Airtran 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

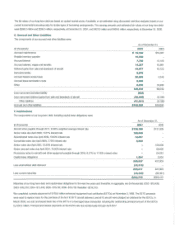

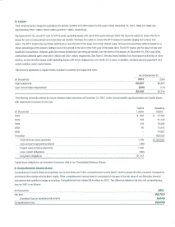

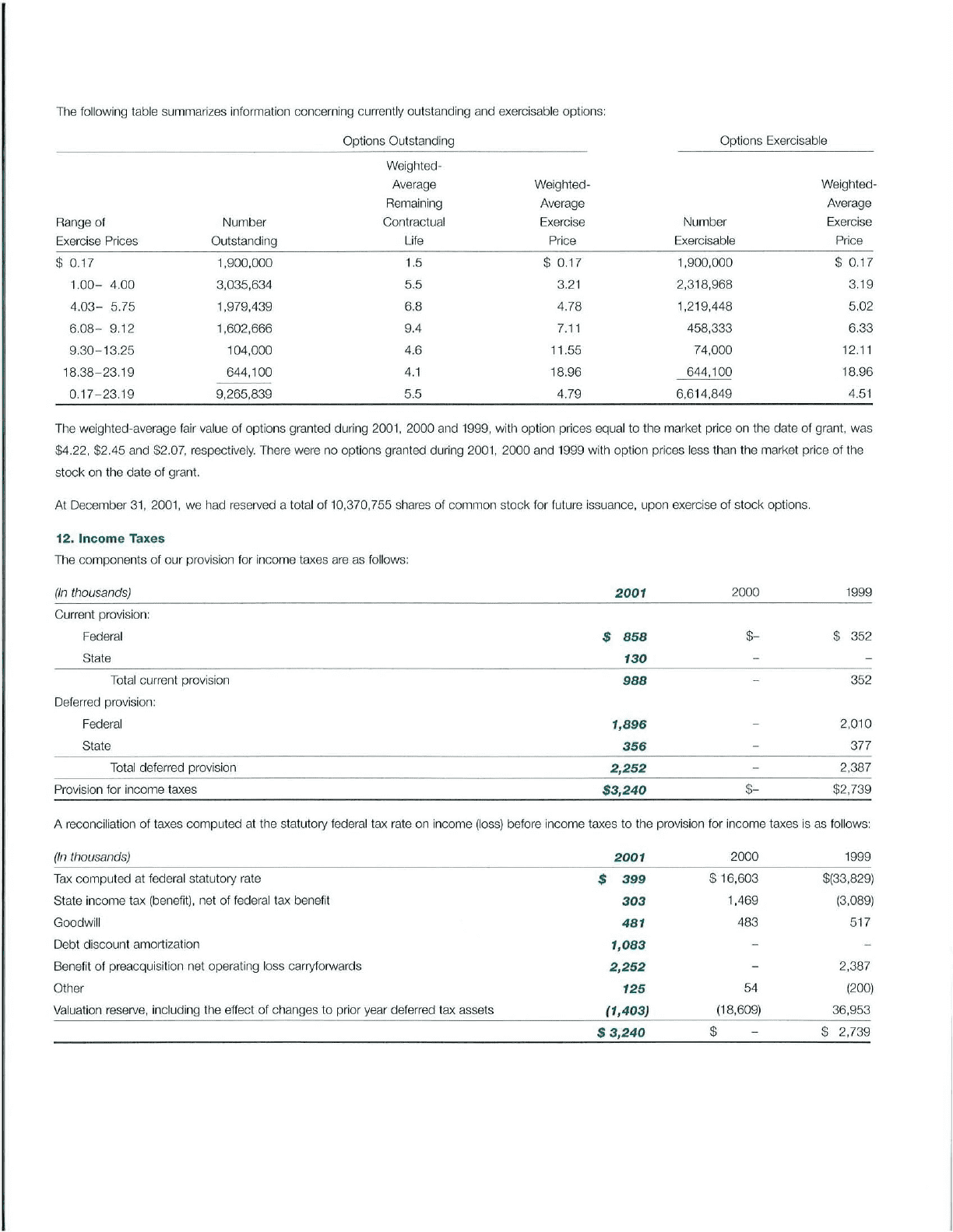

The following table summarizes information concerning currently outstanding and exercisable options:

Options Outstanding Options Exercisable

Weighted-

Average Weighted- Weigtlted-

Remaining Average Average

Range

of

Number Contractual Exercise Number Exercise

Exercise Prices Outstanding Ufe Price Exercisable Price

$0.17 1,900,000 1.5 $0.17 1,900,000 $0.17

1.00-

4.00 3,035,634 5.5

3.21

2,318,968 3.19

4.03-

5.75 1,979,439 6.8 4.78 1,219,448 5.02

6.08-

9.12 1,602,666 9,4

7.11

458,333 6.33

9.30-13.25

104,000 4.6 11.55 74,000

12.11

18.38-23.19

644,100

4.1

18.96 644,100 18.96

0.17-23.19

9,265,839 5.5 4.79 6,614,849

4.51

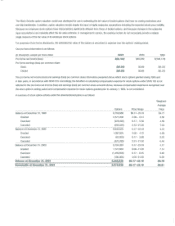

The weighted-average fair value of options granted during 2001, 2000 and 1999, with option prices equal to the market price on the date of grant, was

$4.22,82.45

and $2.07, respectively. There were no options granted during 2001,

2000

and 1999 with option prices

Jess

than the market price

of

the

stock on the date of grant.

At December

31,

2001, we had reserved atotal

of

10,370,755 shares of common stock for future issuance, upon exercise

of

stock options.

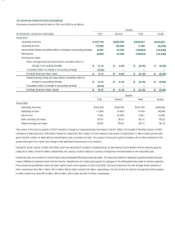

12. Income Taxes

The components

of

our provision for income taxes

are

as follows:

(In

thousands)

Current provision:

Federal

State

Total current provision

Deferred provision:

Federal

State

Total

deferred provision

Provision for income taxes

2001

$

858

130

988

1,896

356

2,252

$3,240

2000

$-

$-

1999

$352

352

2,010

377

2,387

$2,739

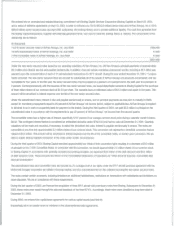

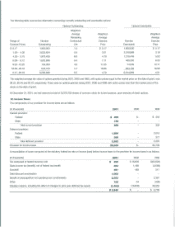

Areconciliation

of

taxes computed at tile statutory federal tax rate on income (loss) before income taxes to the provision for income taxes is as follows:

(In

thousands)

Tax

computed at federal statutory rate

State income tax (benefit), net

of

federal tax benefit

Goodwill

Debt discount amortization

Benefit

of

preacquisition net operating loss carryforwards

Other

Valuation reserve, including the effect

of

changes to prior year deferred tax assets

2001

$

399

303

481

1,083

2,252

125

(1,403)

$

3,240

2000

$16,603

1,469

483

54

(18,609)

$

1999

$(33,829)

(3,089)

517

2,387

(200)

36,953

$2,739