Vonage 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

>a maximum of $5,000 may be paid pursuant to annual

awards granted to any participant in a calendar year;

and

>a maximum of $10,000 may be paid (in the case of

awards denominated in cash) and a maximum of 10,000

shares may be issued (in the case of awards denomi-

nated in shares) pursuant to awards, other than options,

stock appreciation rights or annual awards, granted to

any participant in a calendar year.

The maximum number of shares of our common

stock that are authorized for issuance under our 2006

Incentive Plan will be determined under a formula set forth

in the plan, and will equal approximately 17.65% of the

number of shares that are issued and outstanding from

time to time. Shares issued under the plan may be

authorized and unissued shares or may be issued shares

that we have reacquired. Shares covered by awards that

are forfeited, cancelled or otherwise expire without having

been exercised or settled, or that are settled by cash or

other non-share consideration, will become available for

issuance pursuant to a new award. Shares that are ten-

dered or withheld to pay the exercise price of an award or

to satisfy tax withholding obligations will not be available

for issuance pursuant to new awards. At December 31,

2009, 14,028 shares were available for future grant under

the 2006 Stock Incentive Plan.

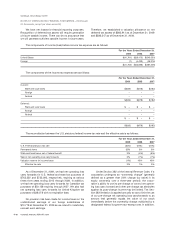

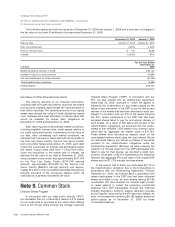

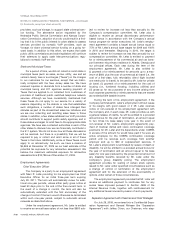

The following table summarizes the activity for all awards under both of our Stock Incentive Plans:

(Shares and Intrinsic Value in Thousands)

Number

of Shares

Range of

Exercise

Prices

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Term in

Years

Aggregate

Intrinsic

Value

Weighted

Average

Grant Date

Fair Value

Awards outstanding at December 31, 2006 18,916 $0.00 - $35.00 $7.25 7.7 $4.09

Granted 10,999 $0.00 - $6.94 $2.53 $2.01

Exercised (1,034) $0.00 - $1.76 $0.79 $2,442 $2.48

Canceled (7,520) $0.00 - $35.00 $6.15 $4.46

Awards outstanding at December 31, 2007 21,361 $0.00 - $35.00 $5.53 5.6 $10,244 $2.97

Granted 16,875 $0.00 - $2.21 $1.45 $1.05

Exercised (832) $0.00 - $1.76 $0.06 $1,102 $3.11

Canceled (5,072) $0.00 - $35.00 $5.07 $3.22

Awards outstanding at December 31, 2008 32,332 $0.00 - $35.00 $3.61 6.5 $2,050 $1.93

Granted 6,819 $0.00 - $1.65 $0.68 $0.60

Exercised (1,004) $0.00 - $1.92 $0.06 $885 $2.53

Canceled (6,827) $0.00 - $35.00 $6.87 $2.59

Awards outstanding at December 31, 2009 31,320 $0.00 - $35.00 $2.44 6.0 $7,612 $1.48

Shares exercisable at December 31, 2009 12,097 $0.00 - $35.00 $4.02 5.0 $761 $2.02

Unvested shares at December 31, 2008 21,446 $0.00 - $18.00 $2.26 6.9 $1,999 $1.61

Unvested shares at December 31, 2009 19,223 $0.00 - $18.00 $1.44 6.6 $6,677 $1.13

The weighted average grant date fair value of options

granted was $0.62, $0.95 and $1.85 for the years ended

December 31, 2009, 2008 and 2007, respectively.

Total share-based compensation expense recog-

nized for the years ended December 31, 2009, 2008 and

2007 was $8,473, $12,238 and $7,542, respectively,

which were recorded to selling, general and administrative

expense in the consolidated statement of operations. As

of December 31, 2009, total unamortized share-based

compensation was $7,824, which is expected to be amor-

tized over the remaining vesting period of each grant, up

to the next 48 months. Compensation costs for all share-

based awards are recognized using the ratable single-

option approach on an accrual basis and are amortized

using an accelerated amortization schedule.

F-24 VONAGE ANNUAL REPORT 2009