United Healthcare 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 UNITEDHEALTH GROUP

On December 10, 2004, our Uniprise business segment acquired Definity Health Corporation (Definity).

Definity is the national market leader in consumer-driven health benefit programs. This acquisition

strengthened our position in the emerging consumer-driven health benefits marketplace. We paid

$305 million in cash in exchange for all of the outstanding stock of Definity. The purchase price and

costs associated with the acquisition exceeded the preliminary estimated fair value of the net tangible

assets acquired by approximately $263 million. We have preliminarily allocated the excess purchase price

over the fair value of the net tangible assets acquired to finite-lived intangible assets of $60 million and

associated deferred tax liabilities of $21 million, and goodwill of $224 million. The finite-lived intangible

assets consist primarily of member lists, with an estimated weighted-average useful life of 15 years. The

acquired goodwill is not deductible for income tax purposes. The results of operations and financial

condition of Definity have been included in our consolidated financial statements since the acquisition

date. The pro forma effects of the Definity acquisition on our consolidated financial statements were not

material. Our preliminary estimate of the acquired net tangible assets of $42 million, which is subject

to further refinement, consisted mainly of cash, cash equivalents, accounts receivable, property and

equipment and other assets partially offset by current liabilities.

For the year ended December 31, 2004, aggregate consideration paid or issued for smaller acquisitions

accounted for under the purchase method was $158 million. These acquisitions were not material to our

consolidated financial statements.

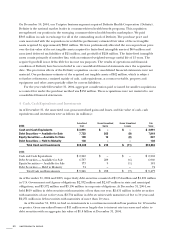

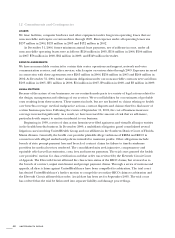

4 Cash, Cash Equivalents and Investments

As of December 31, the amortized cost, gross unrealized gains and losses, and fair value of cash, cash

equivalents and investments were as follows (in millions):

Amortized Gross Unrealized Gross Unrealized Fair

2004 Cost Gains Losses Value

Cash and Cash Equivalents $ 3,991 $ – $ – $ 3,991

Debt Securities — Available for Sale 7,723 205 (9) 7,919

Equity Securities — Available for Sale 199 10 (2) 207

Debt Securities — Held to Maturity 136 – – 136

Total Cash and Investments $12,049 $ 215 $ (11) $12,253

2003

Cash and Cash Equivalents $2,262 $–$–$2,262

Debt Securities — Available for Sale 6,737 229 (6) 6,960

Equity Securities — Available for Sale 173 9 (1) 181

Debt Securities — Held to Maturity 74 – – 74

Total Cash and Investments $9,246 $238 $(7) $9,477

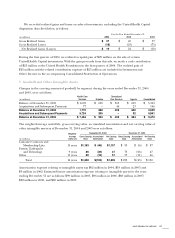

As of December 31, 2004 and 2003, respectively, debt securities consisted of $1,551 million and $1,221 million

in U.S. Government and Agency obligations, $2,932 million and $2,617 million in state and municipal

obligations, and $3,572 million and $3,196 million in corporate obligations. At December 31, 2004, we

held $619 million in debt securities with maturities of less than one year, $2,431 million in debt securities

with maturities of one to five years, $2,734 million in debt securities with maturities of five to 10 years and

$2,271 million in debt securities with maturities of more than 10 years.

As of December 31, 2004, we had no investments in a continuous unrealized loss position for 12 months

or greater. Gross unrealized losses of $11 million were largely due to interest rate increases and relate to

debt securities with an aggregate fair value of $1.8 billion at December 31, 2004.