Vonage 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

Common Stock Warrant

On April 17, 2002, Vonage’s principal stockholder and

Chairman received a warrant to purchase 514 shares of

Common Stock at an exercise price of $0.70 per share that

expires on June 20, 2012. As a result of the issuance of our

Convertible Notes, the exercise price was reduced to $0.58.

In connection with $20,000 of notes payable from our

principal stockholder and Chairman in 2003, we issued a

warrant to purchase Series A-2 preferred stock, which

automatically converted into the 2,571 of common stock

upon our IPO with an exercise price of $1.40 per share

that are included in our consolidated balance sheet under

additional paid-in capital. These warrants expired on

October 1, 2008.

Note 10. Employee Benefit

Plans

Share-Based Compensation

Our stock option program is a long-term retention

program that is intended to attract, retain and provide

incentives for talented employees, officers and directors,

and to align stockholder and employee interests. Cur-

rently, we grant options from our 2006 Incentive Plan. Our

2001 Stock Incentive Plan was terminated by our board of

directors in 2008. As such, share-based awards are no

longer granted under the 2001 Stock Incentive Plan.

Under the 2006 Incentive Plan, share-based awards can

be granted to all employees, including executive officers,

outside consultants and non-employee directors. Vesting

periods for share-based awards are generally four years

for both plans. Awards granted under each plan expire in

five or 10 years from the effective date of grant.

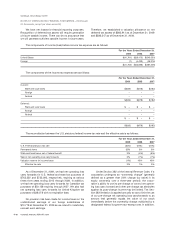

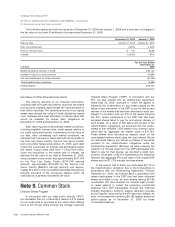

The fair value for these options was estimated at the date of grant using a Black-Scholes option-pricing model. The

assumptions used to value options are as follows:

2009 2008 2007

Risk-free interest rate 1.50-3.12% 1.24-3.23% 3.27-5.04%

Expected stock price volatility 87.70-109.31% 66.29-86.83% 39.4-48.61%

Dividend yield 0.00% 0.00% 0.00%

Expected life (in years) 3.75-6.25 3.75-6.25 3.76-6.9

Beginning January 1, 2006, we estimated the vola-

tility of our stock using historical volatility of comparable

public companies in accordance with guidance in FASB

ASC 718, “Compensation-Stock Compensation”. Begin-

ning in the first quarter of 2008, we used the historical

volatility of our common stock to measure expected vola-

tility for future option grants.

The risk-free interest rate assumption is based upon

observed interest rates appropriate for the term of our

employee stock options. The expected term of employee

stock options represents the weighted-average period

that the stock options are expected to remain out-

standing, which we derive based on our historical settle-

ment experience.

2001 Stock Incentive Plan

In February 2001, we adopted the 2001 Stock

Incentive Plan, which is an amendment and restatement

of the 2000 Stock Incentive Plan of MIN-X.COM, INC. The

2001 Stock Incentive Plan provides for the granting of

options or restricted stock awards to our officers, direc-

tors and employees. The objectives of the 2001 Stock

Incentive Plan include attracting and retaining personnel,

providing for additional performance incentives, and

promoting our success by providing employees the

opportunity to acquire stock. During 2005, the number of

shares authorized for issuance pursuant to options or

restricted stock awards was increased from 7,503 to

28,286. In management’s opinion, all stock options were

granted with an exercise price at or above the fair market

value of our common stock at the date of grant with the

exception of a grant in 2005 for 125 shares. Initially, we

recorded deferred compensation in 2005 related to this

option grant. On January 1, 2006, we reversed the remain-

ing deferred compensation balance in accordance with

FASB ASC 718. There weren’t any options available for

future grant under the 2001 Stock Incentive Plan since our

board of directors terminated the plan in 2008.

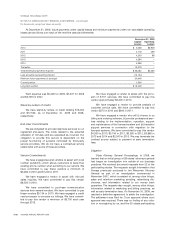

2006 Incentive Plan

In May 2006 we adopted the 2006 Incentive Plan.

The 2006 Incentive Plan permits the grant of stock

options, restricted stock, restricted stock units, stock

appreciation rights, performance stock, performance

units, annual awards and other awards based on, or

related to, shares of our common stock. Options awarded

under our 2006 Incentive Plan may be nonstatutory stock

options or may qualify as incentive stock options under

Section 422 of the Internal Revenue Code of 1986, as

amended. Our 2006 Incentive Plan contains various limits

with respect to the types of awards, as follows:

>a maximum of 20,000 shares may be issued under the

plan pursuant to incentive stock options;

>a maximum of 10,000 shares may be issued pursuant to

options and stock appreciation rights granted to any

participant in a calendar year;

F-23