Airtran 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

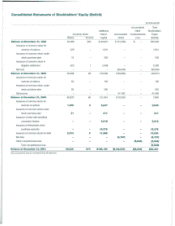

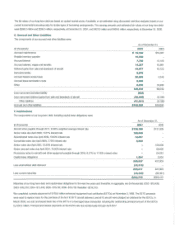

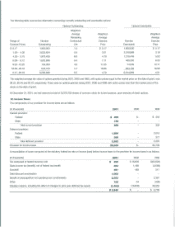

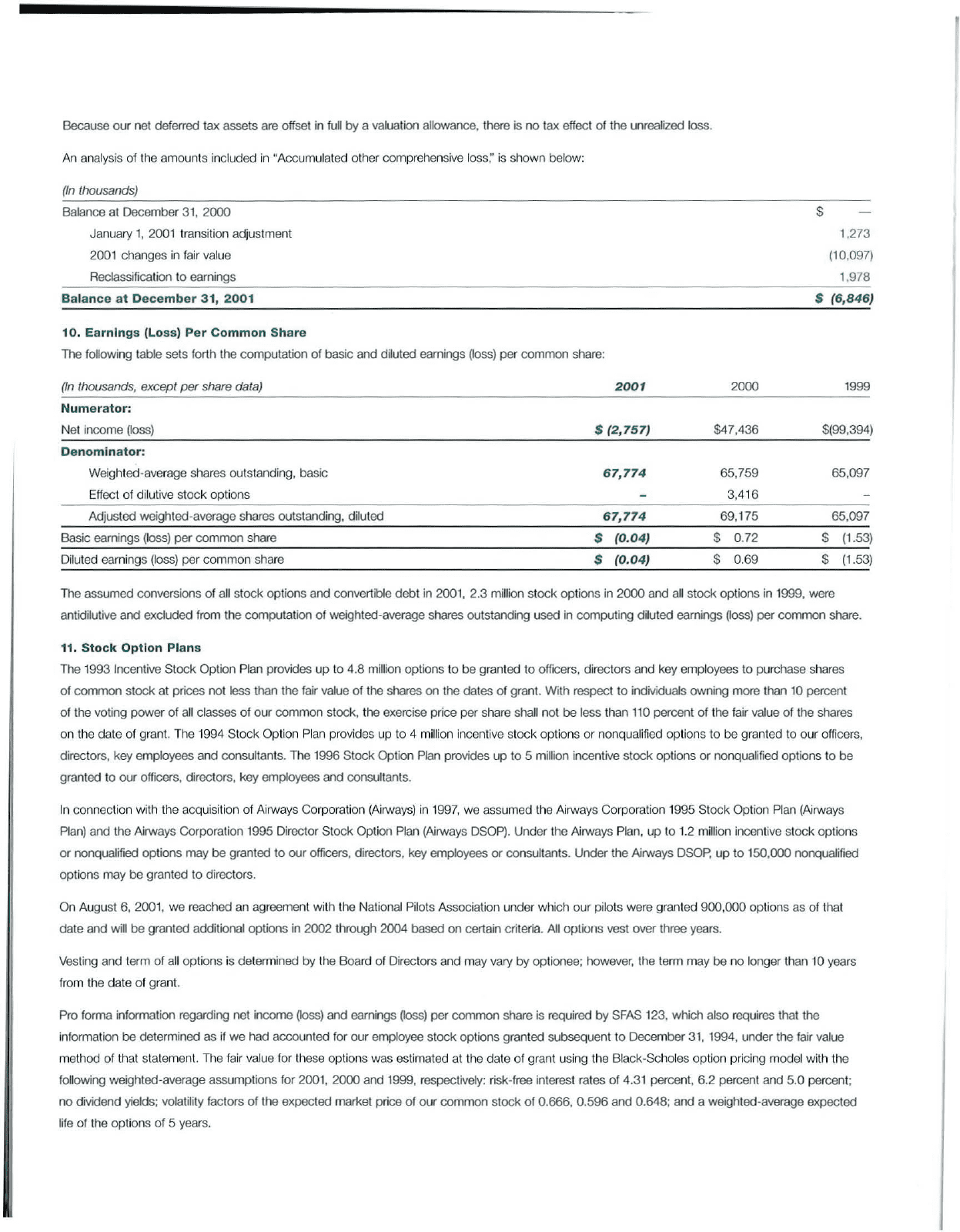

Because

our

net deferred tax assets are offset

in

full

by

avaluation allowance, there is

no

tax effect

of

the unrealized loss.

