Vonage 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

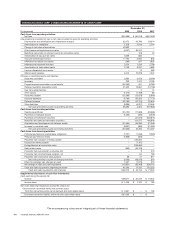

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

Recent Accounting Pronouncements

In October 2009, the FASB issued Accounting Stan-

dards Update No. 2009-13 (“ASU 2009-13”) “Revenue

Recognition (Topic 605), Multiple-Deliverable Revenue

Arrangements a consensus of the FASB Emerging Issues

Task Force (“EITF”). This ASU provides amendments to

the criteria in FASB ASC 605-25 for separating consid-

eration in multiple-deliverable arrangements. ASU

2009-13 changes existing rules regarding recognition of

revenue in multiple deliverable arrangements and expands

ongoing disclosures about the significant judgments used

in applying its guidance. It will be effective for revenue

arrangements entered into or materially modified in the

fiscal year beginning on or after June 15, 2010. Early

adoption is permitted on a prospective or retrospective

basis. We are currently evaluating the impact of ASU

2009-13 on our financial statements.

In May 2008, the FASB affirmed the consensus of

FASB ASC 470-20, “Debt with Conversion and other

Options (Including Partial Cash Settlement),” which

applies to all convertible debt instruments that have a net

settlement feature; which means that such convertible

debt instruments, by their terms, may be settled either

wholly or partially in cash upon conversion. FASB ASC

470-20 requires issuers of convertible debt instruments

that may be settled wholly or partially in cash upon con-

version to separately account for the liability and equity

components in a manner reflective of the issuer’s non-

convertible debt borrowing rate. Previous guidance pro-

vided for accounting for this type of convertible debt

instrument entirely as debt. FASB ASC 470-20 was effec-

tive for financial statements issued for fiscal years

beginning after December 15, 2008 and interim periods

within those fiscal years. The adoption of FASB ASC

470-20 did not have an impact on our financial state-

ments.

In April 2008, the FASB issued FASB ASC 350-30,

“General Intangibles Other than Goodwill.”FASB ASC

350-30 amends the factors an entity should consider in

developing renewal or extension assumptions used in

determining the useful life of recognized intangible assets

under FASB ASC 350-30. This new guidance applies

prospectively to intangible assets that are acquired

individually or with a group of other assets in business

combinations after their acquisitions. FASB ASC 350-30

was effective for financial statements issued for fiscal

years and interim periods beginning after December 15,

2008. Since this guidance applied prospectively, on adop-

tion, there was no impact to our consolidated financial

statements.

In February 2008, the FASB amended FASB ASC

820, which delayed the effective date of FASB ASC 820

for all nonfinancial assets and nonfinancial liabilities,

except those that are recognized or disclosed at fair value

in the financial statements on a recurring basis (at least

annually), until fiscal years beginning after November 15,

2008, and interim periods within those fiscal years. These

nonfinancial items include assets and liabilities such as

reporting units measured at fair value in a goodwill

impairment test and nonfinancial assets acquired and

liabilities assumed in a business combination. The full

adoption of FASB ASC 820 did not have a material impact

on our consolidated financial position, results of oper-

ations or cash flows.

Reclassifications

Certain reclassifications have been made to prior years’ financial statements in order to conform to the current year’s

presentation. The reclassifications had no impact on net earnings previously reported.

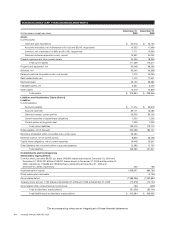

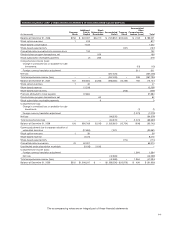

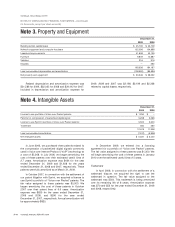

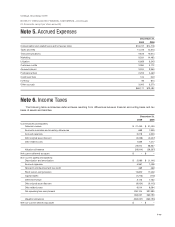

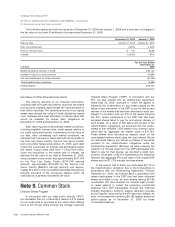

Note 2. Prepaid Expenses and Other Current Assets

December 31,

2009 2008

Inventory $ 9,457 $ 5

Telecommunications 8,845 2,977

Nontrade receivables 7,117 4,710

Software and hardware maintenance and support 6,958 2,814

Services 2,887 1,149

Insurance 1,885 1,739

Marketing 894 4,367

Other prepaids 2,382 564

$40,425 $18,325

F-13