United Healthcare 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 UNITEDHEALTH GROUP

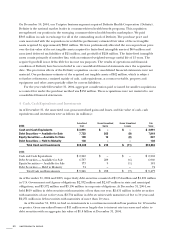

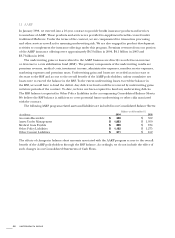

6 Medical Costs Payable

The following table shows the components of the change in medical costs payable for the years ended

December 31:

(in millions) 2004 2003 2002

MEDICAL COSTS PAYABLE, BEGINNING OF PERIOD

$4,152

$3,741 $3,460

ACQUISITIONS

1,040

165 180

REPORTED MEDICAL COSTS

Current Year

27,210

20,864 18,262

Prior Years

(210)

(150) (70)

Total Reported Medical Costs

27,000

20,714 18,192

CLAIM PAYMENTS

Payments for Current Year

(23,173)

(17,411) (15,147)

Payments for Prior Years

(3,479)

(3,057) (2,944)

Total Claim Payments

(26,652)

(20,468) (18,091)

MEDICAL COSTS PAYABLE, END OF PERIOD

$5,540

$4,152 $3,741

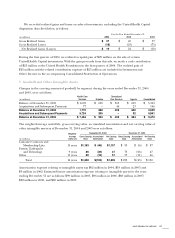

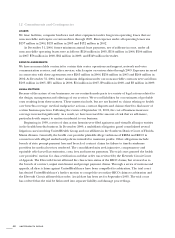

7 Commercial Paper and Debt

Commercial paper and debt consisted of the following as of December 31:

2004 2003

Carrying Fair Carrying Fair

(in millions) Value Value1Value Value1

Commercial Paper

$273 $ 273

$79 $79

Floating-Rate Notes due November 2004

––

150 150

7.5% Senior Unsecured Notes due November 2005

400 417

400 438

5.2% Senior Unsecured Notes due January 2007

400 413

400 427

3.4% Senior Unsecured Notes due August 2007

550 546

––

3.3% Senior Unsecured Notes due January 2008

500 493

500 499

3.8% Senior Unsecured Notes due February 2009

250 247

––

4.1% Senior Unsecured Notes due August 2009

450 452

––

4.9% Senior Unsecured Notes due April 2013

450 453

450 454

4.8% Senior Unsecured Notes due February 2014

250 248

––

5.0% Senior Unsecured Notes due August 2014

500 503

––

Total Commercial Paper and Debt

4,023 4,045

1,979 2,047

Less Current Maturities

(673) (690)

(229) (229)

Long-Term Debt, less current maturities

$3,350 $ 3,355

$1,750 $1,818

1Estimated based on third-party quoted market prices for the same or similar issues.

As of December 31, 2004, our outstanding commercial paper had interest rates ranging from 2.3% to 2.4%.

We have interest rate swap agreements that qualify as fair value hedges to convert the majority of our

interest rate exposure from a fixed to a variable rate. The interest rate swap agreements have aggregate

notional amounts of $2.9 billion with variable rates that are benchmarked to the six-month LIBOR

(London Interbank Offered Rate). At December 31, 2004, the rates used to accrue interest expense on

these agreements ranged from 2.3% to 3.3%. The differential between the fixed and variable rates to be

paid or received is accrued and recognized over the life of the agreements as an adjustment to interest

expense in the Consolidated Statements of Operations.