Aflac 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MESSAGE FROM MANAGEMENT

Daniel P. Amos

Chairman and CEO

Aflac’s Growth Strategy:

A Foundation for Results

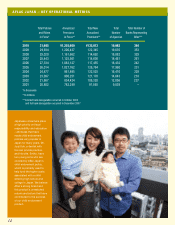

It is not an overstatement to say that

for more than three decades, our two-

part strategy for growth in Japan and

the United States has dramatically

transformed our business: Aflac offers

relevant products that provide financial

protection to consumers through

expanded distribution channels.

And 2010 was no different. Following

the turbulence of the financial markets

in 2009, 2010 provided a measure of

greater stability.

In good times or bad, we continue

to stick to what we do best: protecting

people when they need it most. Our

focus on this simple approach has helped

Aflac achieve solid financial results. Our

administrative efficiency and ability to

control expenses in both Japan and

the United States are reflected in low

operating expense ratios in both markets.

This allows us to create products that

provide excellent value to consumers

and pay competitive commissions.

Our strategy has also allowed us the

privilege of providing more than 50 million

people in the United States and Japan with

financial protection “under our wing,” while

enhancing shareholder value.

Disciplined Strategy Produces Results

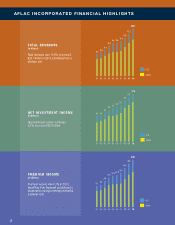

Importantly, in 2010 we continued more

than two decades of achieving our operating

earnings per share objective, which is the

principal financial metric we use internally

to assess the growth of our business.

Operating earnings is defined as the growth

of net earnings per diluted share, excluding

items that are inherently uncontrollable or

unpredictable. We view this measure as

the best indicator of both the growth of

our business and management’s role in

generating that growth. Operating earnings

per diluted share rose 10.1% in 2010,

excluding the impact of the yen. We believe

that achieving our operating earnings

objective for more than two decades has

been a key driver of shareholder value.

Additionally, net earnings in 2010

increased 56.6% over 2009 to $2.3 billion.

Results for the full year benefited from

the stronger yen and from lower realized

investment losses in 2010, compared with

2009. Losses from securities transactions

and impairments impacted net earnings by

$273 million. In addition, net earnings were

suppressed by $1 million due to the impact

from ASC 810.

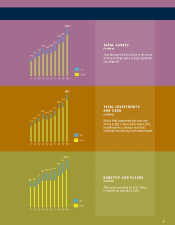

Capital Strength Means Capital

Deployment to Shareholders

In addition to delivering shareholder

value through our earnings growth, we

are very proud that 2010 marked the

28th consecutive year in which Aflac has

increased the

cash dividend.

The decision by

Aflac’s board

of directors to

increase the

cash dividend

is a function

of our strong

capital position. Maintaining this capital

strength is a priority for us and is primarily

measured using the statutory accounting

risk-based capital, or RBC, ratio. Our goal

was to end 2010 with a higher RBC ratio

than our year-end 2009 ratio of 479%,

and we surpassed our goal, ending 2010

at 555%. I believe our ability to maintain

a strong RBC ratio exemplifies our ability

to effectively manage our capital. Our

capital strength gave us the confidence

to resume our share repurchase program

in the fourth quarter of 2010, when we

purchased two million shares of Aflac

Incorporated stock. We anticipate

purchasing six to 12 million shares of

Aflac’s common stock in 2011.

Despite our intense focus on the

balance sheet, we never lost sight of

growing our business. Combined, we

generated more than $2.9 billion in new

annualized premium sales in the United

States and Japan in 2010. Total revenues

rose 13.6% to $20.7 billion, reflecting

solid growth in premium income and net

investment income, as well as the benefit

of the stronger yen/dollar exchange rate

for the year.

4

2010 marked the

28th consecutive

year in which

Aflac has

increased the

cash dividend.