Airtran 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

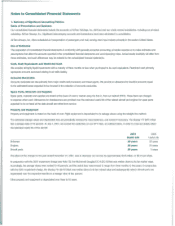

,.

•

Spare

Parts,

Materials

and

Supplies

Spare parts, materials

and

supplies are staled at the lower

of

cost

or

market using the first-in, first-out

method

(FIFO).

These

items are charged

to

expense when used. Allowances for obsolescence are provided over the estimated useful life

of

the related aircraft

and

engines for spare parts

expected

to

be on hand at the date aircraft are retired from service.

Recently

Issued

Accounting

Standards

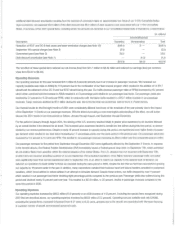

In

June

2001, the Financial Accounting Standards Board

(FASB)

issued Statement

of

Financial Accounting Standards No.

141

(SFAS

141),

"Business

Combinations"

and

Statement

of

Financial Accounting Standards No. 142 (SFAS 142), "Goodwill and Other Intangible Assets." SFAS

141

requires

all business combinations initiated after June 30, 2001 to be accounted for using the purchase method. SFAS 142 prohibits the amortization

of

good-

will

and

intangible assets with indefinite lives and requires that these assets be reviewed for impairment at least annually. Intangible assets with finite

lives will continue

to

be amortized over their estimated useful lives. We will apply SFAS 142 beginning in the first quarter

of

2002 and discontinue the

amortization

of

our trade name, an indefinite-life intangible asset and goodwill. Application

of

the nonamortizalion provisions

of

SFAS 142 is expected

to

result in an increase in net income

in

2002

of

approximately $1.4 million (S.02 per share). We will be required

to

test the goodwill and trade name

for impairment annually in accordance with SFAS 142. We have pertormed the first

of

the required impairment tests for the trade name

and

goodwill

as

of

January

1,

2002

and

will

not

have any impairment

of

these assets

upon

adoption.

On

October

3,2001,

the FASB issued Statement

of

Financial Accounting Standards No. 144 (SFAS 144),

~Accounting

for the Impairment

or

Disposal

of

Long-Lived Assets," which is effective for financial statements issued for fiscal years beginning after December 15, 2001. SFAS

144

supersedes

SFAS

121,

and

applies

to

all long-lived assets

~ncluding

discontinued operations).

We

do

not expect this standard

to

have amaterial impact on our

future financial position

or

results

of

operations.

8717

Aircraft

Program

Update

Boeing recently evaluated the production and delivery schedules

of

its commercial airplane programs,

in

light

of

current market conditions. After a

thorough evaluation

of

the program and market, Boeing made abusiness decision

to

continue production of the

B717.

While Boeing stated the B717

is the leading 1oo-passenger airplane,

due

to reduced near-term demand following the September

11

Events, the program will

go

forward with alower

production rate

and

revised delivery projections.

Our

delivery schedule has not been affected by Boeing's decision

to

lower production rates.

In

2002,

we

anticipate taking delivery

of

20

new

8717s.

New

Service

We

recently announced the launch

of

new

service from Rochester, New York and WIChita, Kansas,

our

37th and

38th

destinations, respectively. Our

new service

to

these new cities is aresult

of

their local governments

and

business interests providing revenue guarantee programs

and

other market-

ing incentives

to

lessen the risks

of

our entry into

these

new

markets. Nonstop service from Rochester

to

Atlanta, Georgia

and

BallimorelWashington

International Airport (BWI) begins

in

March 2002. Nonstop service from Wichita

to

Atlanta, Georgia

and

Chicago, Illinois' Midway International Airport

begins in

May

2002.

During 2001,

we

inaugurated

new

service

to

BWI, and the Florida cities

of

Tallahassee and Pensacola. The

new

service

to

Tallahassee is the result

of

agreements with the City

of

Tallahassee offering revenue guarantees, reduced facility costs and marketing incentives, as well as an exclusive air service

contract with the State

of

Florida. The commencement

of

service to Pensacola coincided with simultaneous termination

of

service

to

Fort Walton

Beach, Florida. The Pensacola Airport, Chamber

of

Commerce and other Gulf Coast parties presented us with an incentive package that includes

reduced facilities

costs

and

marketing dollars, as well as covering moving expenses. More than

300

corporate, government

and

other entities

com-

mitted funds

to

an air travel

bank

in support

of

this new service.

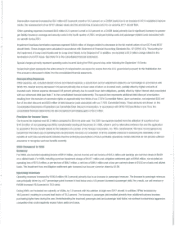

Quantitative

and

Qualitative

Disclosures

About

Market

Risk

Market

Risk-Sensitive

Instruments

and

Positions

We

are subject

to

certain market risks, including interest rates and commodity prices

~.e.,

aircraft fuel). The adverse effects

of

changes in these

markets

pose

apotential loss as discussed below. The sensitivity analyses

do

not consider the effects that such adverse changes may have

on

overall

economic activity,

nor

do

they consider additional actions

we

may take

to

mitigate

our

exposure

to

such changes. Actual results may differ. See the

Notes

to

the consolidated financial statements for adescription

of

our financial policies and additional information.