An

analysis

of

the amounts included

in

"Accumulated other comprehensive

loss,"

is shown below:

(In

lhousands)

Balance at

December

31,

2000

January

1,

2001 transition adjustment

2001 changes in fair value

Reclassification

to

earnings

Balance

at

December

311

2001

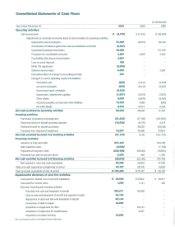

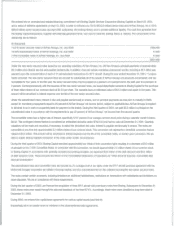

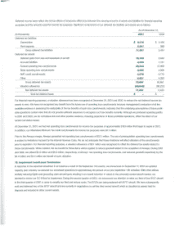

10.

Earnings

(Loss)

Per

Common

Share

The following table sets forth the computation

of

basic

and

diluted earnings (loss)

per

common

share:

$

1,273

(10,097)

1,978

$

(6,846)

(In

thousands, except

per

share data)

2001

2000 1999

Numerator:

Net income

Ooss)

$

(2,757)

$47,436 $(99,394)

Denominator:

Weighted-average shares outstanding, basic

67,774

65,759 65,097

Effect

of

dilutive

stock

options 3,416

Adjusted weighted-average shares outstanding, diluted

67,774

69,175 65,097

Basic earnings (loss)

per

common

share $

(0.04)

S0,72 S(1,53)

Diluted earnings (loss)

per

common

share $

(0.04)

S0,69 S(1,53)

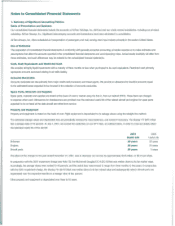

The

assumed

conversions

of

all

stock

options and convertible

debt

in 2001, 2.3 million

stock

options in

2000

and all

stock

options in 1999, were

antidilutive

and

excluded from the computation

of

weighted-average shares outstanding used

in

computing

diluted earnings

Ooss)

per

common

share.

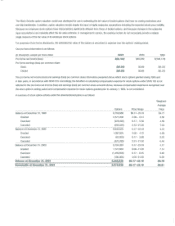

11.

Stock

Option

Plans

The 1993 Incentive

Stock

Option Plan provides

up

to

4.8

million options

to

be

granted

to

offICers, directors

and

key employees

to

purchase shares

of

common

stock

at prices not less than the fair value

of

the shares on the

dates

of

grant. With respect

to

individuals owning more than 10 percent

of

the voting

power

of

all classes

of

our

common

stock, the exercise price

per

share shall

not

be less than 110 percent

of

the fair value

of

the shares

on the

date

of grant. The 1994

Stock

Option Plan provides

up

to

4million incentive

stock

options

or

nonqualified options to

be

granted

to

our

officers,

directors, key employees

and

consultants. The 1996

Stock

Option Plan provides

up

to

5million incentive

stock

options

or

nonqualified options

to

be

granted to

our

officers, directors, key employees and consultants.

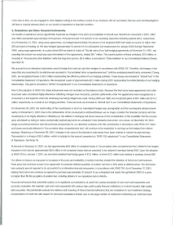

In

connection with the acquisition

of

Airways Corporation (Airways)

in

1997,

we

assumed the Airways Corporation 1995

Stock

Option Plan (Airways

Plan) and the Airways Corporation 1995 Director

Stock

Option Plan (Airways DSOP). Under the Airways Plan,

up

to

1.2 million incentive

stock

options

or

nonqualifled options

may

be

granted

to

our

OffICers,

directors, key employees

or

consultants. Under the Airways DSDP,

up

to

150,000 nonquaHfied

options

may

be

granted

to

directors.

On

August 6, 2001,

we

reached an agreement with the National Pilots Association under which

our

pilots were granted

900,000

options

as

of

that

date

and will be granted additional options in

2002

through 2004 based on certain criteria. All options vest over three years.

Vesting

and

term

of

all

options is determined

by

the Board of Directors and may vary

by

optionee; however, the term

may

be

no

longer than 10 years

from the

date

of

grant.

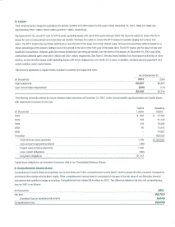

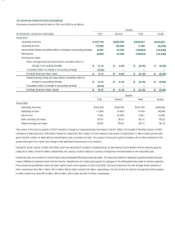

Pro forma information regarding net income (loss)

and

earnings (loss)

per

common

share is required

by

SFAS 123,

which

also requires that the

information

be

determined

as

if

we

had accounted for

our

employee

stock

options granted subsequent

to

December

31, 1994, under the fair value

method

of that statement. The fair value for these options was estimated at the

date

of

grant using the Black-Scholes option pricing model with the

following

weighted~average

assumptions for 2001,

2000

and

1999, respectively: risk-free interest rates

of

4.31 percent,

6.2

percent

and

5.0

percent;

no

dividend yields; volatility factors

of

the expected market price

of

our

common

stock

of

0.666,

0.596

and 0.648; and aweighted-average expected

life

of

the options

of

5years.