Aflac 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

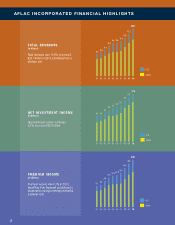

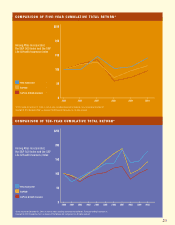

Investment Results in

a Low-Interest-Rate

Environment

We looked for, and identified, opportunities

to improve our investment income in a low-

interest-rate environment while ensuring

that our investment quality withstood

challenging credit markets while mitigating

our risks. In doing so, we improved net

income, which we believe ultimately

benefits shareholder value.

We accomplished this through our

primary focus of matching our assets to

our policy liabilities with long-duration, yen-

denominated, investment-grade securities

as well as incrementally increasing the

amount Aflac Japan invests in dollar-

denominated securities.

Despite global credit downgrades

from rating agencies, Aflac Japan’s

overall credit quality remained high.

At the end of 2010, 93.8% of Aflac

Japan’s debt and perpetual securities

were rated investment grade on an

amortized cost basis.

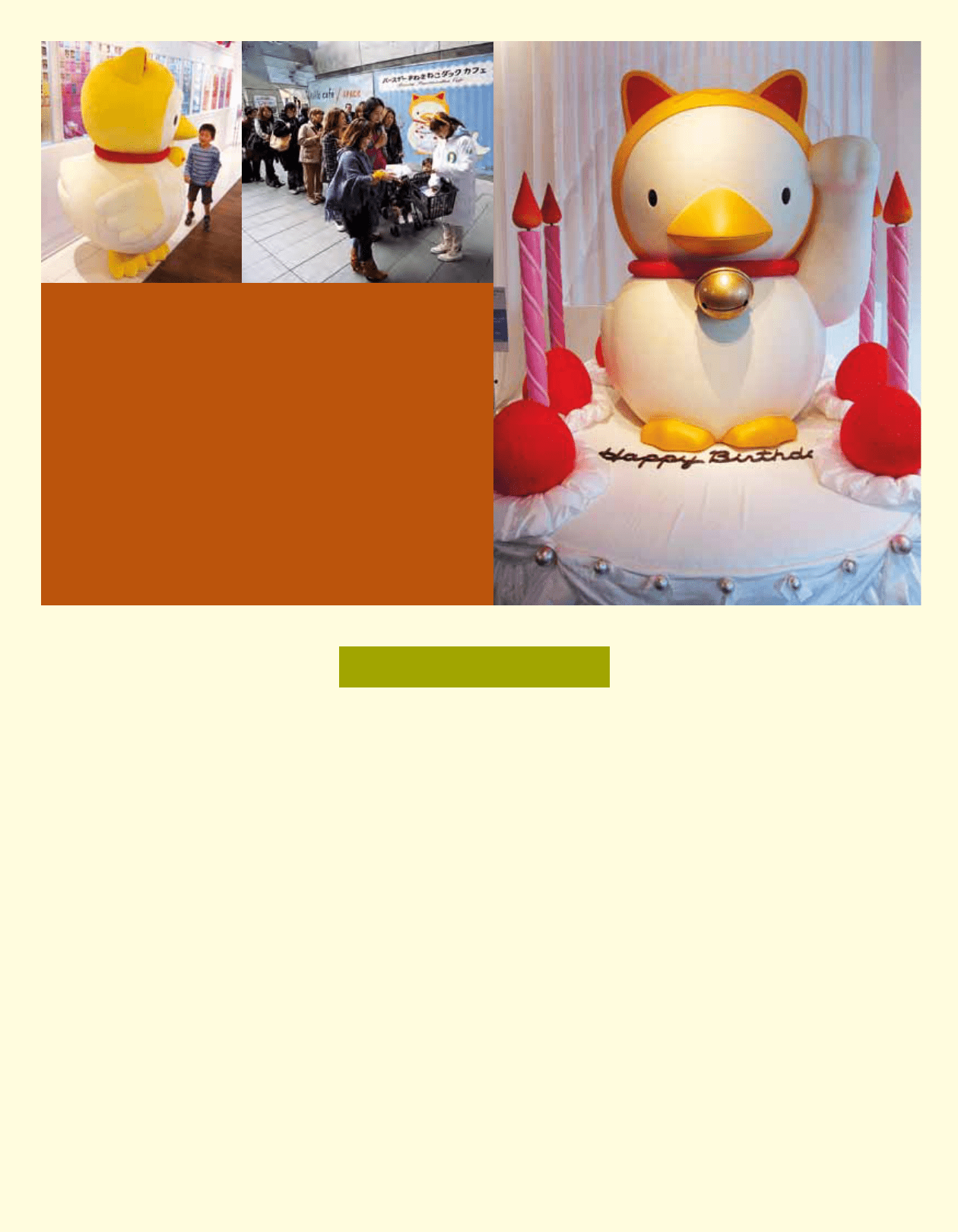

AFLAC DUCK + GOOD LUCK CAT = STRONG BRAND

In 2009, Aflac Japan designed a campaign character to grab

the attention of Japanese consumers: We combined the

popular Aflac Duck with a traditional character, called “maneki

neko,” to promote New EVER, our revised medical product.

Maneki neko is the cat icon that is very widely known in Asia.

Its raised paw is said to attract good luck. This campaign

character, called “maneki neko duck” contributed to a medical

sales increase of 15.6% in 2009. Building on this success,

Aflac Japan continued to feature this character in 2010. The

maneki neko duck became so popular, especially among

children and their mothers, that Aflac Japan expanded the use

of this “maneki neko duck” to promote the cross-selling of our

child endowment product as well.

Administrative Efficiency

Liftoff from Technology

Technology has long been the

essence of what is perhaps Aflac

Japan’s most significant competitive

strength – administrative efficiency.

Our maintenance expenses per policy

in force remain lower than every other

life insurance company operating in

Japan, allowing us to give consumers

quality products at affordable prices

while compensating our sales force

with competitive commissions.

Looking to the Future

Japan’s government continues to

face fiscal pressure. With rising

medical expenses, an aging

population, and a declining birthrate,

Japan’s already-stressed national

health care system may come under

even more pressure in the future.

We believe Japanese citizens,

whose medical costs have already

increased, will continue to look for

solutions to protect their physical and

financial well-being. As we design our

product and distribution initiatives for

the future, we believe the competitive

strengths that have driven Aflac

Japan’s success in 2010 will

continue to benefit us in the future.

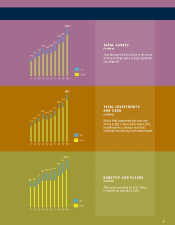

Aflac Japan

Investment Highlights for 2010

• Investments and cash increased

21.3% to $77.9 billion at the end of

2010. In yen, investments and cash

were up 7.3%

• Net investment income increased

8.3% to $2.5 billion. In yen, net

investment income was up 1.6%

• The average yield on new

investments was 2.63% in 2010,

compared with 3.03% in 2009

15