Airtran 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

Table of contents

-

Page 1

-

Page 2

I

/

-

Page 3

There was the day that affected profound and unimaginable changes. But in one very small way, the day after was like all the days before it.

-

Page 4

-

Page 5

..., but managed to be profitable, excluding special items, in the face of these challenges. What your company achieved in 2001 could certainly be credited to the outstanding efforts of our Crew Members, our growing fleet of new Boeing 717s, and our expanding system of very valuable markets. But...

-

Page 6

... many new customers and strengthened our long-term bond with our most loyal flyers. During 2001, AirTran Airways accepted delivery of 14 additional Boeing 717 aircraft, bringing our 717 fleet total to 30. By year-end 2001, more than 50 percent of our fleet was comprised of 717s, a plane that...

-

Page 7

.... Everywhere we go, AirTran Airways continues to directly affect the price of airtare in the marketkeeping air travel affordable for America's traveling public in the cities we serve. We accomplish this while continuing to improve our percentage of completed flights and on-time arrivals. This is...

-

Page 8

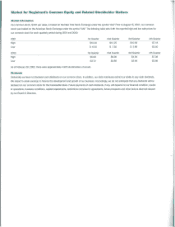

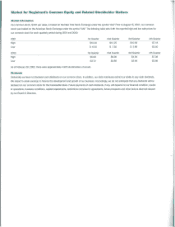

... Related Stockholder Matters

Market Information

Our common stock, $,001 par value, is traded on the New York Stock Exchange under the symbol "MI." Prior to August 15, 2001, our common slock was traded on the American Stock Exchange under the symbol "AAI:' The following table sets forth the reported...

-

Page 9

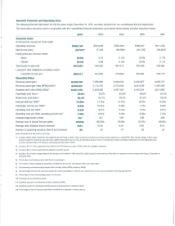

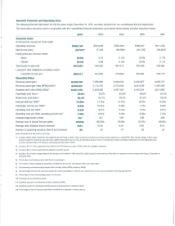

... 49,95¢ 9:54 47

Passenger revenue per ASM"OI

Operating cost per ASM") Operating cost per ASM, excluding aircraft fuel '2, Average stage length (miles) Average cost of aircraft fuel per gallon Average daily utilization (hours:minutes)13l Number of operating aircraft in fleet at end of period

Note...

-

Page 10

...a result

of new information, future events or otherwise.

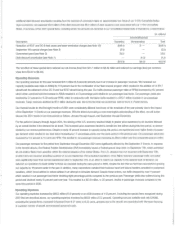

Year in Review

In 2001, we achieved a number of significant accomplishments during a highly challenging period in the commercial airline industry. Our operations continued to grow as we took delivery of 14 new Boeing 717-200 (B717) aircraft...

-

Page 11

... 2001, the slowing of the U.S. economy resulted initially in greater price awareness by air travelers followed by an overall decline in the demand for air travel. This increased price awareness tended to benefit low fare airlines during this time period, as demonstrated by our revenue performance...

-

Page 12

... engine repairs performed in accordance with our maintenance schedule. The timing of maintenance to be performed is predominantly determined by the number of hours the aircraft and engines are operated and their age. During 2001. we retired the 8737 aircraft type from our operating fleet in addition...

-

Page 13

... liability insurance coverage and security costs in the fourth quarter of 2001, employee training costs and passenger-related costs associated with our growth during 2001. Impairment loss/lease termination expenses represent $38.8 million of charges related to decreases in the fair market values of...

-

Page 14

...timing of maintenance to be performed is determined by the number of hours the aircraft and engines are operated and their age. Distribution expenses increased $2.7 million (7.2 percent overall, but flat on a CASM basis) primarily due to an increase in commissionable sales generated by travel agents...

-

Page 15

... three new cities now served. In 2001, we paid $13.3 million in purchase deposits for future 8717 aircraft deliveries. Net cash used for financing activities was primarily related to the refinancing of certain debt obligations associated with the 80eing Capital transactions (see "Other Information...

