Under Armour 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.worldwide and worn by athletes at all levels, from youth to professional, on playing fields around the globe, as

well as by consumers with active lifestyles.

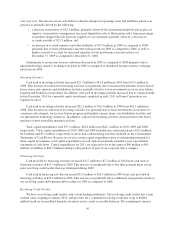

Our net revenues grew to $1,063.9 million in 2010 from $430.7 million in 2006. We believe that our growth

in net revenues has been driven by a growing interest in performance products and the strength of the Under

Armour brand in the marketplace relative to our competitors, as evidenced by the increases in our sales of our

products. We plan to continue to increase our net revenues over the long term by increased sales of our apparel,

footwear and accessories, expansion of our wholesale distribution, growth in our direct to consumer sales channel

and expansion in international markets. Our direct to consumer sales channel includes sales through our factory

house and specialty stores, website, and catalog. New product offerings for 2010 included basketball footwear

which had a limited introduction in the United States and Canada.

Our products are currently offered in over twenty three thousand retail stores worldwide. A large majority of

our products are sold in North America; however we believe our products appeal to athletes and consumers with

active lifestyles around the globe. Internationally, our products are offered primarily in Austria, France,

Germany, Ireland and the United Kingdom, as well as in Japan through a third-party licensee, and through

distributors located in other foreign countries.

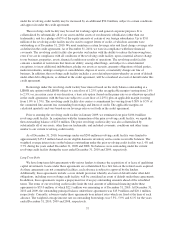

We believe there is an increasing recognition of the health benefits of an active lifestyle. We believe this

trend provides us with an expanding consumer base for our products. We also believe there is a continuing shift

in consumer demand from traditional non-performance products to our performance products, which are intended

to provide better performance by wicking perspiration away from the skin, helping to regulate body temperature

and enhancing comfort. We believe that these shifts in consumer preferences and lifestyles are not unique to the

United States, but are occurring in a number of markets globally, thereby increasing our opportunities to

introduce our performance products to new consumers.

Although we believe these trends will facilitate our growth, we also face potential challenges that could

limit our ability to take advantage of these opportunities, including, among others, the risk of general economic

or market conditions that could affect consumer spending and the financial health of our retail customers. In

addition, we may not be able to effectively manage our growth and a more complex business. We may not

consistently be able to anticipate consumer preferences and develop new and innovative products in a timely

manner that meets changing preferences. Furthermore, our industry is very competitive, and competition

pressures could cause us to reduce the prices of our products or otherwise affect our profitability. We also rely on

third-party suppliers and manufacturers outside the U.S. to provide fabrics and to produce our products, and

disruptions to our supply chain could harm our business. For a more complete discussion of the risks facing our

business, refer to “Risk Factors.”

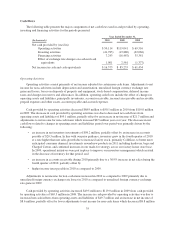

General

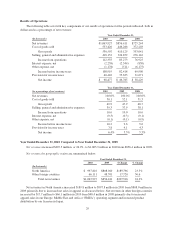

Net revenues comprise both net sales and license revenues. Net sales comprise sales from our primary

product categories, which are apparel, footwear and accessories. Our license revenues consist of fees paid to us

by our licensees in exchange for the use of our trademarks on core products of socks, headwear, bags, eyewear,

custom-molded mouth guards, other accessories and team uniforms, as well as the distribution of our products in

Japan. We have developed our own headwear and bags, and beginning in 2011, these products are being sold by

us rather than by one of our licensees. We expect our net revenues to increase by approximately $60 million from

2010 to 2011 as a result of this change, which includes an increase in accessories revenues and a decrease in our

license revenues in 2011. In addition we expect the related cost of goods sold to increase.

Cost of goods sold consists primarily of product costs, inbound freight and duty costs, outbound freight

costs, handling costs to make products floor-ready to customer specifications, royalty payments to endorsers

based on a predetermined percentage of sales of selected products and write downs for inventory obsolescence.

The fabrics in many of our products are made of petroleum-based synthetic materials. Therefore our product

27