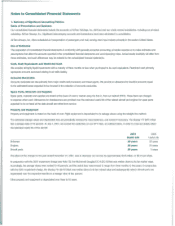

Airtran 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

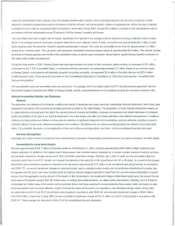

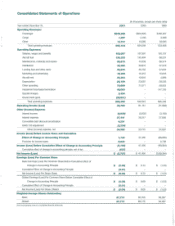

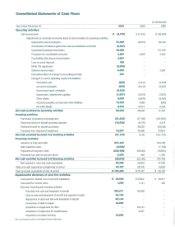

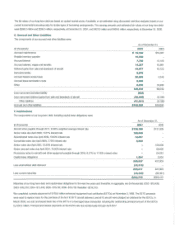

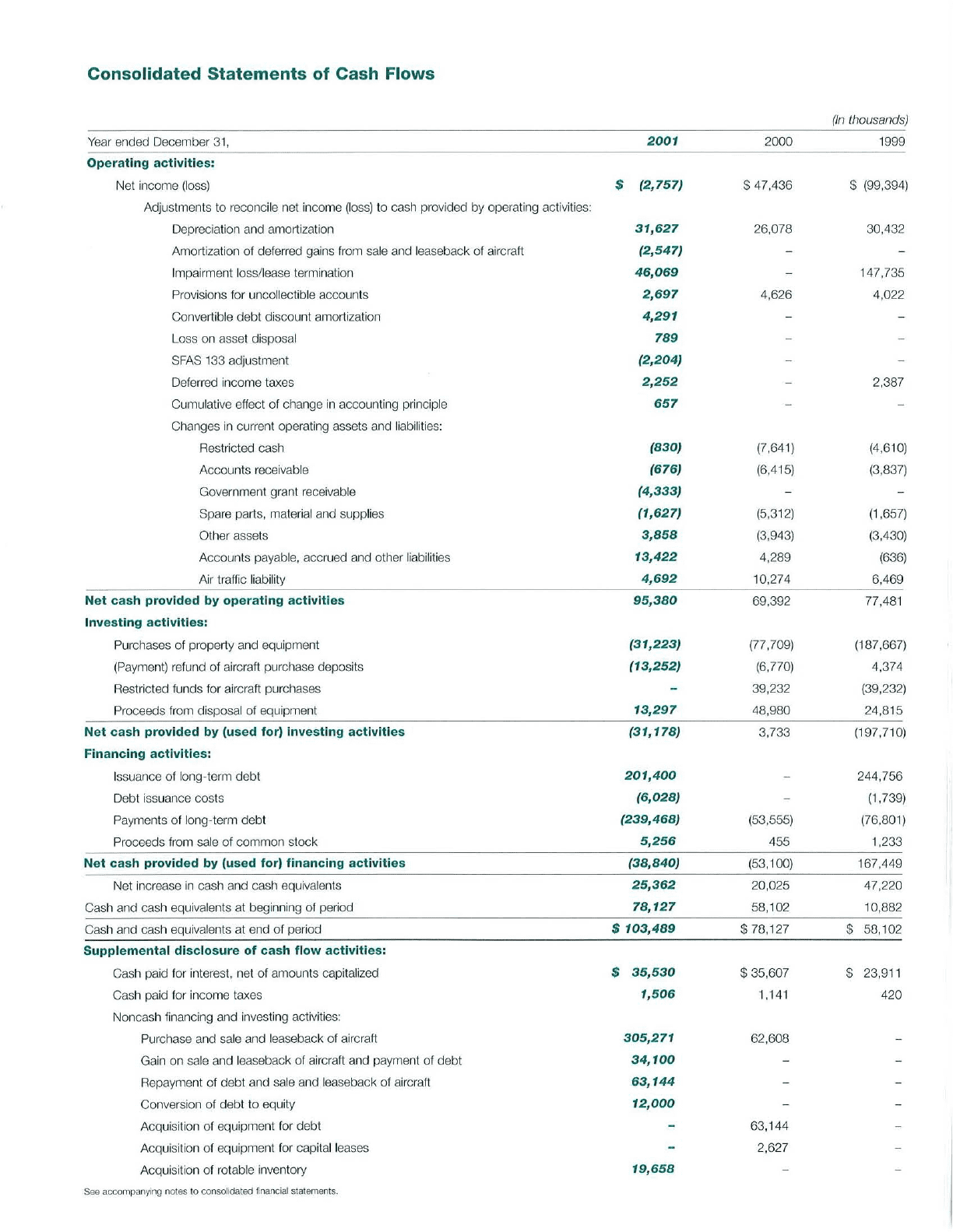

Consolidated

Statements

of

Cash

Flows

Year

ended December

31,

Operating

activities:

Net income (loss)

Adjustments

to

reconcile net income (loss) to cash provided by operating activities:

Depreciation and amortization

Amortization

of

deferred gains from sale and leaseback

of

aircraft

Impairment loss/lease termination

Provisions for uncollectible accounts

Convertible

debt

discount amortization

Loss on asset disposal

SFAS 133 adjustment

Deferred income taxes

Cumulative effect

of

change

in

accounting principle

Changes in current operating assets and liabilities:

Restricted

cash

Accounts

receivable

Government grant receivable

Spare parts, material and supplies

Other assets

Accounts payable, accrued and other liabilities

Air traffic liability

Net

cash provided by

operating

activities

Investing activities:

Purchases of property and equipment

(Payment) refund

of

aircraft purchase deposits

Restricted funds for aircraft purchases

Proceeds from disposal of equipment

Net

cash provided by (used for) investing activities

Financing activities:

Issuance of long-term

debt

Debt issuance costs

Payments

of

long-term

debt

Proceeds from sale

of

common

stock

Net

