Airtran 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

58

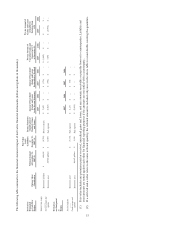

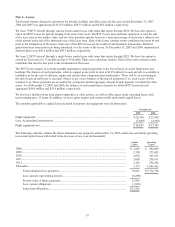

Amortization of assets recorded under capital leases is included as “depreciation and amortization” in the accompanying

consolidated statements of operations.

We have variable interests in our aircraft leases. The lessors are trusts established specifically to purchase, finance and lease

aircraft to us. These leasing entities meet the criteria of variable interest entities, as defined by FASB Interpretation 46R,

Consolidation of Variable Interest Entities. We are generally not the primary beneficiary of the leasing entities if the lease

terms are consistent with market terms at the inception of the lease and do not include a residual value guarantee, a fixed-

price purchase option or similar feature that obligates us to absorb decreases in value or entitles us to participate in increases

in the value of the aircraft. This is the case in the majority of our aircraft leases; however we have two aircraft leases that

contain fixed-price purchase options that allow us to purchase the aircraft at predetermined prices on specified dates during

the lease term. We have not consolidated the related trusts because even taking into consideration these purchase options, we

are not the primary beneficiary based on our cash flow analysis. Our maximum exposure under the two leases is limited to

the remaining lease payments, which are reflected in the future minimum lease payments in the table above.

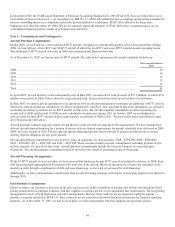

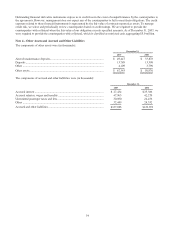

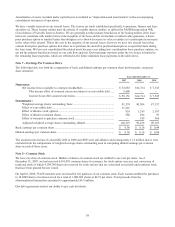

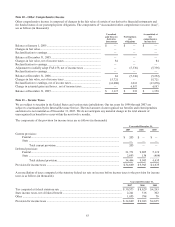

Note 7 – Earnings Per Common Share

The following table sets forth the computation of basic and diluted earnings per common share (in thousands, except per

share amounts):

Year ended Decembe

r

31

,

2007 2006 2005

Numerator:

Net income (loss) available to common stockholders ......................................... $ 52,683 $14,714 $ 7,545

Plus income effect of assumed conversion-interest on convertible debt ..... 5,468 — —

Income (loss) after assumed conversion.................................................... $ 58,151 $14,714 $ 7,545

Denominator:

Weighted-average shares outstanding, basic....................................................... 91,574 90,504 87,337

Effect of convertible debt .................................................................................. 11,241 — —

Effect of dilutive stock options .......................................................................... 924 1,243 2,187

Effect of dilutive restricted shares...................................................................... 580 494 97

Effect of warrants to purchase common stock .................................................... — 195 564

Adjusted weighted-average shares outstanding, diluted ...................................... 104,319 92,436 90,185

Basic earnings per common shar

e

............................................................................... $ 0.58 $ 0.16 $ 0.09

Diluted earnings per common share............................................................................ $ 0.56 $ 0.16 $ 0.08

The assumed conversions of convertible debt in 2006 and 2005 were anti-dilutive and consequently 11.2 million shares were

excluded from the computation of weighted-average shares outstanding used in computing diluted earnings per common

share in each of those years.

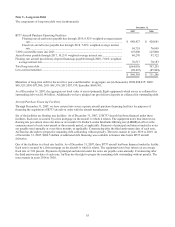

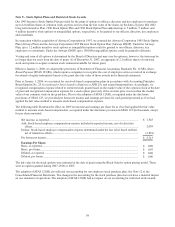

Note 8 – Common Stock

We have one class of common stock. Holders of shares of common stock are entitled to one vote per share. As of

December 31, 2007, we had reserved 6,381,991 common shares for issuance for stock option exercises and conversion of

restricted stock of which 4,198,746 shares are reserved for stock options that are vested and exercisable and restricted stock

that have been granted but not vested.

On April 6, 2006, 55,468 warrants were exercised for the purchase of our common stock. Each warrant entitled the purchaser

to 18.0289 shares of common stock for a total of 1,000,024 shares at $4.51 per share. Total proceeds from the

aforementioned transaction amounted to approximately $4.5 million.

Our debt agreements restrict our ability to pay cash dividends.