Vonage 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

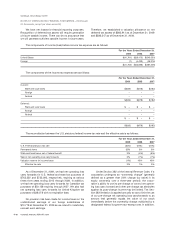

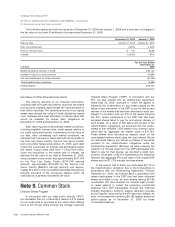

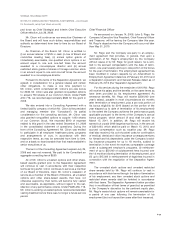

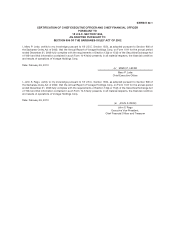

Restricted stock and restricted stock unit activity under our 2006 Incentive Plan was as follows:

(Shares in Thousands)

Number

of

Shares

Weighted

Average

Grant Date

Fair Value

Aggregate

Intrinsic

Value

Awards outstanding at December 31, 2006 1,912 $6.49

Granted 3,130 $2.40

Exercised (364) $6.42 $ 847

Canceled (1,574) $4.68

Awards outstanding at December 31, 2007 3,104 $3.33 $7,139

Granted 1,747 $1.91

Exercised (786) $3.28 $1,059

Canceled (960) $2.92

Awards outstanding at December 31, 2008 3,105 $2.67 $2,050

Granted 1,188 $0.51

Exercised (971) $1.58 $ 880

Canceled (536) $2.25

Awards outstanding at December 31, 2009 2,786 $1.72 $2,688

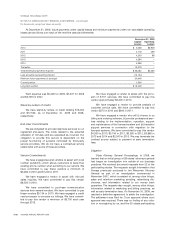

The weighted average grant date fair value of

restricted stock and restricted stock units granted was

$0.51, $1.91 and $2.40 during the year ended

December 31, 2009, 2008 and 2007, respectively.

Retirement Plan

In March 2001, we established a 401(k) Retirement

Plan (the “Retirement Plan”) available to employees who

meet the plan’s eligibility requirements. Participants may

elect to contribute a percentage of their compensation to

the Retirement Plan up to a statutory limit. We may make

a contribution to the Retirement Plan in the form of a

matching contribution. The employer matching con-

tribution is 50% of each employee’s contributions not to

exceed $6 in 2007, 2008 and 2009. Our expense related

to the Retirement Plan was $620 $1,307 and $1,695 in

2009, 2008 and 2007, respectively.

Note 11. Commitments and

Contingencies

Capital Leases

Assets financed under capital lease agreements are

included in property and equipment in the consolidated

balance sheet and related depreciation and amortization

expense is included in the consolidated statements of

operations.

On March 24, 2005, we entered into a lease for our

headquarters in Holmdel, New Jersey. We took pos-

session of a portion of the office space at the inception of

the lease, another portion on August 1, 2005 and took

over the remainder of the office space in early 2006. The

overall lease term is twelve (12) years and five (5) months.

In connection with the lease, we issued a letter of credit

which requires $7,350 of cash as collateral, which is

classified as restricted cash. The gross amount of the

building recorded under capital leases totaled $25,709 as

of December 31, 2009 and accumulated depreciation was

approximately $8,853 as of December 31, 2009.

Operating Leases

We have entered into various non-cancelable operat-

ing lease agreements for certain of our existing office and

telecommunications co-location space in the U.S. and for

international subsidiaries with original lease periods expir-

ing between 2010 and 2011. We are committed to pay a

portion of the buildings’ operating expenses as

determined under the agreements.

F-25