United Healthcare 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP 47

POLICY ACQUISITION COSTS

For our health insurance contracts, costs related to the acquisition and renewal of customer contracts

are charged to expense as incurred. Our health insurance contracts typically have a one-year term and

may be cancelled upon 30 days notice by either the company or the customer.

STOCK-BASED COMPENSATION

We account for activity under our stock-based employee compensation plans under the recognition and

measurement principles of Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to

Employees.” Accordingly, we do not recognize compensation expense in connection with employee stock

option grants because we grant stock options at exercise prices not less than the fair value of our common

stock on the date of grant.

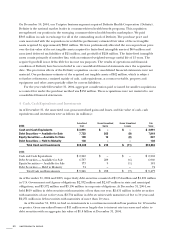

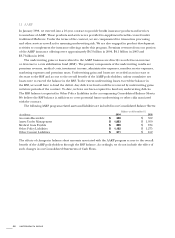

The following table shows the effect on net earnings and earnings per share had we applied the fair

value expense recognition provisions of Statement of Financial Accounting Standards (FAS) No. 123,

“Accounting for Stock-Based Compensation,” to stock-based employee compensation.

For the Year Ended December 31,

(in millions, except per share data) 2004 2003 2002

NET EARNINGS

As Reported

$2,587

$1,825 $1,352

Compensation Expense, net of tax effect

(132)

(122) (101)

Pro Forma

$2,455

$1,703 $1,251

BASIC NET EARNINGS PER COMMON SHARE

As Reported

$4.13

$3.10 $2.23

Pro Forma

$3.92

$2.89 $2.06

DILUTED NET EARNINGS PER COMMON SHARE

As Reported

$3.94

$2.96 $2.13

Pro Forma

$3.74

$2.76 $1.97

WEIGHTED-AVERAGE FAIR VALUE PER SHARE OF

OPTIONS GRANTED

$19

$11 $14

Information on our stock-based compensation plans and data used to calculate compensation expense

in the table above are described in more detail in Note 9.

NET EARNINGS PER COMMON SHARE

We compute basic net earnings per common share by dividing net earnings by the weighted-average

number of common shares outstanding during the period. We determine diluted net earnings per

common share using the weighted-average number of common shares outstanding during the period,

adjusted for potentially dilutive shares that might be issued upon exercise of common stock options.

DERIVATIVE FINANCIAL INSTRUMENTS

As part of our risk management strategy, we enter into interest rate swap agreements to manage our

exposure to interest rate risk. The differential between fixed and variable rates to be paid or received

is accrued and recognized over the life of the agreements as an adjustment to interest expense in the

Consolidated Statements of Operations. Our existing interest rate swap agreements convert a portion

of our interest rate exposure from a fixed to a variable rate and are accounted for as fair value hedges.

Additional information on our existing interest rate swap agreements is included in Note 7.