Airtran 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

54

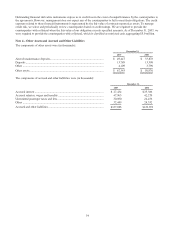

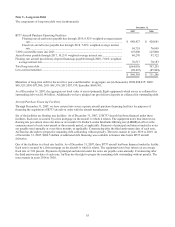

Outstanding financial derivative instruments expose us to credit loss in the event of nonperformance by the counterparties to

the agreements. However, management does not expect any of the counterparties to fail to meet their obligations. The credit

exposure related to these financial instruments is represented by the fair value of contracts reported as assets. To manage

credit risk, we select and periodically review counterparties based on credit ratings. We are required to provide the

counterparties with collateral when the fair value of our obligation exceeds specified amounts. As of December 31, 2007, we

were required to provide the counterparties with collateral, which is classified as restricted cash, aggregating $5.9 million.

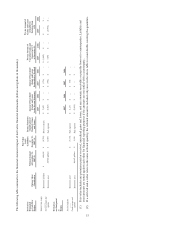

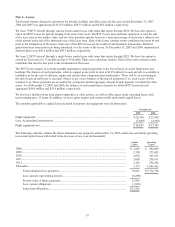

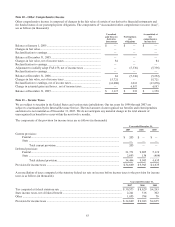

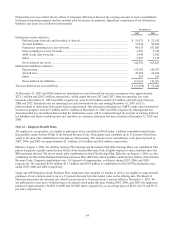

Note 4 – Other Assets and Accrued and Other Liabilities

The components of other assets were (in thousands):

Decembe

r

31

,

2007 2006

Aircraft maintenance deposits......................................................................

.

$ 49,447 $ 33,878

Deposits......................................................................................................

.

13,789 13,308

Other ..........................................................................................................

.

4,109 3,790

Other assets.................................................................................................

.

$ 67,345 $ 50,976

The components of accrued and other liabilities were (in thousands):

Decembe

r

31

,

2007 2006

Accrued interest ........................................................................................... $ 27,434 $ 25,386

Accrued salaries, wages and benefits ............................................................ 47,963 42,279

Unremitted passenger taxes and fees............................................................. 30,050 24,456

Other ........................................................................................................... 32,449 28,532

Accrued and other liabilities ......................................................................... $137,896 $120,653