United Healthcare 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 UNITEDHEALTH GROUP

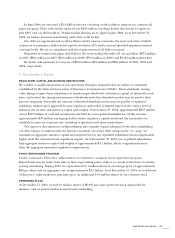

OTHER CONTINGENCIES

In 2002, Oxford, which we acquired on July 29, 2004, entered into agreements with two insurance

companies that guaranteed cost reduction targets related to certain orthopedic medical services. In 2003,

the insurers sought to rescind or terminate the agreements claiming various misrepresentations and

material breaches of the agreements by Oxford. Pursuant to the agreements, Oxford filed claims to

recover approximately $50 million of costs incurred and expensed in excess of the cost reduction targets

for the period from November 2002 to October 2004. An arbitration hearing with the insurance company

holding a large majority of the coverage under the policies was held in January 2005, and a decision was

issued on February 22, 2005, denying the insurer’s ability to rescind or terminate its agreement. As a result

of the decision, Oxford was awarded approximately $30 million in net recoveries. The insurer has not

yet indicated whether it will appeal this decision. Oxford will not record the net recoveries until all

contingencies have been resolved. We believe that the remaining insurer’s claims are also without merit,

and we will vigorously seek to enforce our rights.

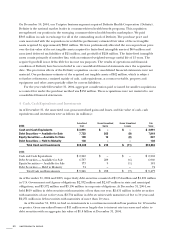

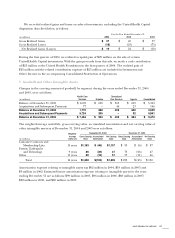

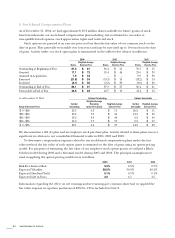

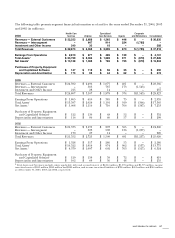

13 Segment Financial Information

Factors used in determining our reportable business segments include the nature of operating activities,

existence of separate senior management teams, and the type of information presented to the company’s

chief operating decision-maker to evaluate our results of operations.

Our accounting policies for business segment operations are the same as those described in the

Summary of Significant Accounting Policies (see Note 2). Transactions between business segments

principally consist of customer service and transaction processing services that Uniprise provides to

Health Care Services, certain product offerings sold to Uniprise and Health Care Services customers

by Specialized Care Services, and sales of medical benefits cost, quality and utilization data and predictive

modeling to Health Care Services and Uniprise by Ingenix. These transactions are recorded at

management’s best estimate of fair value, as if the services were purchased from or sold to third parties.

All intersegment transactions are eliminated in consolidation. Assets and liabilities that are jointly used

are assigned to each segment using estimates of pro-rata usage. Cash and investments are assigned such

that each segment has minimum specified levels of regulatory capital or working capital for non-regulated

businesses. The “Corporate and Eliminations” column also includes eliminations of intersegment

transactions.

Substantially all of our operations are conducted in the United States. In accordance with accounting

principles generally accepted in the United States of America, segments with similar economic

characteristics may be combined. The financial results of UnitedHealthcare, Ovations and AmeriChoice

have been combined in the Health Care Services segment column in the tables presented on the next

page because these businesses have similar economic characteristics and have similar products and

services, types of customers, distribution methods and operational processes, and operate in a similar

regulatory environment, typically within the same legal entity.