran 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

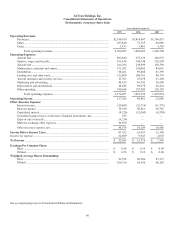

30

Distribution costs decreased 15.9 percent on a cost per ASM basis reflecting the new rates in our GDS agreements that were

renegotiated during the fourth quarter 2005. For the year ended December 31, 2006, approximately 60 percent of our sales were made

via our internal website. We recognize significant cost savings when our sales are booked directly through our website compared with

more traditional methods, such as travel agent systems (GDS).

Marketing and advertising costs were unchanged on a cost per ASM basis. The year ended December 31, 2006 included expense of

$4.1 million related to a fourth quarter 2005 barter transaction. The 2006 expense was due to changes in the estimated volume of

travel exchanged in connection with the 2005 promotion. The year ended December 31, 2005 included $4.6 million expense related to

this barter transaction.

Aircraft insurance and security services decreased 6.7 percent on a cost per ASM basis. While the addition of 22 new Boeing aircraft

to our fleet during the year ended December 31, 2006 increased our total insured hull value and related insurance premiums, the

decrease on a cost per ASM basis is primarily due to a reduction in hull and liability insurance rates for our 2006 fleet coverage.

Depreciation increased 23.1 percent on a cost per ASM basis, primarily due to the addition of 13 owned B737 for the year ended

December 31, 2006 as well as the purchase of spare aircraft parts for the new B737 fleet. Additionally, during the year ended

December 31, 2006 we charged depreciation expense $1.6 million for property and equipment no longer in use.

Other operating expense decreased 1.2 percent on a cost per ASM basis. The decrease is attributable in large part to the favorable $3.2

million impact of claim settlements with vendors recognized during the year ended December 31, 2006.

Non-operating (Income) Expense

Other (income) expense, net increased by $5.7 million. Higher invested cash balances along with higher interest rates increased

interest income by $9.9 million. Interest expense, including amortization of debt issuance costs, increased by $20.1 million primarily

due to the effect of aircraft debt financings entered into during 2005 and 2006. Capitalized interest increased by $4.4 million due to

increased deposits on future aircraft deliveries. Capitalized interest represents the interest cost to finance purchase deposits for future

aircraft. These amounts are classified as part of the cost of the aircraft upon delivery.

Income Tax Expense

Our effective income tax rate was 40.3 percent and 38.1 percent for the years ended December 31, 2006 and 2005, respectively. Our

tax expense for 2005 includes a one-time benefit of $1.7 million resulting from an adjustment to our deferred tax liabilities due to a

decrease in our state effective rate. The overall rate increase resulted primarily from a combination of the $1.7 million 2005 benefit

and 2006 permanent differences related to stock based compensation.

LIQUIDITY AND CAPITAL RESOURCES

At December 31, 2007 we had total cash, cash equivalents and short term investments of $318.0 million, which is an increase of $7.8

million compared to December 31, 2006. As of December 31, 2007 we also had $29.6 million of restricted cash and $8.2 million of

long-term investments. Our primary sources of cash are from operating activities and primary uses of cash are for investing and

financing activities.

Operating activities in 2007 provided $182.1 million of cash flow compared to $75.1 million in 2006. Cash flow from operating

activities is related to both the level of our profitability and to changes in working capital and other assets and liabilities. Operating

cash inflows are largely attributable to revenues derived from the transportation of passengers. Operating cash outflows are largely

attributable to recurring expenditures for fuel, labor, aircraft rent, aircraft maintenance, marketing and other activities. For the year

ended December 31, 2007, we reported net income of $52.7 million compared to net income of $14.7 million for the year ended

December 31, 2006. The increase in profitability favorably impacted cash provided by operating activities.