Aflac 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

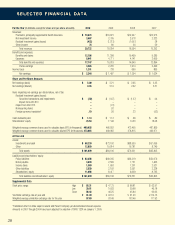

Policies and Annualized Total New Licensed Sales

Certificates Premiums Annualized Associates

in Force* in Force** Premiums** and Brokers

2010 11,436 $4,973 $1,382 72,535

2009 11,688 4,956 1,453 75,315

2008 11,437 4,789 1,551 74,390

2007 11,116 4,510 1,558 71,258

2006 10,519 4,101 1,423 68,394

2005 9,884 3,711 1,259 63,008

2004 9,341 3,374 1,186 58,992

2003 8,805 3,043 1,128 57,493

2002 8,077 2,674 1,070 53,149

2001 7,031 2,238 919 43,188

*In thousands

**In millions

2010. Based on amortized cost, 95.7% of

our holdings were investment grade at the

end of 2010.

Aflac U.S.

Investment Highlights for 2010

• Investments and cash were $9.6

billion at the end of 2010, up 14.2%

from 2009

• Net investment income was $549

million in 2010, up 9.9% from $499

million in 2009

• The average yield on new

investments was 5.82% in 2010,

down from 7.26% in 2009

Outlook for Aflac U.S. – Great

Opportunity to Spread Our Wings

We are convinced the United States is still

a vast market with significant potential to

sell the products we offer. We will stay true

to our strategy of offering relevant products

through an expanding distribution network.

For Aflac U.S., that means offering an

expanded portfolio of individual and

group products through sales agents

and brokers to reach the tens of millions

of consumers who can benefit from our

affordable insurance protection.

a part of our culture. Recognized as one

of the top childhood cancer centers in the

country by U.S. News & World Report,

the Aflac Cancer Center treats more

than 370 new cancer patients each year

and follows more than 2,500 patients

with sickle cell disease, hemophilia, and

other blood disorders. The Aflac Cancer

Center features three hospital campuses

with nationally renowned physicians and

researchers in addition to a world-class

family support team consisting of child-life

specialists, social workers, chaplains and

teachers – all who support the whole child

and the child’s family.

Employing Emerging Technologies

Means Efficiency, Effectiveness,

and Excellence

Effectively employing new technologies

allows us to improve our products,

attract new sales associates, and

allocate more resources to advertising.

For instance, for more than 16 years,

our sales associates have used our

unique laptop-based enrollment system,

SmartApp®, to electronically sell and

transmit new business from the field

directly to headquarters. SmartApp Next

Generation®, or SNG, our most recent

version, has upgraded features that

streamline the application process even

further by ensuring greater accuracy and

reducing policies that require additional

follow-up. We continue to improve the

functionality and versatility of SNG to

accommodate broker needs and empower

our sales associates for success. In

2010, about 93% of our applications for

coverage were electronically submitted

using SNG and other Internet-based

programs. In addition, more than 82%

of all new payroll accounts were set up

with Online Billing, which results in more

efficient and accurate billing, reconciliation,

and service to our payroll accounts.

Aflac U.S. Investment Strategy:

Prudent and Effective

While we’ve dealt with the low-interest-

rate environment in Japan for many

years, interest rates in the United States

have been more stable. In light of the

uncertainty in global financial markets,

and the resulting investor concerns about

insurance companies’ balance sheets, we

believe our investment approach proved

once again to be prudent and effective.

Corporate debt securities accounted for

the majority of our U.S. investments in

19

A f l A c u . s . – K e Y o P e r At i o n A l m e t r i c s