Vonage 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

Security

Amounts borrowed under the Financing are secured by

substantially all of the assets of the Credit Parties. The col-

lateral secures the First Lien Senior Facility on a first lien

basis, the Second Lien Senior Facility on a second lien

basis and the Convertible Notes on a third lien basis, sub-

ject to an inter creditor agreement.

Commencing October 1, 2009, all specified unre-

stricted cash above $30,000, subject to certain adjust-

ments, is swept into a Concentration Account, and until the

balance in the Concentration Account is at least equal to

$30,000, we may not access or make any withdrawals from

the Concentration Account. Thereafter, with limited

exceptions, we will have the right to withdraw funds from

the Concentration Account in excess of $30,000. As of

December 31, 2009, we have funded $3,277 into the Con-

centration Account. We funded an additional $18,718

through February 25, 2010.

Other Terms and Conditions of the Financing

The Credit Documentation includes customary repre-

sentations and warranties of the Credit Parties. In addition,

Credit Documentation for the Financing contains affirmative

and negative covenants that affect, and in many respects

may significantly limit or prohibit, among other things, the

Credit Parties’ ability to incur, prepay, refinance or modify

indebtedness; enter into acquisitions, investments, sales,

mergers, consolidations, liquidations and dissolutions;

invest in foreign subsidiaries, repurchase and redeem

stock; modify material contracts; engage in transactions

with affiliates and 5% stockholders; change lines of busi-

ness; and make marketing expenditures under contracts

with a duration in excess of one year that exceed

(i) $95,000 until December 31, 2009 and (ii) for each quarter

thereafter, an amount equal to 20% of consolidated

pre-marketing operating income for the four quarters

immediately preceding such quarter. Board approval must

be obtained for any long-term commitment or series of

related long-term commitments that would result in

aggregate marketing expenditures by any of the Credit Par-

ties of more than $25,000 during the term of the Financing.

In addition, we must comply with certain financial cove-

nants, which include a total leverage ratio, senior lien lever-

age ratios, minimum consolidated adjusted EBITDA, a fixed

charge coverage ratio, maximum consolidated capital

expenditures, minimum consolidated liquidity and minimum

consolidated pre-marketing operating income. As of

December 31, 2009, we were in compliance with all cove-

nants, including financial covenants, under the Credit

Documentation.

The Credit Documentation contains events of default

that may permit acceleration of the debt under the Credit

Documentation and a default interest rate of 3% above the

interest rate which would otherwise be applicable. If an

event of default has occurred, and the debt under the

Financing becomes due and payable as a result, such

payment will be subject to a make-whole (or the prepay-

ment premium, if applicable to the First Lien Senior Facility

in years 4 and 5) and, in the case of the Convertible Notes,

liquidated damages payable in the form of shares of

common stock for any loss of the option to convert in

whole or in part. Conversion rights will continue to exist

while the Convertible Notes are outstanding notwithstand-

ing acceleration or maturity, including as a result of a volun-

tary or involuntary bankruptcy.

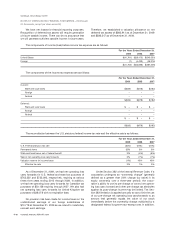

Note 8. Fair Value of Financial

Instruments

Effective January 1, 2008, we adopted FASB ASC 820,

“Fair Value Measurements and Disclosures” (“FASB ASC

820”). This standard establishes a framework for measuring

fair value and expands disclosure about fair value

measurements. We did not elect fair value accounting for

any assets and liabilities allowed by FASB ASC 825,

“Financial Instruments”.

FASB ASC 820 defines fair value as the amount that

would be received for an asset or paid to transfer a liability

(i.e., an exit price) in the principal or most advantageous

market for the asset or liability in an orderly transaction

between market participants on the measurement date.

FASB ASC 820 also establishes a fair value hierarchy that

requires an entity to maximize the use of observable inputs

and minimize the use of unobservable inputs when measur-

ing fair value. FASB ASC 820 describes the following three

levels of inputs that may be used:

>Level 1: Quoted prices (unadjusted) in active markets that

are accessible at the measurement date for identical

assets and liabilities. The fair value hierarchy gives the

highest priority to Level 1 inputs.

>Level 2: Observable prices that are based on inputs not

quoted on active markets but corroborated by mar-

ket data. Our common stock warrant with a value of $553

as of December 31, 2009 is included as a Level 2 liability.

>Level 3: Unobservable inputs when there is little or no

market data available, thereby requiring an entity to

develop its own assumptions. The fair value hierarchy

gives the lowest priority to Level 3 inputs. The embedded

derivative within our Convertible Notes with a value of

$25,050 as of December 31, 2009 is included as a Level 3

liability.

F-21