Airtran 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

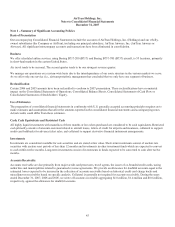

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160 (SFAS 160), Noncontrolling Interests in

Consolidated Financial Statements—An Amendment of ARB No. 51. SFAS 160 establishes new accounting and reporting standards for

the non-controlling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160 is effective for fiscal years

beginning on or after December 15, 2008. We do not currently expect the adoption of SFAS 160 to have a material impact on our

consolidated financial position, results of operations and cash flows.

Note 2 – Commitments and Contingencies

Aircraft Purchase Commitments

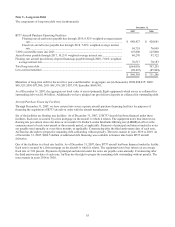

During 2007, we took delivery of ten purchased B737 aircraft, excluding two aircraft subsequently sold as discussed below. During

2006, we took delivery of two B717 and 20 B737 aircraft of which the two B717 and seven B737 were held under operating leases.

The additional 13 B737 aircraft deliveries in 2006 were purchased and financed with debt.

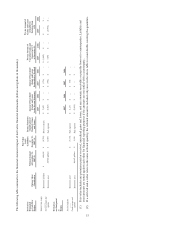

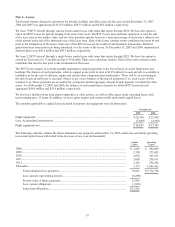

As of December 31, 2007, we had on order 63 B737 aircraft. The table below summarizes all aircraft scheduled for delivery:

Fir

m

Aircraf

t

Deliveries

B737

2008 .............................................................................................................................................................

.

10

2009 .............................................................................................................................................................

.

14

2010 .............................................................................................................................................................

.

14

2011 .............................................................................................................................................................

.

13

2012 .............................................................................................................................................................

.

12

Total.............................................................................................................................................................

.

63

In April 2007, we took delivery of and subsequently sold, in May 2007, two aircraft for cash proceeds of $77.9 million, of which $5.0

million was received in 2006. Unless otherwise expressly indicated, all aircraft delivery totals are net of these two deliveries.

In June 2007, we entered into an amendment to an agreement with an aircraft manufacturer to purchase an additional 15 B737 aircraft.

The newly-ordered aircraft are scheduled to be delivered during 2011 and 2012. Also, pursuant to that same amendment, we agreed to

reschedule the delivery positions for six B737 aircraft on firm order. The aircraft originally scheduled to be delivered during the

second half of 2008 and first half of 2009 are now scheduled to be delivered during 2011. In October 2007 we rescheduled the

delivery dates for three B737 aircraft on firm order from the second half of 2008 to 2011. The new orders and revised delivery dates

are reflected in the table above.

Aircraft purchase contracts typically require the purchaser to make pre-delivery deposits to the manufacturer. We have arranged pre-

delivery aircraft deposit financing for a portion of our pre-delivery deposit requirements for aircraft scheduled to be delivered in 2008,

2009, and some aircraft in 2010. The pre-delivery deposit financing typically funds between 75 percent and 80 percent of our pre-

delivery deposit obligation for any given aircraft.

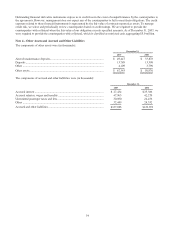

Our aircraft purchase commitments for the next five years, in aggregate, are (in thousands): 2008—$391,300; 2009—$508,000;

2010—$518,600; 2011—$462,300; and 2012—$401,300. These amounts include payment commitments, including payment of pre-

delivery deposits, for aircraft on firm order. Aircraft purchase commitments include the forecasted impact of contractual price

escalations. The aircraft purchase commitment totals do not reflect the effects of prearranged aircraft financings.

Aircraft Financing Arrangements

Of the 63 B737 aircraft we have on order, we have secured debt financing for nine B737 aircraft scheduled for delivery in 2008. Such

debt financing funds approximately 85 percent of the total cost of the aircraft. While our intention is to finance the remainder of the

aircraft on order through a combination of debt and lease financings, we have not yet arranged for such financing.

Additionally, we have sale/leaseback commitments from an aircraft leasing company with respect to four spare engines to be delivered

through 2010.

Fuel Purchase Commitments

Efforts to reduce our exposure to increases in the price and decreases in the availability of aviation fuel include the utilization of fuel

pricing arrangements in purchase contracts with fuel suppliers covering a portion of our anticipated fuel requirements. The fuel pricing

arrangements consist of both fixed price and collar arrangements. Because these contracts are accounted for under the normal

purchase exception included in SFAS 133, these contracts are not considered derivative financial instruments for financial reporting

purposes. As of December 31, 2007, we had no fixed price or collar arrangements with fuel suppliers for any future period.