Airtran 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

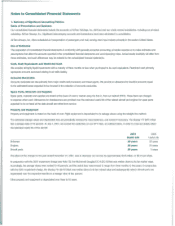

T

T

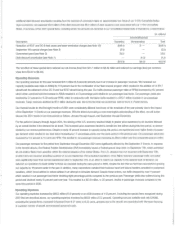

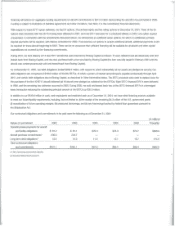

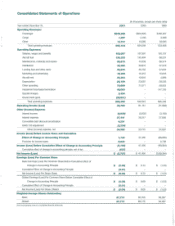

Our contractual obligations

and

commitments,

as

described in the preceding table, have been modified

by

the

amendments

to

our

8717

purchase

contract

described above and

would

be

modified

if

transactions subject

to

the lease financing proposal from Boeing

capital

are

completed

as

con-

templated. The lease financing proposal provides for

the

lease-finance

of

atotal

of

20

87175 scheduled for delivery during

2002

(see

Note

16

to

the

consolidated financial statements). The amounts

in

the table above have been modified

by

the

amendments

as

follows; (ij aircraft purchase

commit-

ments have increased for 2002 and decreased for 2003; and

(ii)

purchase deposits that were previously

paid

for aircraft deliveries in 2002 will

be

applied

to

future aircraft deliveries, rather than reducing the balance

of

the lotal purchase price

due

at delivery.

The

amounts in the lable above

would

also

be

modified

by

the lease financing proposal

as

follows:

~)

aggregate operating lease payments for aircraft

would

increase for all periods;

and

(ii)

aggregate aircraft purchase

commitments

would

decrease

in

2002. Our contractual obligations and commitments after giving effect to the above

described amendments and lease financing proposal, are

as

follows:

(In

millions) 2002

Revised total contractual obligations

and

commitments

$113.7

2003

$354.0

2004

$139.7

2005

$141.3

2006

$140.3

Thereafter

$1,507.8

Avariety

of

assumptions were necessary in order

to

derive the information described

in

the paragraph herein, including,

but

not limited to: (ij

our

deci-

sion

to

acquire

new

versus previously owned B717 aircraft; (iij the timing

of

aircraft delivery dates; and

~iij

estimated rental factors

which

are correlated

to

floating interest rates prior

to

delivery.

OUr

actual results may differ from these estimates under different assumptions

or

conditions.

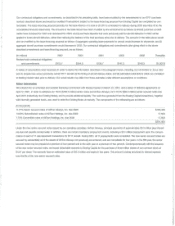

Other

Information

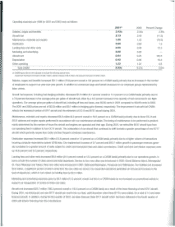

We

entered into an amended

and

restated financing commitment with Boeing Capital

on

March 22, 2001, and aseries

of

definitive agreements on

April 12, 2001, in

order

to

refinance

our

10:&%

($150.0 million) senior

notes

and AirTran Airways, Inc.'s

10~%

($80.0 million) senior secured notes

due

April 2001 (collectively, the Existing Notes), and

10

provide additional liquidity. The cash flow generated from the Boeing

capilal

transactions, together

with internally generated funds, was used

to

retire the Existing Notes at maturity. The

components

of

the refinancing are as follows:

(In

thousands)

11.27% Senior secured notes

of

AirTran Airways, Inc. due

2008

13.00% Subordinated notes

of

AirTran Holdings, Inc.

due

2009

7.75% Convertible

noles

of

AirTran Holdings, Inc.

due

2009

$166,400

17,500

17,500

$201,400

!.

Under

the

new

senior secured

notes

issued by

our

operating subsidiary, AirTran Airways, principal payments

of

approximately S3.3 million plus interest

are

due

and payable semiannually.

In

addition, there are certain mandatory prepayment events, including a

$3.1

million prepayment upon the

consum-

mation

of

each

of

11

sale-leaseback transactions for B717 aircraft. During 2001,

aJI11

prepayments were completed. The

new

senior secured

notes

are

secured

by

substantially all

of

the assets

of

AirTran Airways

not

previously encumbered,

and

are noncallable for four years.

In

the fifth year, the senior

secured notes

may

be

prepaid at apremium

of

four percent and in the sixth year at apremium

of

two

percent. Contemporaneously with the issuance

of

the

new

senior secured notes,

we

issued detachable warrants

to

Boeing Capital for the purchase

of

three million shares of

our

common

stock

at

$4.51

per

share. The warrants have an estimated value

of

$12.3 million and expire

in

five years. This amount is being amortized

to

interest expense

over the life

of

the

new

senior secured notes.