United Healthcare 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 UNITEDHEALTH GROUP

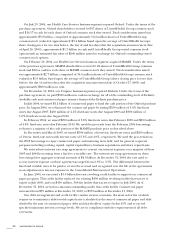

On July 29, 2004, our Health Care Services business segment acquired Oxford. Under the terms of the

purchase agreement, Oxford shareholders received 0.6357 shares of UnitedHealth Group common stock

and $16.17 in cash for each share of Oxford common stock they owned. Total consideration issued was

approximately $5.0 billion, comprised of approximately 52.2 million shares of UnitedHealth Group

common stock (valued at approximately $3.4 billion based upon the average of UnitedHealth Group’s

share closing price for two days before, the day of and two days after the acquisition announcement date

of April 26, 2004), approximately $1.3 billion in cash and UnitedHealth Group vested common stock

options with an estimated fair value of $240 million issued in exchange for Oxford’s outstanding vested

common stock options.

On February 10, 2004, our Health Care Services business segment acquired MAMSI. Under the terms

of the purchase agreement, MAMSI shareholders received 0.82 shares of UnitedHealth Group common

stock and $18 in cash for each share of MAMSI common stock they owned. Total consideration issued

was approximately $2.7 billion, comprised of 36.4 million shares of UnitedHealth Group common stock

(valued at $1.9 billion based upon the average of UnitedHealth Group’s share closing price for two days

before, the day of and two days after the acquisition announcement date of October 27, 2003) and

approximately $800 million in cash.

On December 10, 2004, our Uniprise business segment acquired Definity. Under the terms of the

purchase agreement, we paid $305 million in cash in exchange for all of the outstanding stock of Definity.

Available cash and commercial paper issuance financed the Definity purchase price.

In July 2004, we issued $1.2 billion of commercial paper to fund the cash portion of the Oxford purchase

price. In August 2004, we refinanced the commercial paper by issuing $550 million of 3.4% fixed-rate

notes due August 2007, $450 million of 4.1% fixed-rate notes due August 2009 and $500 million of

5.0% fixed-rate notes due August 2014.

In February 2004, we issued $250 million of 3.8% fixed-rate notes due February 2009 and $250 million

of 4.8% fixed-rate notes due February 2014. We used the proceeds from the February 2004 borrowings

to finance a majority of the cash portion of the MAMSI purchase price as described above.

In December and March 2003, we issued $500 million of four-year, fixed-rate notes and $450 million

of 10-year, fixed-rate notes with interest rates of 3.3% and 4.9%, respectively. We used the proceeds from

the 2003 borrowings to repay commercial paper and maturing term debt, and for general corporate

purposes including working capital, capital expenditures, business acquisitions and share repurchases.

We entered into interest rate swap agreements to convert our interest exposure on a majority of these

2003 and 2004 borrowings from a fixed to a variable rate. The interest rate swap agreements on these

borrowings have aggregate notional amounts of $2.9 billion. At December 31, 2004, the rate used to

accrue interest expense on these agreements ranged from 2.3% to 3.3%. The differential between the

fixed and variable rates to be paid or received is accrued and recognized over the life of the agreements

as an adjustment to interest expense in the Consolidated Statements of Operations.

In June 2004, we executed a $1.0 billion five-year revolving credit facility to support our commercial

paper program. This credit facility replaced our existing $450 million revolving facility that was set to

expire in July 2005, and our $450 million, 364-day facility that was set to expire in July 2004. As of

December 31, 2004, we had no amounts outstanding under this credit facility. Commercial paper

increased from $79 million at December 31, 2003, to $273 million at December 31, 2004.

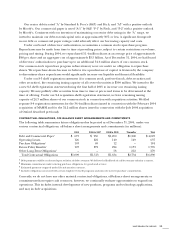

Our debt arrangements and credit facility contain various covenants, the most restrictive of which

require us to maintain a debt-to-total-capital ratio (calculated as the sum of commercial paper and debt

divided by the sum of commercial paper, debt and shareholders’ equity) below 45% and to exceed

specified minimum interest coverage levels. We are in compliance with the requirements of all debt

covenants.