cash provided by (used for) financing activities

Net increase

in

cash and cash equivalents

Castl and cash equivalents at beginning of period

Castl and cash equivalents at end

of

period

Supplemental

disclosure

of

cash flow activities:

Cash paid for interest, net

of

amounts capitalized

Cash paid for income taxes

Noncash financing and investing activities:

Purchase and sale and leaseback

of

aircraft

Gain on sale and leaseback of aircraft and payment

of

debt

Repayment

of

debt

and sale and leaseback

of

aircraft

Conversion of

debt

to equity

Acquisition of equipment for

debt

Acquisition of equipment for capital leases

Acquisition

of

rotable inventory

See accompanying notes

to

consolidated financial statements.

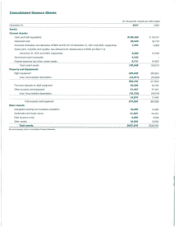

2001

2000

$

(2,757)

$

47,436

31,627

26,078

(2,547)

46,069

2,697

4,626

4,291

789

(2,204)

2,252

657

(830)

(7,641)

(676)

(6,415)

(4,333)

(1,627)

(5,312)

3,858

(3,943)

13,422

4,289

4,692

10,274

95,380

69,392

(31,223)

(77,709)

(13,252)

(6,770)

39,232

13,297

48,980

(31,178)

3,733

201,400

(6,028)

(239,468)

(53,555)

5,256

455

(38,840)

(53,100)

25,362

20,025

78,127

58,102

$

103,489

$70,127

$

35,530

$35,607

1,506

1,141

305,271

62,608

34,100

63,144

12,000

63,144

2,627

19,658

(In

thousands)

1999

$(99,394)

30,432

147,735

4,022

2,387

(4,610)

(3,837)

(1,657)

(3,430)

(636)

6,469

77,481

(187,667)

4,374

(39,232)

24,815

(197,710)

244,756

(1,739)

(76,801)

1,233

167,449

47,220

10,882

$

50,102

$23,911

420