Airtran 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

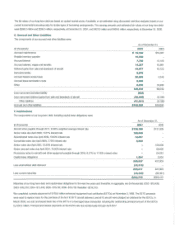

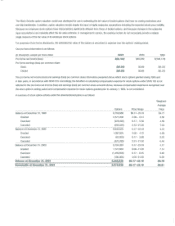

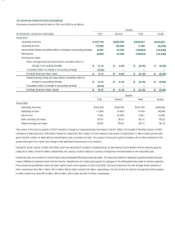

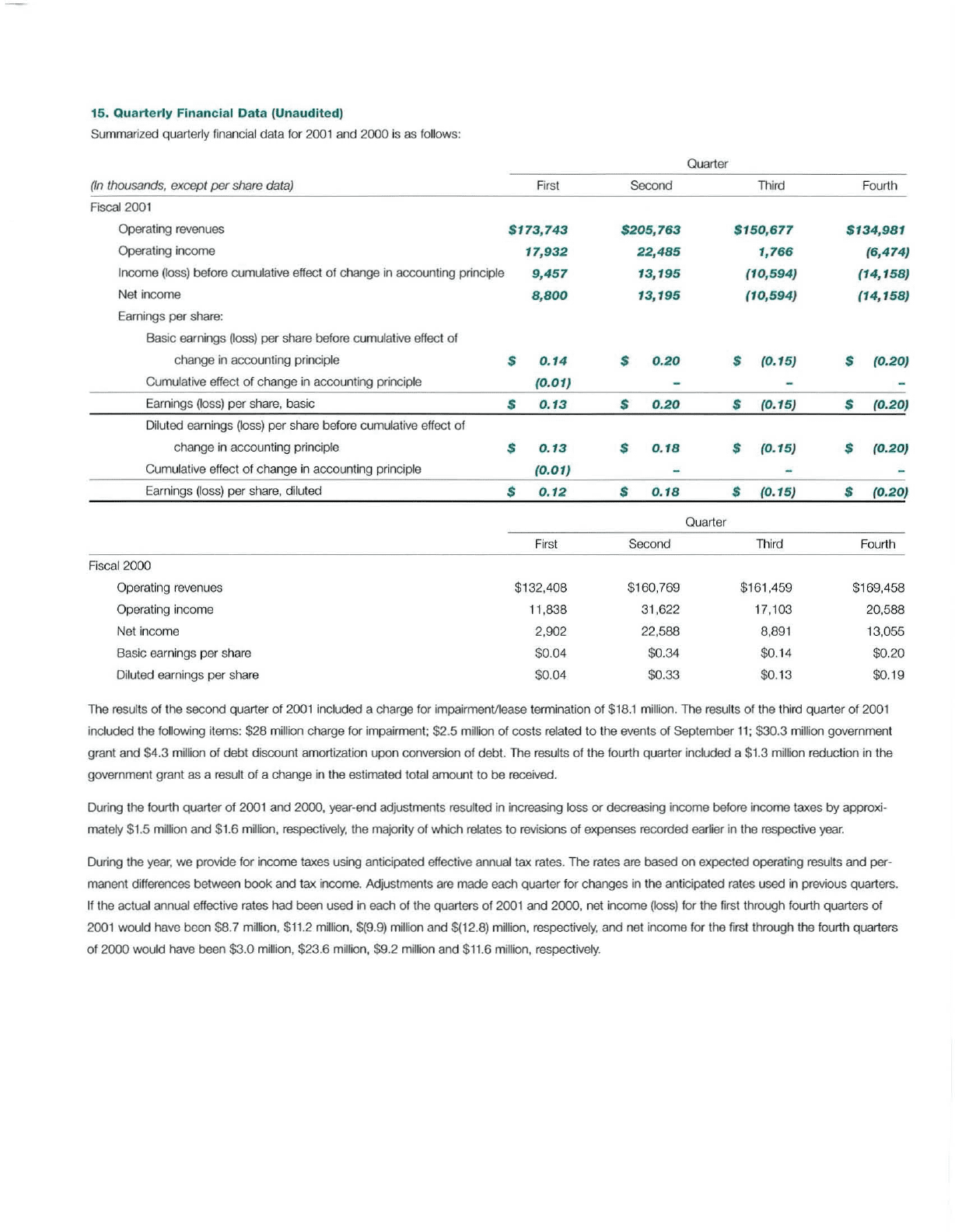

15.

