United Healthcare 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 UNITEDHEALTH GROUP

9 Stock-Based Compensation Plans

As of December 31, 2004, we had approximately 49.2 million shares available for future grants of stock-

based awards under our stock-based compensation plan including, but not limited to, incentive or

non-qualified stock options, stock appreciation rights and restricted stock.

Stock options are granted at an exercise price not less than the fair value of our common stock on the

date of grant. They generally vest ratably over four years and may be exercised up to 10 years from the date

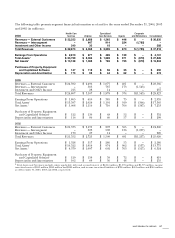

of grant. Activity under our stock option plan is summarized in the tables below (shares in millions):

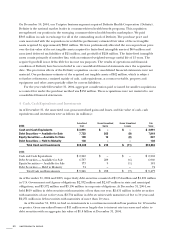

2004

2003 2002

Weighted-Average Weighted-Average Weighted-Average

Shares Exercise Price Shares Exercise Price Shares Exercise Price

Outstanding at Beginning of Year

87.3 $ 27

86.4 $21 76.7 $15

Granted

17.1 $ 72

18.4 $44 25.0 $38

Assumed in Acquisitions

7.6 $ 34

–$–0.9 $30

Exercised

(21.8) $ 24

(15.3) $15 (13.2) $14

Forfeited

(2.1) $ 35

(2.2) $30 (3.0) $20

Outstanding at End of Year

88.1 $ 37

87.3 $27 86.4 $21

Exercisable at End of Year

44.8 $ 22

42.7 $16 41.4 $12

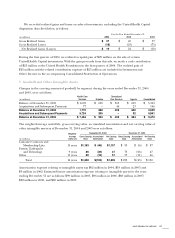

As of December 31, 2004

Options Outstanding Options Exercisable

Weighted-Average

Number Remaining Weighted-Average Number Weighted-Average

Range of Exercise Prices Outstanding Option Term (years) Exercise Price Exercisable Exercise Price

$0 - $20 26.5 4.3 $11 26.2 $11

$21 - $40 29.4 7.0 $34 12.2 $32

$41 - $60 18.2 8.0 $48 6.2 $46

$61 - $85 14.0 9.7 $75 0.2 $67

$0 - $85 88.1 6.8 $37 44.8 $22

We also maintain a 401(k) plan and an employee stock purchase plan. Activity related to these plans was not

significant in relation to our consolidated financial results in 2004, 2003 and 2002.

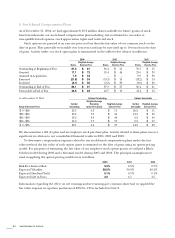

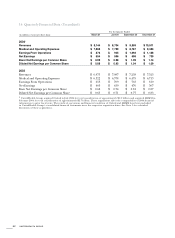

To determine compensation expense related to our stock-based compensation plans under the fair

value method, the fair value of each option grant is estimated on the date of grant using an option-pricing

model. For purposes of estimating the fair value of our employee stock option grants, we utilized a Black-

Scholes model during 2002 and a binomial model during 2003 and 2004. The principal assumptions we

used in applying the option pricing models were as follows:

2004 2003 2002

Risk-Free Interest Rate

3.3%

2.6% 2.5%

Expected Volatility

28.5%

30.9% 40.2%

Expected Dividend Yield

0.1%

0.1% 0.1%

Expected Life in Years

4.2

4.1 4.5

Information regarding the effect on net earnings and net earnings per common share had we applied the

fair value expense recognition provisions of FAS No. 123 is included in Note 2.