Airtran 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

For derivative instruments that are designated and qualify as a cash flow hedge (i.e., hedging the exposure to variability in expected

future cash flows that is attributable to a particular risk), the effective portion of the gain or loss on the derivative instrument is

reported as a component of other comprehensive income (loss) and reclassified into earnings in the same line item associated with the

forecasted transaction in the same period or periods during which the hedged transaction affects earnings (for example, in “interest

expense” when the hedged transactions are interest cash flows associated with floating-rate debt). The ineffective portion of the

unrealized gain or loss on the cash flow hedges is reported currently as non-operating (income) expense in our Consolidated

Statements of Operations.

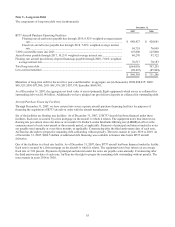

Income Taxes

The Company accounts for deferred income taxes utilizing Statement of Financial Accounting Standards No. 109 (SFAS 109),

Accounting for Income Taxes. SFAS 109 requires the asset and liability method, whereby deferred tax assets and liabilities are

recognized based on the tax effects of temporary differences between the financial statement and the tax bases of assets and liabilities,

as measured at current enacted tax rates. When appropriate the Company evaluates the need for a valuation allowance to reduce

deferred tax assets.

In June 2006, the Financial Accounting Standards Board (FASB) issued Interpretation No. 48 (FIN 48), Accounting for Uncertainty in

Income Taxes—An interpretation of FASB Statement No. 109. The Interpretation clarifies the accounting for uncertainty in income

taxes recognized in an enterprise’s financial statements and prescribes a recognition threshold and measurement attributes of income

tax positions taken or expected to betaken on a tax return. Under FIN 48, the impact of an uncertain tax position taken or expected to

be taken on an income tax return must be recognized in the financial statements at the largest amount that is more-likely-than-not to be

sustained upon audit by the relevant taxing authority. An uncertain income tax position will not be recognized in the financial

statements unless it is more likely than not of being sustained. We adopted the provisions of FIN 48 as of January 1, 2007. The impact

of adopting FIN 48 was not material as of the date of adoption or in subsequent periods.

Interest associated with uncertain income tax positions is classified as interest expense and penalties are classified as income tax

expense. The Company has not recorded any material interest or penalties during any of the years presented.

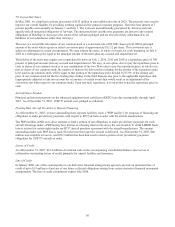

New Accounting Standards

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157 (SFAS 157), Fair Value Measurements .

SFAS 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting

principles, and expands disclosures about fair value measurements. This statement does not require any new fair value measurements;

rather, it applies under other accounting pronouncements that require or permit fair value measurements. The provisions of this

statement are to be applied prospectively as of the beginning of the fiscal year in which this statement is initially applied, with any

transition adjustment recognized as a cumulative-effect adjustment to the opening balance of retained earnings. The provisions of

SFAS 157, as issued, are effective for the fiscal years beginning after November 15, 2007. However, on December 14, 2007, the

FASB issued a proposed FASB Staff Position that would amend SFAS 157 to delay the effective date of Statement 157 for all non-

financial assets and non-financial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a

recurring basis (that is, at least annually). The proposed Staff Position defers the effective date of Statement 157 to fiscal years

beginning after November 15, 2008, and interim periods within those fiscal years for items within the scope of the proposed Staff

Position. We adopted the required provision of SFAS 157 as of January 1, 2008. We do not expect the adoption of SFAS 157 to have a

material impact on our Consolidated Financial Statements.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159 (SFAS 159), The Fair Value Option for

Financial Assets and Financial Liabilities. The fair value option established by SFAS 159 permits, but does not require, all entities to

choose to measure eligible items at fair value, as measured in accordance with SFAS 157, at specified election dates. An entity would

report unrealized gains and losses on items for which the fair value option has been elected in earnings at each subsequent reporting

date. SFAS 159 is effective as of the beginning of an entity's first fiscal year that begins after November 15, 2007. Although we

adopted SFAS 159 as of January 1, 2008, we have not yet elected the fair value option for any items permitted under SFAS 159.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (Revised 2007) (SFAS 141R), Business

Combinations. SFAS 141R will change the accounting for business combinations. Under SFAS 141R, an acquiring entity will be

required to recognize all the assets acquired and liabilities assumed in a transaction at the acquisition-date fair value with limited

exceptions. SFAS 141R will change the accounting treatment and disclosure for certain specific items in a business combination.

SFAS 141R applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first

annual reporting period beginning on or after December 15, 2008. SFAS 141R will have an impact on accounting for business

combinations once adopted but the effect is dependent upon acquisitions at that time.