Under Armour 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

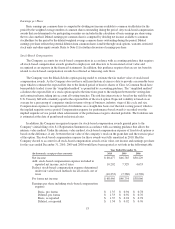

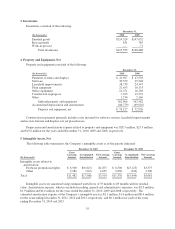

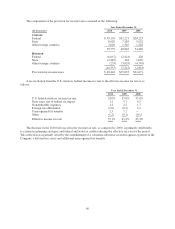

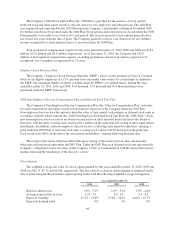

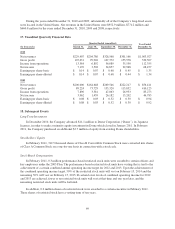

The components of the provision for income taxes consisted of the following:

Year Ended December 31,

(In thousands) 2010 2009 2008

Current

Federal $ 39,139 $32,215 $28,225

State 8,020 7,285 5,022

Other foreign countries 3,620 1,345 1,242

50,779 40,845 34,489

Deferred

Federal (6,617) (2,421) 226

State (3,487) 244 1,699

Other foreign countries (233) (3,035) (4,743)

(10,337) (5,212) (2,818)

Provision for income taxes $ 40,442 $35,633 $31,671

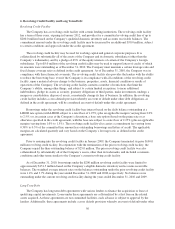

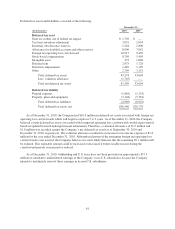

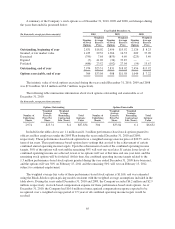

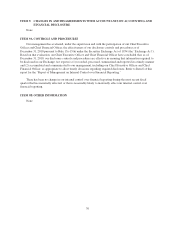

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate is as

follows:

Year Ended December 31,

2010 2009 2008

U.S. federal statutory income tax rate 35.0% 35.0% 35.0%

State taxes, net of federal tax impact 1.2 5.7 6.5

Nondeductible expenses 1.4 2.2 1.7

Foreign rate differential (1.6) (0.7) 2.2

Unrecognized tax benefits 2.3 1.1 —

Other (1.2) (0.1) (0.1)

Effective income tax rate 37.1% 43.2% 45.3%

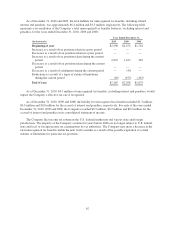

The decrease in the 2010 full year effective income tax rate, as compared to 2009, is primarily attributable

to certain tax planning strategies and federal and state tax credits reducing the effective tax rate for the period.

This reduction was partially offset by the establishment of a valuation allowance recorded against a portion of the

Company’s deferred tax assets and additional unrecognized tax benefits.

60