-

Page 16

... aircraft to be purchased in 2003. Funding is subject to finalization of definitive agreements and other conditions. See Note 4 to the consolidated financial statements. With respect to future B717 option deliveries, we had 21 options, 20 purchase rights and five rolling options at December 31, 2001...

-

Page 17

...notes and AirTran Airways, Inc.'s %~01 ($80.0 million) senior secured notes due

April 2001 (collectively, the Existing Notes), and 10 provide additional liquidity. The cash flow generated from the Boeing capilal transactions, together with internally generated funds, was used to retire the Existing...

-

Page 18

...million of flight equipment and related equipment. In addition to the original cost of these assets, their recorded value is impacted by a number of policy elections made by us including estimated useful lives, salvage values and in 2001 and 1999, impairment charges. Effective July 1, 2001, in order...

-

Page 19

...future financial position or results of operations.

8717 Aircraft Program Update

Boeing recently evaluated the production and delivery schedules of its commercial airplane programs, in light of current market conditions. After a thorough evaluation of the program and market, Boeing made a business...

-

Page 20

... 2001, changes in fair value of the derivative instruments have been marked to market through earnings. This resulted in a charge of $0.2 million, which is included in the amount presented as "SFAS 133 adjustment" in our Consolidated Statements of Operations. Recent terminations of our aircraft fuel...

-

Page 21

...53)

Change in Accounting Principle

Cumulative Effect of Change in Accounting Principle Net Income (Loss) Per Share, Diluted

$

(O.03) (0.0 f)

0.69

(1.53)

$

(O.04)

0.69

(1.53)

Weighted-Average Shares Outstanding

Basic Diluted

See accompanying notes to consolidated financial statements.

67...

-

Page 22

...,794

Purchase deposits for flight equipment Other property and equipment Less: Accumulated depreciation

39,396 31,407

(16,733)

14,674

Total property and equipment

274,864

Other Assets:

Intangibles resulting from business acquisition Trademarks and trade names Debt issuance costs Other assets...

-

Page 23

... and Contingencies Stockholders' Equity:

Preferred stock, $.01 par value per share, 5,000 shares authorized, no shares issued or outstanding Common stock, $.001 par value per share, 1,000,000 shares authorized, and 69,528 and 65,823 shares issued and outstanding at December 31, 2001 and 2000...

-

Page 24

...

Comprehensive

Equity

Shares

Balance at December 31, 1998

Issuance of common slock for exercise of options Issuance of common stock under

Amount

Deficit

$ (91.292) $

Loss

(Deficit) $55.630

64,898

$65

$146,857

226

1,031

1,031

slock purchase plan

Issuance of common stock in

51

202...

-

Page 25

... of aircraft Impairment loss/lease termination Provisions for uncollectible accounts Convertible debt discount amortization Loss on asset disposal SFAS 133 adjustment Deferred income taxes Cumulative effect of change in accounting principle Changes in current operating assets and liabilities:

2001...

-

Page 26

... in consolidation. AirTran Airways, Inc. offers scheduled air transportation of passengers and mail, serving short-haul markets primarily in the eastern United States.

Use of Estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting principles...

-

Page 27

... purchased but not yet used is included in air traffic liability.

Frequent Flyer Program

We accrue the estimated incremental cost of providing free travel for awards earned under our A+ Rewards Program.

Stock-Based Compensation

We grant stock options for a fixed number of shares to our officers...

-

Page 28

... of a change in a derivative's fair value that is considered to be ineffective, as defined, is recorded immediately in MSFAS 133 adjustment- in the Consolidated Statements of Operations. We use financial derivative instruments to hedge our exposure to jet fuel price increases and account for these...

-

Page 29

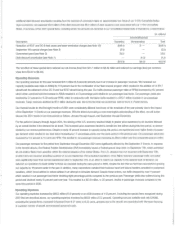

... Note 5 for further information on our derivatives and fuel price risk management.

