Vonage 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

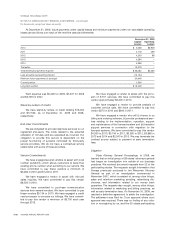

(In thousands, except per share amounts)

unamortized beneficial conversion related to the Previous

Convertible Notes comprised the $30,570.

For the remaining $46,037 of the Financing, since

many of the purchasers purchased more than one compo-

nent of the Financing, we allocated the net proceeds of

$44,543 (reflecting a reduction of $1,494 for the portion of

$7,167 discount attributed to $46,037) to the First Lien

Senior Facility, Second Lien Senior Facility and Convertible

Notes based upon their relative fair values with $20,138

allocated to the First Lien Senior Facility, $12,652 allocated

to the Second Lien Senior Facility and $11,753 allocated to

the Convertible Notes.

For the First Lien Senior Facility, an aggregate value of

$105,322 or a discount of $24,978 was recorded. This

discount is currently amortized to interest expense over the

life of the loan using the effective interest method. The

accumulated amortization was $5,362 and $766 at

December 31, 2009 and December 31, 2008, respectively.

The amortization for the year ended December 31, 2009

and 2008 was $4,956 and $766, respectively.

For the Second Lien Senior Facility, an aggregate value

of $67,273 or a discount of $4,727 was recorded. This

discount is currently amortized to interest expense over the

life of the loan using the effective interest method. The

accumulated amortization was $766 and $116 at

December 31, 2009 and December 31, 2008, respectively.

The amortization for the year ended December 31, 2009

and 2008 was $650 and $116, respectively.

For the Convertible Notes, an aggregate value of

$55,884 or a premium of $37,884 was recorded. Given the

magnitude of the premium, this amount was recorded as

additional-paid-in capital as prescribed in FASB ASC

470-20-25 “Debt with Conversions and Other Options-

Recognition”.

The following descriptions summarize certain material

terms of the Financing as provided in the Credit

Documentation.

First Lien Senior Facility

The loans under the First Lien Senior Facility will

mature in October 2013. Principal amounts under the First

Lien Senior Facility are repayable in quarterly installments of

$326 for each quarter ending December 31, 2008

through September 30, 2011 and $3,258 for each quarter

ending December 31, 2011 through September 30, 2013,

with the balance due in October 2013. Amounts under the

First Lien Senior Facility, at our option, bear interest at:

>the greater of 4.00% and LIBOR plus, in either case,

12.00%, payable on the last day of each relevant interest

period or, if the interest period is longer than three

months, each day that is three months after the first day

of the interest period and the last day of such interest

period, or

>the greater of 6.75% and the higher of (i) the rate quoted

in The Wall Street Journal, Money Rates Section as the

Prime Rate as in effect from time to time and (ii) the

federal funds effective rate from time to time plus 0.50%

plus, in either case, 11.00%, payable on the last day of

each month in arrears.

Certain events could trigger prepayment obligations

under the First Lien Senior Facility. If we have more than

$75,000 of specified unrestricted cash in any quarter after

January 1, 2009, we may be obligated to prepay without

premium certain amounts. To the extent we obtain pro-

ceeds from asset sales, insurance/condemnation recoveries

or extraordinary receipts, certain prepayments may be

required that will be subject to a premium of 8% in year 1,

7% in year 2, 6% in year 3, 5% in year 4 and 3% in the first

9 months of year 5 and no premium thereafter. In addition,

any voluntary prepayments or any mandatory prepayments

that may be required from proceeds of debt and equity

issuances will be subject to a make-whole during the first

three years, and thereafter a premium of 5% in year 4 and

3% in the first 9 months of year 5, with the First Lien Senior

Facility callable at par thereafter.

Second Lien Senior Facility

The loans under the Second Lien Senior Facility will

mature in October 2015. Principal amounts under the

Second Lien Senior Facility will be repayable in quarterly

installments of $1,800 commencing the later of: (i) the last

day of the fiscal quarter after payment-in-full of amounts

under the First Lien Senior Facility and (ii) December 31,

2012, with the balance due in October 2015. Amounts

under the Second Lien Senior Facility bear interest at 20%

payable quarterly in arrears and payable in-kind, or PIK,

beginning December 31, 2008 until the third anniversary of

the effective date and thereafter 20% payable quarterly in

arrears in cash. If the First Lien Senior Facility has not been

refinanced in full by the third anniversary of the effective

date, then until such refinancing has occurred 70% of the

interest due will be payable in cash with the balance pay-

able in PIK. The amount of PIK interest as of December 31,

2009 and December 31, 2008 was $18,576 and $2,320,

respectively. After payment-in-full of amounts under the

First Lien Senior Facility or in the event mandatory pay-

ments are waived by lenders under the First Lien Senior

Facility, the Second Lien Senior Facility will be subject to

prepayment obligations and premiums consistent with

those for the First Lien Senior Facility. Voluntary prepay-

ments for the Second Lien Senior Facility may be made at

any time subject to a make-whole.

Third Lien Convertible Notes

Subject to conversion, repayment or repurchase of the

Convertible Notes, the Convertible Notes mature in October

2015. Subject to customary anti-dilution adjustments

(including triggers upon the issuance of common stock

below the market price of the common stock or the con-

version price of the Convertible Notes), the Convertible

Notes are convertible into shares of our common stock at a

rate equal to 3,448.2759 shares for each $1,000 principal

amount of Convertible Notes, or approximately $0.29

F-19