Vonage 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VONAGE HOLDINGS CORP.

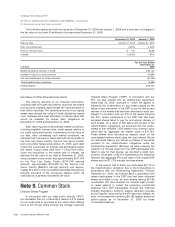

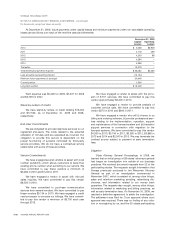

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

ped down as Chief Strategist and Interim Chief Executive

Officer effective July 29, 2008.

Mr. Citron will continue as non-executive Chairman of

the Board and will have such duties, responsibilities and

authority as determined from time to time by our Board of

Directors.

As Chairman of the Board, Mr. Citron is entitled to

(i) an annual retainer of $125 in cash (in lieu of Board and

committee meeting fees), (ii) annual option grants of

immediately exercisable, non-qualified stock options in an

amount equal to one and one-half times the amount

awarded to a non-employee director and (iii) annual

restricted stock grants of shares of Vonage common stock

in an amount equal to one and one-half times the amount

awarded to a non-employee director.

Pursuant to the terms of the Separation Agreement, we

agreed, in consideration for a general release and certain

other obligations, to make a one time payment to

Mr. Citron, which constituted Mr. Citron’s pro-rata bonus

for 2008. Mr. Citron was also granted nonqualified options

to acquire 750 shares of our Common Stock. Under FASB

ASC 718, we recorded approximately $682 for this grant in

2008.

We also entered into a Consulting Agreement with a

limited liability company of which Mr. Citron is the president

and managing member (the “Consultant”). As partial

consideration for the consulting services, Mr. Citron was

also granted nonqualified options to acquire 1,000 shares

of our Common Stock. We recorded $910 of expense

related to this grant in the year ended December 31, 2008

in the consolidated statement of operations. During the

term of the Consulting Agreement, Mr. Citron was entitled

to participate in all employee healthcare plans, programs

and arrangements of ours, in accordance with their

respective terms, as may be amended from time to time,

and on a basis no less favorable than that made available to

senior executives of us.

The term of the Consulting Agreement expired July 29,

2009 and was not renewed. We paid to the Consultant an

aggregate consulting fee of $250.

All of Mr. Citron’s unvested options and other share-

based awards granted prior to the Separation Agreement

will continue to vest in accordance with their respective

terms as long as Mr. Citron continues to serve as a member

of our Board of Directors. Upon Mr. Citron’s cessation of

service as a member of the Board of Directors, all unvested

options and other share-based awards that have not

otherwise expired by their terms will become fully vested

and exercisable, as applicable, without regard to the sat-

isfaction of any performance criteria. Under FASB ASC 718,

Mr. Citron’s existing unvested options received accelerated

vesting treatment since there was no longer a future service

period.

Chief Financial Officer

As announced on January 14, 2009, John S. Rego, the

Company’s Executive Vice President, Chief Financial Officer

and Treasurer, will be leaving the Company later this year.

Mr. Rego’s departure from the Company will occur not later

than May 31, 2010.

Mr. Rego and the Company are party to an employ-

ment agreement that provides, in general, that upon a

termination of Mr. Rego’s employment by the Company

without cause or by Mr. Rego for good reason, he is enti-

tled to his accrued compensation until the date of termi-

nation, one year’s salary and a pro rata portion of his bonus

for the year of termination. The employment agreement has

been modified in certain respects by an Amendment to

Employment Agreement dated as of February 23, 2010 and

a Separation Agreement and General Release dated as of

February 23, 2010 (the “Separation Agreement”).

For his services during the remainder of 2010 Mr. Rego

will receive his salary and the benefits on the same terms as

have been provided by his employment agreement. As

severance benefits, Mr. Rego will receive $300,000 (one

year’s salary), payable in most circumstances six months

after termination of employment, plus a pro rata portion of

his bonus eligibility for 2010 (based on the portion of the

year elapsed up to date of termination of his employment)

to the extent the Company achieves the performance goals

applicable pursuant to the terms of the Company’s annual

bonus program, which amount (if any) shall be paid on

March 15, 2011. In addition, Mr. Rego will receive his

earned but unpaid 2009 target annual bonus, in the amount

of $324,000, which shall be paid on March 15, 2010, and

accrued compensation such as vacation pay. Mr. Rego

shall also receive (i) his out-of-pocket costs for continuation

of medical, dental and vision insurance coverage premiums

for himself and his dependents under the Company’s exist-

ing insurance programs for up to 18 months, subject to

termination in the event he receives comparable coverage

under a subsequent employer’s programs, (ii) reimburse-

ment of up to $50,000 of outplacement fees incurred over

the 12 months following termination of his employment, and

(iii) up to $15,000 in reimbursement of legal fees incurred in

connection with the negotiation of the Separation Agree-

ment.

The unvested stock options and unvested restricted

share awards held by Mr. Rego will continue to vest in

accordance with their terms through the date of termination

of his employment; any then unvested stock options and

restricted share awards shall be forfeited in accordance

with their terms. The Separation Agreement further provides

that, in modification of their terms of grant but as permitted

in the Company’s discretion by the pertinent equity plan,

Mr. Rego’s vested stock options will remain exercisable for

a period of one year following the termination of his

employment (but not beyond ten years after their issuance).

F-31