Quarterly

Financial

Data

(Unaudited)

Summarized quarterly financial

data

for 2001

and

2000

is as follows:

Quarter

First Second Third Fourth

$173,743

$205,763 $150,677

$134,981

17,932

22,485

1,766

(6,474)

9,457

13,195

(10,594)

(14,158)

8,800

13,195

(10,594)

(14,158)

$

0.14

$

0.20

$

(0.15)

$

(0.20)

(0.01)

$

0.13

$

0.20

$

(0.15)

$

(0.20)

$

0.13

$

0.18

$

(0.15)

$

(0.20)

(0.01)

$

0.12

$

0.18

$

(0.15)

$

(0.20)

Quarter

First Second Third Fourth

$132,408 $160,769 $161,459 $169,458

11,838 31,622 17,103 20,588

2,902 22,588 8,891 13,055

$0.04 $0.34 $0.14 $0.20

$0.04 $0.33 $0.13 $0.19

(In

thousands, except

per

share data)

Fiscal 2000

Operating revenues

Operating income

Net income

Basic earnings per share

Diluted earnings per share

Diluted earnings (loss) per share before cumulative effect

of

change in accounting principle

Cumulative effect

of

change in accounting principle

Earnings (loss) per share, basic

Earnings (loss) per share, diluted

Fiscal

2001

Operating revenues

Operating income

Income (loss) before cumulative effect

of

change

in

accounting principle

Net income

Earnings per share:

Basic earnings

Voss)

per

share before cumulative effect

of

change in accounting principle

Cumulative effect

of

change

in

accounting principle

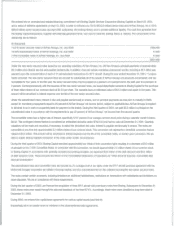

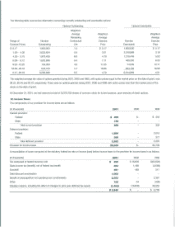

The results

of

the second quarter

of

2001 included acharge for impairmentflease termination

of

$18.1

million. The results

of

the third quarter

of

2001

included the following items:

$28

million charge for impairment; $2.5 million

of

costs

related

to

the events

of

September

11;

$30.3 million government

grant

and

$4.3

million

of

debt

discount amortization

upon

conversion

of

debt. The results

of

the fourth quarter included a$1.3

milUon

reduction in the

government grant as aresult

of

achange

in

the estimated total amount

to

be

received.

During the fourth quarter

of

2001

and

2000, year-end adjustments resulted in increasing loss

or

decreasing income before income taxes

byapproxi-

matety $1.5 million and $1.6 million, respectively, the majority

of

which relates

to

revisions

of

expenses recorded earlier in the respective

year.

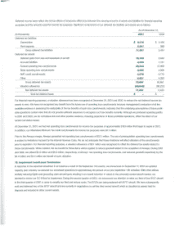

During the year, we provide for income taxes using anticipated effective annual tax rates. The rates are

based

on

expected operating results and per-

manent differences between

book

and tax income. Adjustments are

made

each quarter for changes in the anticipated rates used

in

previous quarters.

If

the actual annual effective rates

had

been

used in

each

of

the quarters

of

2001 and 2000, net income

(k:>ss)

for the first through fourth quarters

of

2001 would have been $8.7 million, $11.2 million, $(9.9) million

and

$(12.8) million, respectively, and net income for the first through the fourth quarters

of

2000

would have been

$3.0

million, $23.6 mmion, $9.2 million and $11.6 million, respectively.