3. Federal Grants and Special Charges Related to Terrorist Attacks

On September 11, 2001, terrorists hijacked and used four aircraft in terrorist attacks on the United States (terrorist attacks). As a result of these...

-

Page 30

... 81.2 million was realized in earnings during 2001. Our efforts to reduce our exposure to increases in the price and availability of aviation fuel also include the utilization 01 fIXed price fuel contracts. Fixed price fuel contracts consist of an agreement to purchase defined quantities of aviation...

-

Page 31

... Subordinated notes due April 2009, 13.00% interest rate Convertible notes due April 2009, 7.75% interest rate Senior notes due April 2001, 10.25% interest rate Senior secured notes due April 2001, 10.50% interest rate Promissory notes for aircraft and other equipment payable through 2018, 8.27% to...

-

Page 32

...events, including a $3.1 million prepayment upon the consummation of each of 11 sale-leaseback transactions for B717 aircraft. During the year ended December 31,2001,11 prepayments occurred. The new senior secured notes are secured by substantially all of the assets of AirTran Airways not previously...

-

Page 33

...or near the end of the lease term at fair market value, and two have purchase options based on a stated percentage of the lessor's defined cost of the aircraft at the end of the 13th year of the lease term. TIle 8717 leases are the result of sate and leaseback transactions. Deferred gains from these...

-

Page 34

... used in computing diluted earnings Ooss) per common share.

11. Stock Option Plans

The 1993 Incentive Stock Option Plan provides up to 4.8 million options to be granted to offICers, directors and key employees to purchase shares of common stock at prices not less than the fair value of the shares...

-

Page 35

... the expected stock price volatility. Because our employee stock options have characteristics significantly different from those of traded options, and because changes in the subjective input assumptions can materially affect the fair value estimate, in management's opinion, the existing models do...

-

Page 36

.... There were no options granted during 2001, 2000 and 1999 with option prices Jess than the market price of the stock on the date of grant. At December 31, 2001, we had reserved a total of 10,370,755 shares of common stock for future issuance, upon exercise of stock options.

12. Income Taxes...

-

Page 37

... schedule. With other airlines similarly reducing flights and grounding older aircraft types resulting in an overall reduction in values in the previously owned aircraft market, we decided to review our DC-9 neet for impairment. During the second quarter of 2001, we announced our intention to retire...

-

Page 38

... costs related to buying out the lease and to bring the aircraft into compliance with the return provisions of the lease agreement. The lease termination charge was $7.3 million. The remaining balance of accruals for the lease termination at December 31, 2001 was $6.7 million.

14. Employee Benefit...

-

Page 39

... of which relates to revisions of expenses recorded earlier in the respective year. During the year, we provide for income taxes using anticipated effective annual tax rates. The rates are based on expected operating results and permanent differences between book and tax income. Adjustments are made...

-

Page 40

... for aircraft deliveries in 2002 will be applied to future aircraft deliveries, rather than reducing the balance of the total purchase price due at delivery. We have signed a lease financing proposal from 80eing Capital for 19 (20 at 80eing Capital's option) new or previously owned 8717 aircraft to...

-

Page 41

Report of Independent Auditors

The Stockholders and Board of Directors AirTran Holdings, Inc.

We have audited the accompanying consolidated balance sheets of AirTran Holdings, Inc" as of December 31, 2001 and 2000, and the related consolidated statements of operations, stockholders' equity (deficit...

-

Page 42

... available upon request by writing: AirTran Holdings, Inc. Attn: Investor Relations 9955 AirTran Blvd. Orlando, FL 32827

Kevin P. Healy

Vice President, Planning and Sales

Rocky B. Wiggins

Vice President, Chief Information Officer

We invite your comments about this annual report. Visit us online...

-

Page 43

AirTran Airways' Route Map

MlnneapolislSt. Paul

Wichita

IEffe

-

Page 44

airTn~

AirTran Holdings, Inc. Annual Report 2001