Vonage 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.customers. In addition, future regulatory developments could

increase our cost of doing business and limit our growth.

Our international operations are also subject to regulatory

risks, including the risk that regulations in some jurisdictions will

prohibit us from providing our services cost-effectively or at all,

which could limit our growth. Currently, there are several coun-

tries where regulations prohibit us from offering service. In addi-

tion, because customers can use our services almost anywhere

that a broadband Internet connection is available, including coun-

tries where providing VoIP services is illegal, the governments of

those countries may attempt to assert jurisdiction over us, which

could expose us to significant liability and regulation.

We identified a material weakness in our internal control

over financial reporting which was remediated as of

December 31, 2007 and may identify additional material

weaknesses in the future that may cause us to fail to meet

our reporting obligations or result in material misstate-

ments of our financial statements.

Our management is responsible for establishing and maintain-

ing adequate internal control over financial reporting. Internal

control over financial reporting is a process designed to provide

reasonable assurance regarding the reliability of financial report-

ing and the preparation of financial statements in accordance with

accounting principles generally accepted in the United States. A

material weakness is a deficiency, or a combination of deficien-

cies, in internal control over financial reporting, such that there is

a reasonable possibility that a material misstatement of the

company’s annual or interim financial statements will not be pre-

vented or detected on a timely basis. We reported a material

weakness that existed in the design of our internal control proce-

dures relating to recording stock-based compensation expense

during 2007, which was remediated as of December 31, 2007.

If we fail to maintain the adequacy of our internal controls, we

may not be able to conclude in the future that we have effective

internal control over financial reporting in accordance with the

Sarbanes-Oxley Act. Moreover, effective internal controls are

necessary for us to produce reliable financial reports and are

important to help prevent fraud. As a result, our failure to maintain

effective internal controls could result in the loss of investor con-

fidence in the reliability of our financial statements, which in turn

could harm the market value of our common stock. Any failure to

maintain effective internal controls also could impair our ability to

manage our business and harm our financial results.

Our common stockholders may suffer dilution in the

future upon exercise of our Convertible Notes.

In connection with the Financing, we issued $18,000

aggregate principal amount of Convertible Notes to Silver Point

Finance, LLC, certain of its affiliates, other third parties and affili-

ates of us. In 2009, an aggregate of $12,305 principal amount of

Convertible Notes were converted into 42,431 shares of our

common stock. If the remaining conversion rights in the Con-

vertible Notes are exercised, the exercising note holders may

obtain a significant equity interest in us and other stockholders

may experience significant and immediate dilution. Conversion of

the entire remaining $5,695 aggregate principal amount of Con-

vertible Notes at the initial conversion rate would have resulted in

an increase of our outstanding common stock from 199,898

shares (as of December 31, 2009) to 219,536 shares, an approx-

imate 9.0% dilution to our common stockholders.

Jeffrey A. Citron, our founder, Chairman and a significant

stockholder, exerts significant influence over us.

As of December 31, 2009, Mr. Citron beneficially owned

approximately 28.3% of our outstanding common stock, including

outstanding securities convertible into or exercisable for common

stock within 60 days of such date. As a result, Mr. Citron is able to

exert significant influence over all matters presented to our stock-

holders for approval, including election and removal of our direc-

tors and change of control transactions. In addition, as our

Chairman, Mr. Citron has and will continue to have significant

influence over our strategy and other matters. Mr. Citron’s inter-

ests may not always coincide with the interests of other holders of

our common stock.

We may be unable to fully realize the benefits of our net

operating loss (“NOL”) carry forwards if an ownership

change occurs.

If we were to experience another “change in ownership”

under Section 382 of the Internal Revenue Code (“Section 382”),

the NOL carry forward limitations under Section 382 would

impose an annual limit on the amount of the future taxable income

that may be offset by our NOL generated prior to the change in

ownership. If a change in ownership were to occur, we may be

unable to use a significant portion of our NOL to offset future

taxable income. In general, a change in ownership occurs when,

as of any testing date, there has been a cumulative change in the

stock ownership of the corporation held by 5% stockholders of

more than 50 percentage points over an applicable three-year

period. For these purposes, a 5% stockholder is generally any

person or group of persons that at any time during an applicable

three-year period has owned 5% or more of our outstanding

common stock. In addition, persons who own less than 5% of the

outstanding common stock are grouped together as one or more

“public group” 5% stockholders. Under Section 382, stock

ownership would be determined under complex attribution rules

and generally includes shares held directly, indirectly (though

intervening entities) and constructively (by certain related parties

and certain unrelated parties acting as a group).

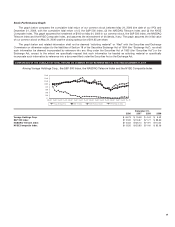

The market price of our common stock has been and may

continue to be volatile, and purchasers of our common

stock could incur substantial losses.

Securities markets experience significant price and volume

fluctuations. This market volatility, as well as general economic

conditions, could cause the market price of our common stock to

fluctuate substantially. The trading price of our common stock has

been, and is likely to continue to be, volatile. Many factors that are

beyond our control may significantly affect the market price of our

shares. These factors include:

>changes in our earnings or variations in operating results;

>any shortfall in revenue or increase in losses from levels

expected by securities analysts;

>judgments in our litigation;

>changes in regulatory policies or tax law;

>operating performance of companies comparable to us; and

>general economic trends and other external factors.

If any of these factors causes the price of our common stock

to fall, investors may not be able to sell their common stock at or

above their respective purchase prices.

16 VONAGE ANNUAL REPORT 2009