United Healthcare 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP 67

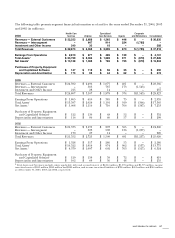

GROWTH & PROFITS — CONSOLIDATED

(in millions, except per share data) 2004 2003 2002

Revenues

$37,218

$28,823 $25,020

Earnings From Operations

$4,101

$2,935 $2,186

Operating Margin

11.0%

10.2% 8.7%

Return on Net Assets

35.3%

43.7% 37.5%

Net Earnings

$2,587

$1,825 $1,352

Net Margin

7.0%

6.3% 5.4%

Diluted Net Earnings per Common Share

$3.94

$2.96 $2.13

GROWTH & PROFITS — BY SEGMENT

(in millions) 2004 2003 2002

HEALTH CARE SERVICES

Revenues

$32,673

$24,807 $21,552

Earnings From Operations

$2,810

$1,865 $1,328

Operating Margin

8.6%

7.5% 6.2%

Return on Net Assets

30.1%

40.5% 35.5%

UNIPRISE

Revenues

$3,365

$3,107 $2,725

Earnings From Operations

$677

$610 $517

Operating Margin

20.1%

19.6% 19.0%

Return on Net Assets

58.2%

55.2% 48.7%

SPECIALIZED CARE SERVICES

Revenues

$2,295

$1,878 $1,509

Earnings From Operations

$485

$385 $286

Operating Margin

21.1%

20.5% 19.0%

Return on Net Assets

66.5%

59.1% 50.7%

INGENIX

Revenues

$670

$574 $491

Earnings From Operations

$129

$75 $55

Operating Margin

19.3%

13.1% 11.2%

Return on Net Assets

16.7%

9.7% 7.6%

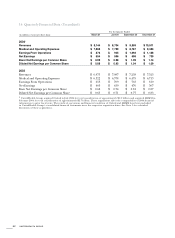

CAPITAL ITEMS

(in millions, except per share data) 2004 2003 2002

Cash Flows From Operating Activities

$4,135

$3,003 $2,423

Capital Expenditures

$350

$352 $419

Consideration Paid or Issued for Acquisitions

$7,782

$590 $869

Debt-to-Total-Capital Ratio

27.3%

27.8% 28.5%

Return on Shareholders’ Equity

31.4%

39.0% 33.0%

Year-End Market Capitalization

$56,603

$33,896 $25,005

Year-End Common Share Price

$88.03

$58.18 $41.75

FINANCIAL PERFORMANCE AT A GLANCE