Vonage 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

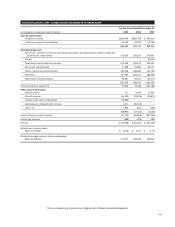

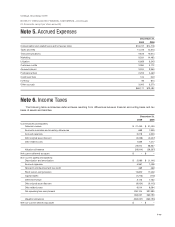

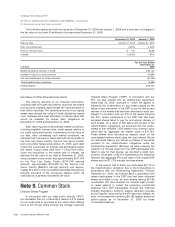

Note 5. Accrued Expenses

December 31,

2009 2008

Compensation and related taxes and temporary labor $16,747 $14,776

Taxes and fees 14,415 14,313

Telecommunications 9,873 10,614

Marketing 9,331 14,482

Litigation 6,689 5,343

Customer credits 3,384 2,172

Accrued interest 3,304 3,350

Professional fees 2,209 3,439

Credit card fees 124 549

Inventory 95 874

Other accruals 3,000 3,570

$69,171 $73,482

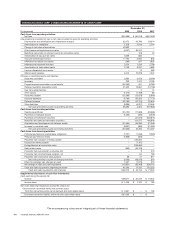

Note 6. Income Taxes

The following table summarizes deferred taxes resulting from differences between financial accounting basis and tax

basis of assets and liabilities.

December 31,

2009 2008

Current assets and liabilities:

Deferred revenue $ 21,450 $ 21,405

Accounts receivable and inventory allowances 688 1,309

Accrued expenses 5,218 4,253

Debt original issue discount (2,098) (2,027)

Debt related costs 1,656 1,417

26,914 26,357

Valuation allowance (26,914) (26,357)

Net current deferred tax asset $–$–

Non-current assets and liabilities:

Depreciation and amortization $ 2,089 $ (1,141)

Accrued expenses 5,567 7,408

Research and development tax credit 469 469

Stock option compensation 19,820 17,059

Capital leases (1,275) (772)

Deferred revenue 3,173 7,732

Debt original issue discount (6,934) (9,112)

Debt related costs 6,014 6,564

Net operating loss carryforward 330,104 331,983

359,027 360,190

Valuation allowance (359,027) (360,190)

Net non-current deferred tax asset $–$–

F-15