Airtran 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

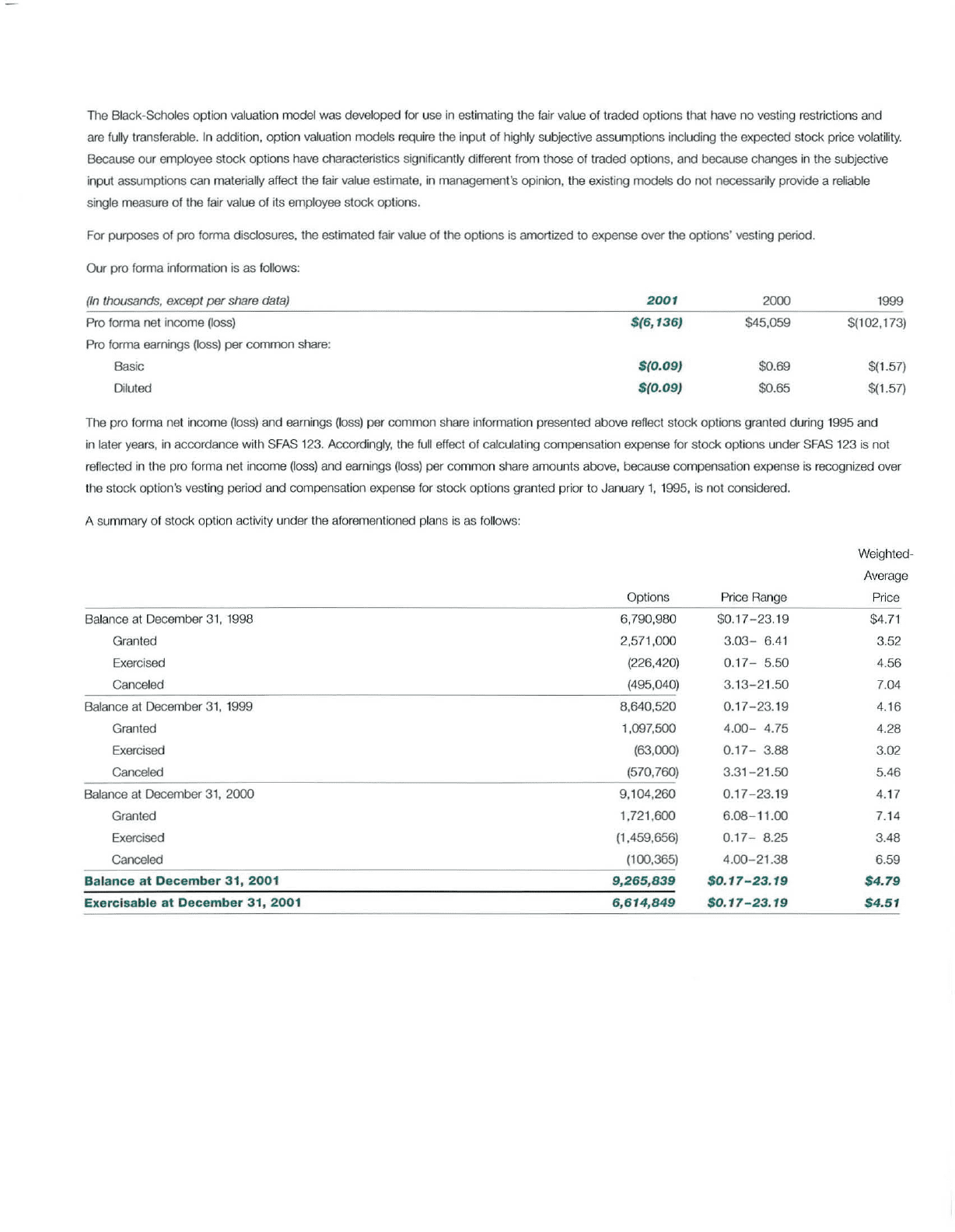

The Black-Scholes option valuation model was developed for use in estimating the fair value of traded options that have

no

vesting restrictions and

are fully transferable.

In

addition, option valuation models require the input of highly subjective assumptions including the expected stock price volatility.

Because our employee stock options have characteristics significantly different from those of traded options, and because changes in the subjective

input assumptions can materially affect the fair value estimate, in management's opinion, the existing models

do

not necessarily provide areliable

single measure of the fair value of its employee stock options.

For purposes

of

pro forma disclosures, the estimated fair value of the options is amortized to expense over the options' vesting period.

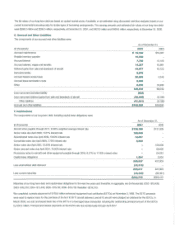

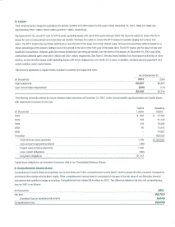

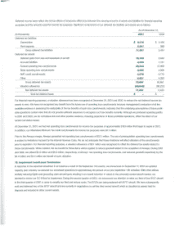

Our pro forma information is as follows:

(In

thousands, except

per

share data)

Pro forma net income (loss)

Pro forma earnings (loss)

per

common share:

Basic

Diluted

2001

$(6,136)

$(0.09)

$(0.09)

2000

$45,059

$0.69

$0.65

1999

$(102,173)

$(1.57)

$(1.57)

The pro forma net income (loss) and earnings (loss) per common share information presented above renect stock options granted during 1995 and

in later years, in accordance with SFAS 123. Accordingly, the

full

effect of calculating compensation expense for stock options under

SFAS

123 is not

reflected

in

the pro forma net income (loss) and earnings

(loss)

per common share amounts above, because compensation expense

is

recognized over

the stock option's vesting period and compensation expense for stock options granted prior to January

1,

1995, is not considered.

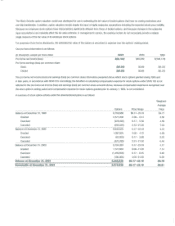

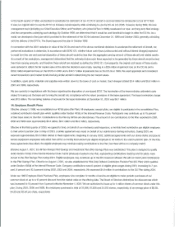

Asummary of stock option activity under the aforementioned plans

is

as

follows:

Weighted-

Average

Options Price Range Price

Balance at December

31,

1998 6,790,980 $0.17

-23.19

$4.71

Granted 2,571,000

3.03-

6.41

3.52

Exercised (226.420)

0.17-

5.50 4.56

Canceled (495,040)

3.13-21.50

7.04

Balance at December

31,

1999 8,640,520

0.17-23.19

4.16

Granted 1,097,500

4.00-

4.75 4.28

Exercised (63,000)

0.17-

3.88 3.02

canceled (570,760)

3.31-21.50

5.46

Balance at December

31,

2000 9,104,260

0.17-23.19

4.17

Granted 1,721,600

6.08-11.00

7.14

Exercised (1,459,656)

0.17-

8.25 3.48

Ganceled (100,365)

4.00-21.38

6.59

Balance

at

December

31,2001

9,265,839

$0.17-23.19

$4.79

Exercisable

at

December

31,

2001

6,614,849

$0.17-23.19

$4.51