Aflac 2010 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2010 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

01 02 03 04 05 06 07 08 09 10

90

100

80

70

110

120

130

¥140

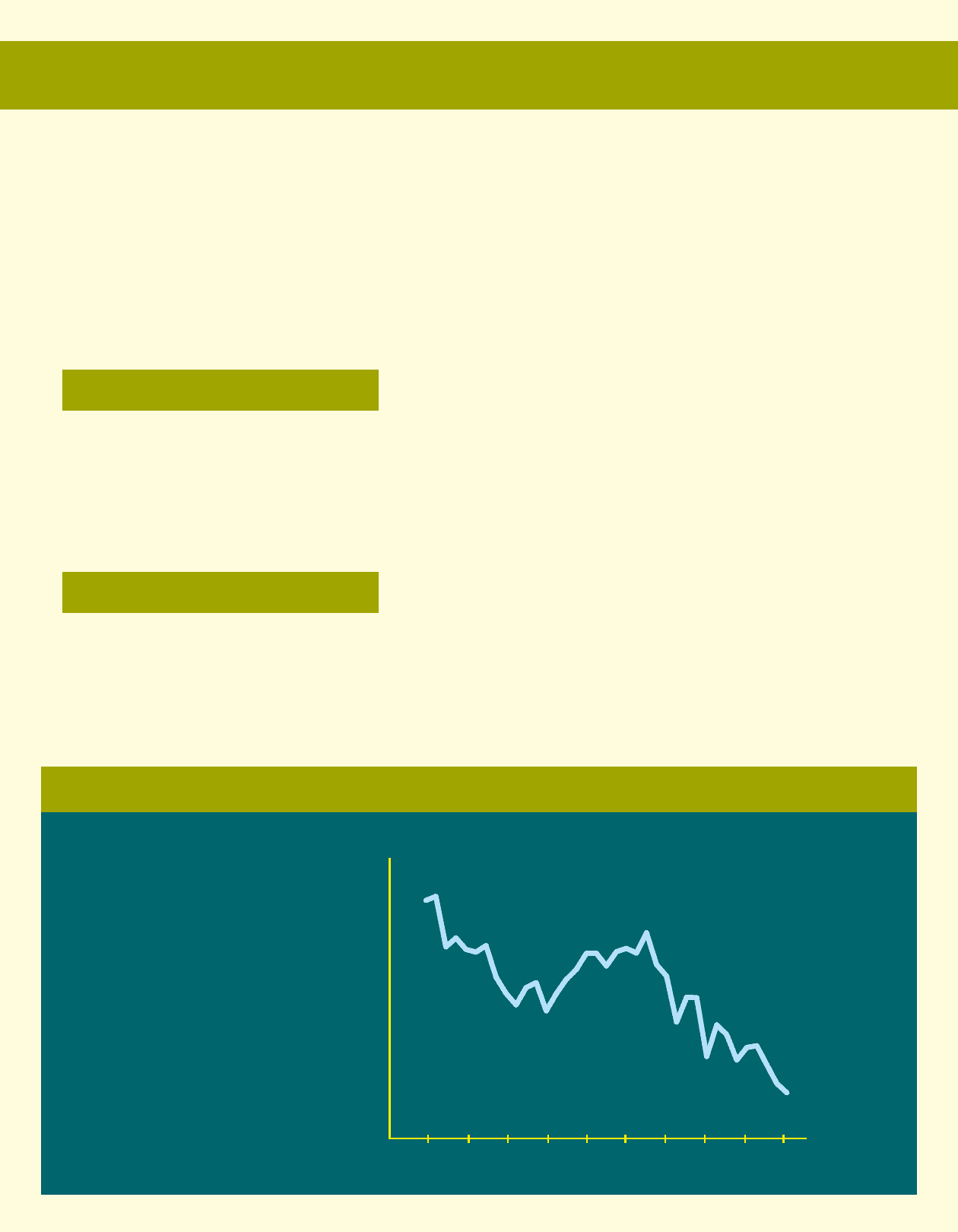

Y e n / D o l l A r e x c h A n g e r At e

(Closing rates)

During 2010, the average

yen/dollar exchange

rate strengthened 6.6%,

which magnified Aflac

Japan’s growth rates in

dollar terms

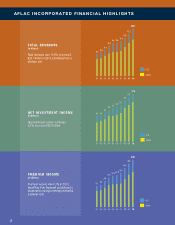

Aflac Japan Takes Off!

2010 was a year in which Aflac Japan remained focused – and very effective – in executing our strategy for growth: offering

relevant products that provide financial protection to consumers through expanded distribution channels. As a result, Aflac

Japan generated an 11.0% increase in 2010 new annualized premium sales, surpassing our sales target for the second year

in a row. Our 2010 sales growth was a particularly significant accomplishment for Aflac Japan after facing extremely difficult

comparisons from the prior year.

In terms of the distribution side of our strategy, 2010 was the year of the bank channel, as bank branch participation

gained momentum throughout the year. On the product side of our strategy, not only did Aflac Japan remain the number one

seller of cancer and medical insurance policies in Japan, but we also leveraged our presence in the banks by offering products

that banks want to sell. Once again, our stable block of in-force business was marked by strong persistency and improved

profitability. Additionally, Aflac Japan produced solid financial results and enhanced our portfolio of products that respond to

the wants and needs of consumers and distribution channels.

Aflac Japan

2010 Financial Highlights in Yen

• Premium income rose 3.8% to ¥1.18 trillion,

compared with ¥1.14 trillion in 2009

• Total revenues increased 3.4% to ¥1.40

trillion, compared with ¥1.35 trillion in 2009

• Pretax operating earnings rose 10.0% to

¥287.9 billion in 2010, compared with ¥261.7

billion in 2009

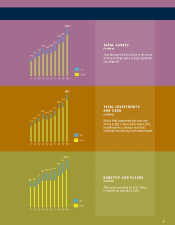

Aflac Japan

2010 Financial Highlights in Dollars

• Premium income rose 10.8% to $13.5

billion, up from $12.2 billion in 2009

• Total revenues were up 10.3% to $16.0

billion, compared with $14.5 billion in 2009

• Pretax operating earnings increased 17.3%

to $3.3 billion from $2.8 billion in 2009

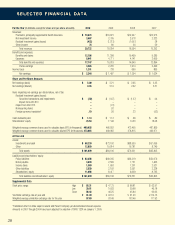

The Impact of the Yen/Dollar Exchange Rate

Aflac Japan collects premiums in yen, pays benefits and expenses

in yen, and primarily holds yen-denominated assets to support yen-

denominated liabilities. With the exception of a limited number of

transactions, we do not convert yen into dollars. Therefore, currency

changes do not have a material effect on Aflac in economic terms.

However, for financial reporting purposes, we translate Aflac Japan’s

income statement from yen into dollars using an average exchange rate,

which does influence our reported financial results in dollar terms.

Translating Aflac Japan’s results from yen into dollars means that

growth rates are magnified in dollar terms when the yen strengthens

against the dollar, compared with the preceding year. Conversely,

growth rates in dollar terms are suppressed when the yen weakens

against the dollar, compared with the preceding year. During 2010, the

yen averaged 87.69 to the dollar, or 6.6% stronger than the average of

93.49 in 2009, enhancing our reported results in dollar terms.

10

A F L A C J A P A N