Airtran 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

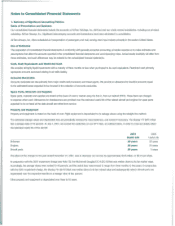

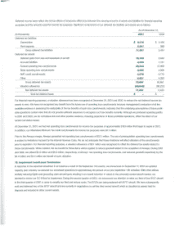

instruments and some ineffectiveness that has been experienced

in

our

fuel

hedges. See Note 5for further information on our derivatives and

fuel

price

risk management.

3.

Federal Grants and Special Charges Related to Terrorist

Attacks

On September

11,

2001, terrorists hijacked and used four aircraft

in

terrorist attacks on the United States (terrorist attacks). As aresult

of

these

terrorist attacks, the Federal Aviation Administration

(FAA)

immediately suspended all commercial airline flights on the morning

of

September

11.

We resumed flight activity on September

14

and were operating

at

approximately

80

percent of our normal pre-September

11

flight schedule

by September 18, 2001. From September

11

until

we

resumed flight operations on September

14,

we cancelled approximately 1,000 flights.

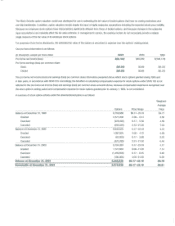

On September 22, 2001, President Bush signed into law the Air Transportation Safety and System Stabilization Act (the Stabilization Act). The

Stabilization Act provides for

up

to $5 billion

in

cash grants to qualifying U.S. airlines and freight carriers to compensate for direct and incremental

losses, as defined

in

the Stabilization Act, from September

11,

2001 through December

31,

2001, associated with the terrorist attacks. Each airline's

total eligible grant is being determined based on that airline's percentage

of

ASMs during August 2001 to total eligible carriers' ASMs for August 2001.

less an undetermined amount set aside for eligible carriers that provide services not measured by ASMs. The U.S. Department

of

Transportation

(DOl)

will make the final determination

of

the amount

of

eligible direct and incremental losses incurred by each airline. Direct and incremental losses, while

defined generally

in

the Stabilization Act, are subject to interpretation by the

DOT.

Lastly, final applications for grants must be accompanied by Agreed

Upon Procedures reports from independent accountants and may be subject to additional audit or review by the DOT and Congress.

During 2001,

we

recognized approximately $29 million from grants under the Stabilization Act, approximately $24.6 million

of

which we have received

in cash. We expect to receive the remaining amount

in

the second quarter of 2002. We believe our actual direct and incremental losses related to

the September

11

terrorist attacks will exceed the total amount for which we will ultimately be eligible, but the amount

is

subject to change upon final

determination by the DOT

of

our share

of

the total compensation under the Stabilization Act.

We recorded special charges of $2.5 million in 2001 primarily related to operating costs incurred during the period flights were suspended as aresult

of

the terrorist attacks.

4.

Commitments

and Contingencies

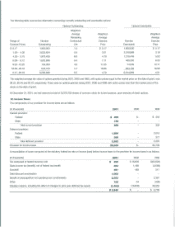

At December

31,

2001, our contractual commitments consisted primarily

of

scheduled aircraft acquisitions. As

of

December

31,

2001, our deliveries

of 8717s from the 80eing Company (Boeing) totaled 30 aircraft. Initially, we contracted with Boeing to purchase 50 B717s for delivery between 1999

and 2002, with options to purchase an additional 50 8717s. During 2000, we revised our contracts with Boeing relating to the purchase and financing

of

our future 8717 aircraft deliveries,

in

addition to recharacterizing the 50 option aircraft to provide for 25 options,

20

purchase rights and five rolling

options. The options and purchase rights, to the extent exercised, would provide for delivery to us

of

all

of

our B717s on or before September 30,

2005. Prior to this revision, we had committed to purchase 50 8717s during the following years: 1999 (eight aircraft), 2000 (eight aircraft), 2001

(16 aircraft) and 2002 (18 aircraft). Also prior to the revision, the

50

option aircraft, if exercised, would have been available for delivery between

January 2003 and January 2005.

As

of

December

31,

2001, our remaining commitments with respect to 8717 aircraft were for the acquisition

of

12

aircraft

in

2002 and

11

aircraft

in

2003. Aggregate funding, net

of

previously paid purchase deposits, required for these aircraft commitments was approximately $470.2 million. Although

we expect to finance the acquisition of these aircraft, we did not have financing

in

place for these aircraft at December

31,

2001. See Note

16.

With respect to future 8717 option deliveries, we had

21

options, 20 purchase rights and five rolling options at December

31,

2001. Three

of

the

25 original options were exercised with two 8717s having been delivered

in

2001, and one B717 scheduled for delivery

in

2003; one option expired

un·exercised. See Note 16.

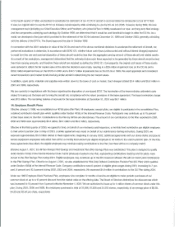

In

November

1997,

we

filed asuit against SabreTech and its parent corporation seeking to hold them responsible for the accident involving Flight 592.

On September 23, 1999, we settled the lawsuit against SabreTech and its parent. The net proceeds

of

$19.6 million from the settlement are included

in

other revenue in our 1999 Consolidated Statement

of

Operations.

Several stockholder class action suits were filed against us and certain

of

our current and former executive officers and directors. The suits were

subsequently consolidated into asingle action. On December

31,

1998,

we

entered into aMemorandum

of

Understanding to settle the consolidated

lawsuit. Although we denied that

we

violated any

of

our obligations under the federal securities laws,

we

paid $2.5 million

in

cash and $2.5 million

in

common stock

in

the settlement which was approved on October 28, 1999.