Airtran 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

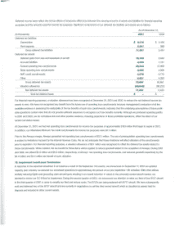

16. Subsequent Events

On March

21,

2002, we amended our 8717 purchase contract as follows:

(i)

our commitments to acquire 8717s

in

2002 increased from

12

aircraft

to

20

aircraft, comprised

of

13 firm and seven option aircraft;

(ii)

our commitments to acquire 8717s

in

2003 decreased from

11

aircraft to

10

aircraft,

comprised

of

nine firm and one option aircraft; and

(iii)

purchase deposits that were previously paid for aircraft deliveries

in

2002 will be applied to

future aircraft deliveries, rather than reducing the balance

of

the total purchase price due at delivery.

We have signed alease financing proposal from 80eing Capital for

19

(20 at 80eing Capital's option) new or previously owned 8717 aircraft to be

delivered in 2002. According to this proposal, the lease term for each

of

these aircraft commences upon delivery and will continue for

18

to

19

years,

at which time we can renew the lease at fair market rental or purchase the aircraft at the greater

of

apredetermined amount

or

its fair market value.

If

completed as contemplated, this lease financing will reduce our aggregate funding requirements for aircraft commitments to $211.3 million representing

the aircraft to be purchased

in

2003. Funding is subject to finalization

of

definitive agreements and other conditions. See Note

4.

On

March

13,

2002,

we

terminated all our derivative agreements with the counterparty. The current fair value

of

the derivative liability on the termination

date was estimated to be less than $1.0 million, as compared to aliability of $8.7 million at December 31,2001. Since this

is

an early termination

of

derivative contracts, losses

of

$6.8 million at December

31,

2001, deferred

in

other comprehensive loss will continue to be reclassified to earnings as

the related fuel

is

used through September 2004. See Note

5.