Vonage 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VONAGE HOLDINGS CORP.

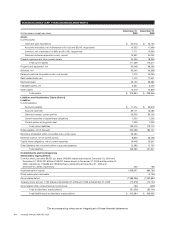

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

review indicates that the carrying value of an asset will not

be recoverable, based on a comparison of the carrying

value of the asset to the undiscounted future cash flows,

the impairment will be measured by comparing the carrying

value of the asset to its fair value. Fair value will be

determined based on quoted market values, discounted

cash flows or appraisals. Impairments are recorded in the

statement of operations as part of depreciation expense. In

2009, 2008 and 2007, we incurred an impairment loss of

$1,886, $1,762 and $1,374, respectively. The impairments

were mainly for marketing displays, network equipment,

computer hardware and furniture and fixtures.

Facility Exit and Restructuring Costs

In June 2009, we announced the closing of our office

facility in Canada. The facility exit and restructuring costs

for the year ended December 31, 2009 were $2,529. These

costs included $1,090 for severance and personnel-related

costs which were recorded as selling, general and admin-

istrative in the statement of operations, $670 for lease

termination and facilities-related costs which were recorded

as selling, general and administrative in the statement of

operations and $769 for asset impairments which were

recorded in the statement of operations as part of deprecia-

tion expense. As of December 31, 2009, all of these costs

were paid.

Restricted Cash and Letters of Credit

Our credit card processors have established reserves

to cover any exposure that they may have as we collect

revenue in advance of providing services to our customers,

which is a customary practice for companies that bill their

customers in advance of providing services. As such, we

have provided our credit card processors with cash

reserves of $22,423 and a cash collateralized letter of credit

for $10,500. We have a cash collateralized letter of credit

for $7,350 and $7,000 as of December 31, 2009 and

December 31, 2008, respectively, related to lease deposits

for our offices. The total amount of collateralized letters of

credit was $18,000 and $17,562 at December 31, 2009 and

December 31, 2008, respectively. Pursuant to the terms of

credit facilities (see Note 7. Long-term Debt) commencing

October 1, 2009, all specified unrestricted cash above

$30,000, subject to certain adjustments, is swept into a

concentration account (the “Concentration Account”), and

until the balance in the Concentration Account is at least

equal to $30,000, we may not access or make any with-

drawals from the Concentration Account. Thereafter, with

limited exceptions, we will have the right to withdraw funds

from the Concentration Account in excess of $30,000. As of

December 31, 2009, we have funded $3,277 into the Con-

centration Account. We funded an additional $18,718

through February 25, 2010. In the aggregate, cash reserves

and collateralized letters of credit of $43,700 and $39,585

were recorded as long-term restricted cash at

December 31, 2009 and December 31, 2008, respectively.

Debt Related Costs

Costs incurred in raising debt are deferred and amor-

tized as interest expense using the effective interest

method over the life of the debt. In connection with our

financing transaction in November 2008, we recorded debt

related costs of $12,271, which are being amortized over

the life of the debt which is five years and seven years.

Amortization expense related to these costs is included in

interest expense in the consolidated statements of oper-

ations and was $2,708 and $478 for 2009 and 2008,

respectively. Accumulated amortization of debt related

costs was $4,859 and $478 at December 31, 2009 and

December 31, 2008, respectively, including a $1,673 write

off of debt related costs associated with the conversion of

convertible notes for the year ended December 31, 2009.

Costs of $9,935 in connection with our December

2005 and January 2006 issuance of convertible notes was

deferred and amortized as interest expense through Sep-

tember 30, 2007 over the five-year term of the notes.

Although the notes would have matured on December 1,

2010, they could have been put to us on December 16,

2008. In the fourth quarter of 2007, the rate of amortization

was accelerated so that only one third of the original

deferred financing costs remained to be amortized in 2008.

Amortization expense related to these costs was included

in interest expense in the consolidated statements of oper-

ations and was $2,758, $4,689 in 2008 and 2007,

respectively. Additionally, the unamortized portion of $414

at the time the convertible notes (“Previous Convertible

Notes”) were repaid was included in loss on early

extinguishment of notes in our consolidated statement of

operations for 2008.

Derivatives

We do not hold or issue derivative instruments for trad-

ing purposes; however, certain features within our 20%

senior secured third lien notes due 2015 and a common

stock warrant to purchase 514 shares of common stock at

an exercise price of $0.58 require us to account for such

features as derivative instruments. In accordance with new

guidance codified in FASB ASC 815, “Derivatives and

Hedging” (“FASB ASC 815”) which we adopted on Jan-

uary 1, 2009, we recognize these embedded derivatives as

liabilities in our consolidated balance sheet at fair value

each period and recognize any change in the fair value in

our statement of operations in the period of change. We

estimate the fair value of these embedded derivatives using

available market information and appropriate valuation

methodologies.

Foreign Currency

Generally, the functional currency of our non-U.S.

subsidiaries is the local currency. The financial statements

of these subsidiaries are translated to U.S. dollars using

month-end rates of exchange for assets and liabilities, and

average rates of exchange for revenues, costs and

expenses. Translation gains and losses are deferred and

F-11