Airtran 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

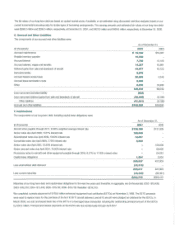

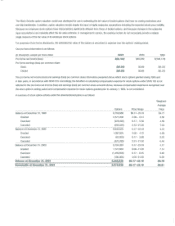

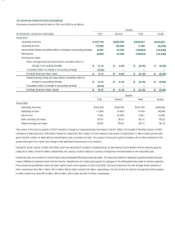

Deferred income taxes reflect the net tax effects

of

temporary differences between the carrying amounts

of

assets and liabilities for financial reporting

purposes and the

amounts

used for income tax purposes. Significant

components

of

our

deferred tax liabilities

and

assets are

as

follows:

(In

thousands)

Deferred tax liabilities:

Depreciation

Rent expense

Gross deferred tax liabilities

Deferred tax assets:

Deferred gains from sale

and

leaseback

of

aircraft

Accrued liabilities

Federal operating loss carryforwards

State operating loss carryfOfWards

AMT

credit carryfOfWards

Other

Gross deferred tax assets

Valuation allowance

Net deferred tax assets

Total net deferred taxes

As

of

December 31,

2001

2000

$

9,010

S4,436

2,841

988

11,851

5,424

16,749

3,846

4,905

1,181

36,043

47,959

4,095

4,606

4,078

3,770

4,821

4,289

70,691

65,651

(58,840)

(60,227)

11,851

5,424

$$

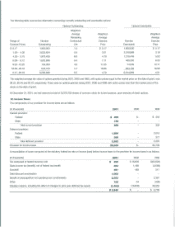

For financial reporting purposes, avaluation allowance has been recognized at December

31,

2001 and 2000,

to

reduce the net deferred income tax

assets to zero. We have not recognized any benefit from the future use

of

operating loss carryforwards because management's evaluation

of

all

tile

available evidence

in

assessing the realizability

of

the tax benefits of such loss carryforwards, indicates that the underlying assumptions

of

future profit-

able operations contain risks that

do

not provide sufficient assurance

to

recognize such tax benefits currently. Although

we

produced

operating profits

in 2001 and 2000,

we

do

not

believe this and other positive evidence, including projections of future profitable operations, offset the effect of

our

recent cumulative losses.

At

December

31, 2001,

we

had net operating loss carryforwards for income tax purposes

of

approximately $103 million thaI begin to expire

in

2012.

In

addition,

our

Alternative Minimum

Tax

credit carryfOlwards for income tax purposes were

S4.1

million.

Prior

to

the Airways merger, Airways generated net operating loss carryforwards

of

523.1 million. The

use

of

preacquisition operating loss carryforwards

is subject

to

limitations imposed by the Internal Revenue Code.

We

do not anticipate that these limitations will affect utilization

of

the carryforwards

prior

to

expiration. For financial reporting purposes, avaluation allowance

of

$8.1 million was recognized

to

offset the deferred tax assets related

to

those carryforwards. When realized, the tax benefit for those items will

be

applied

to

reduce goodwill related

10

the acquisition

of

Airways. During 2001

and 1999,

we

utilized

85.9

million

and

$6.3

million,

resJ)eCtively,

of

/iJrways' net operating loss carryfOfWards,

and

reduced gex>dwill respectively

by

the

$2.3

million and S2.4 million

tax

benefit

of

such utilization.

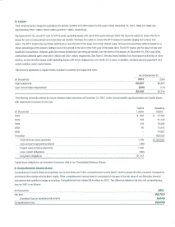

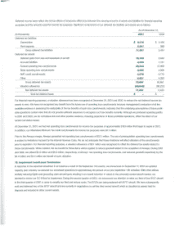

13.

Impairment

Loss/Lease

Termination

In response

to

the

expected

slowdown

in air travel

as

aresult

of

the September

11

th events.

we

announced

on

September

17,

200

1an

updated

capacity plan whereby

we

reduced

Our

scheduled operations

10

appfOximately

80

percent

of

our

pre-September

11th

schedule. With

other

airlines

similarly reducing flights

and

grounding older aircraft types resulting in an overall reduction in values in the previously

owned

aircraft market,

we

decided

to

review

our

DC-9

neet for impairment. During the second quarter

of

2001,

we

announced

our

intention to retire

our

fleet

of

four

8737

aircraft

in the third quarter

of

2001 in

order

to

simplify

our

fleet and reduce costs. The

8737s

are being replaced with 8717 aircraft. We have subsequently

sold and delivered

two

01

the

8737

aircraft and are currently in negotiations

to

sell the third

owned

aircraft

which

is classified

as

assets held for

disposal and included in other current assets.