Airtran 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

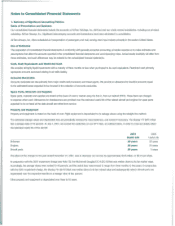

Measurement

of

Impairment

In

accordance with Statement

of

Financial Accounting Standards No.

121

(SFAS

121),

"Accounting for the Impairment

of

Long-Lived Assets and for

Long-Lived Assets to be Disposed

of,"

we record impairment losses on long-lived assets used in operations when events or circumstances indicate

that the assets may be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the net book value

of

those assets. See Note

13.

Intangibles

The trade name and intangibles resulting from business acquisitions consist of cost in excess

of

net assets acquired, and are being amortized using

the straight-line method over

30

years. Accumulated amortization at December

31,

2001 and 2000, was approximately $6.4 million and

$5.1

million,

respectively. Pursuant to Statement

of

Financial Accounting Standards No. 142

(SFAS

142), "Goodwill and Other Intangible Assets," effective January

1,

2002, goodwill and indefinite lived intangibles, such as trade names, will no longer be amortized but will be subject to periodic impairment reviews.

See "Recently Issued Accounting Standards" below.

Capitalized

Interest

Interest attributable to funds used to finance the acquisition of new aircraft

is

capitalized as an additional cost

of

the related asset. Interest

is

capitalized

at our weighted-average interest rate on long-term debt

or,

where applicable, the interest rate related to specific borrowings. Capitalization

of

interest

ceases when the asset

is

placed in service.

In

2001,2000

and 1999, approximately $8.0 million, $8.8 million and $6.7 million of interest cost was

capitalized, respectively.

Aircraft and Engine

Maintenance

We account for airframe and engine overhaul costs using the direct-expensing method. Overhauls are performed on acontinuous basis, and the cost

of overhauls and routine maintenance costs for airframe and engine maintenance are charged to maintenance expense as incurred.

Advertising Costs

Advertising costs are charged to expense

in

the period the costs are incurred. Advertising expense was approximately $17.5 million, $15.7 million and

$14.8 million for the years ended December

31,

2001, 2000 and 1999, respectively.

Revenue Recognition

Passenger and cargo revenue is recognized when transportation is provided. Transportation purchased but not yet used is included

in

air traffic liability.

Frequent Flyer Program

We accrue the estimated incremental cost

of

providing free travel for awards earned under our A+ Rewards Program.

Stock-Based Compensation

We grant stock options for afixed number

of

shares to our officers, directors, key employees and consultants, with an exercise price equal to or below

the fair value

of

the shares

at

the date

of

grant. We account for stock option grants

in

accordance with Accounting Principles Board Opinion No. 25

(APB

25),

"Accounting for Stock Issued

to

Employees," and accordingly recognize compensation expense only if the market price

of

the underlying

stock exceeds the exercise price

of

the stock option on the date of grant.

Statement of Financial Accounting Standards No. 123

(SFAS

123), "Accounting for Stock-Based Compensation," provides an alternative to APB 25 in

accounting for stock-based compensation issued to employees. However, we will continue to account for stock-based compensation

in

accordance

wittl APB 25. See Note

11.